Circle's USDC and Tether's USDT remain the top two stablecoins. In 2025, USDC shows strong growth in trading volume and market share. However, it still lags behind the market leader USDT.

This article analyzes key data about USDC from Kaiko's latest report and assesses USDC's position in the highly competitive stablecoin market.

Will USDC Overtake USDT on Centralized Exchanges?

According to Kaiko Research's report, USDC set a new record with $219 billion in trading volume in April 2025. This is more than double the $106.5 billion recorded in January 2024.

The world's largest cryptocurrency exchange, Binance, played a crucial role. Thanks to a strategic agreement with Circle in December 2024, it accounted for over 57% of USDC's global trading volume.

According to Kaiko data, USDC's stablecoin market share on Binance increased from 10% at the end of last year to nearly 20% today.

In contrast, USDT's market share on Binance decreased from 75% at the end of 2024 to about 60% today.

USDC's impressive growth in trading volume and market share can be explained by two main factors. First, the partnership with Binance allowed USDC access to a large user base.

Second, USDC benefited from increased demand for regulatory-compliant stablecoins, especially in Europe, where the MiCA framework is currently being implemented.

"This deal is also highly profitable for Binance. Circle prepaid over $60 million and provides ongoing incentives, aligning with Binance's push for compliance under European MiCA regulations." – Kaiko report.

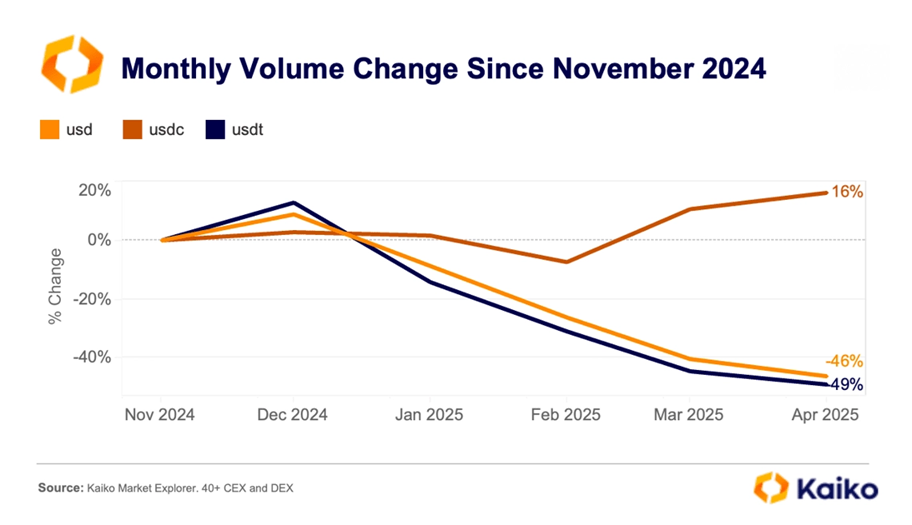

Additionally, when comparing the trading volume changes of USDC and USDT during the same period, USDC shows stronger performance.

Since November 2024, USDT's monthly trading volume has decreased by 49%. In contrast, USDC's volume increased by 16%.

"While USDC is gaining momentum on centralized exchanges, Tether's USDT is facing headwinds. USDT trading volume on CEX has sharply declined... This reflects an overall contraction in dollar trading activity. This decrease reflects continued risk-averse sentiment, weak retail participation, and limited speculative appetite across the cryptocurrency market." – Kaiko explanation.

Despite USDC's growth, it still has a long way to go to catch up. As of May 2025, USDT's market capitalization is $152 billion, 2.3 times higher than its market cap in July 2022.

Meanwhile, USDC's market capitalization is $60 billion, 12% higher than its level in July 2022.

Tether, the company behind USDT, reported outstanding profits. In 2024, it earned $13 billion, compared to Circle's $15.5 million in the same year. Additionally, USDT still dominates off-exchange applications, especially in cross-border payments.

USDC and USDT remain the primary stablecoins. However, the stablecoin market can quickly change with the emergence of new competitors. Major financial institutions like PayPal, World Liberty Financial, Fidelity, Ripple, BlackRock, and Meta have entered the competition.