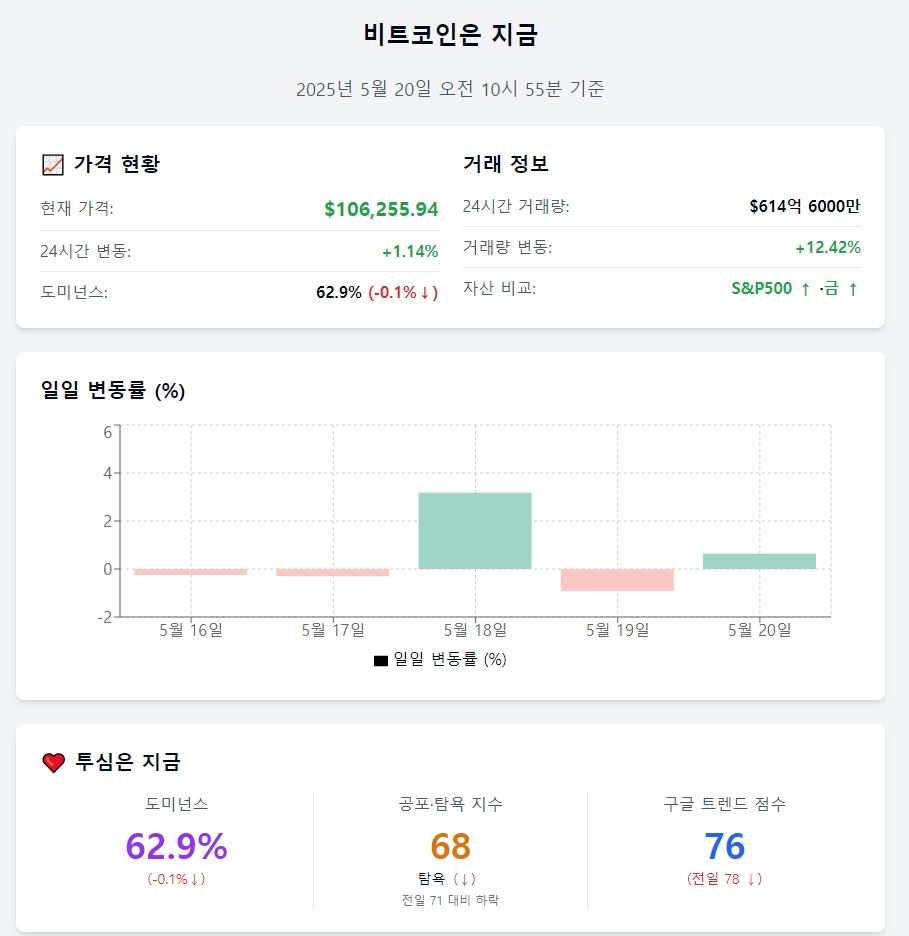

As of 10:55 AM on May 20, 2025

After a short-term correction, Bitcoin has successfully rebounded with trading volume, and the on-chain buying sentiment and market interest continue to show a solid trend.

📈 Price is now

Price $106,255.94 (+1.14%) Bitcoin is trading at $106,255.94, up 1.14% from the previous day. After a slight decline yesterday, it has successfully rebounded again, with continued low-price buying.

Trading volume $6.146 billion (+12.42%) Bitcoin's trading volume increased by approximately 12.4% to $6.146 billion compared to the previous day. As the price rises, trading volume is also increasing, indicating more active market participation.

Daily fluctuation rate +0.64% In the last 5 trading days, Bitcoin's price showed -0.25% (16th), -0.3% (17th), +3.18% (18th), -0.91% (19th), +0.64% (20th). Short-term rebounds and adjustments are repeating, maintaining a gradual upward trend.

Asset comparison S&P500↑·Gold↑ On the 19th, S&P500 rose 0.09%, and gold price rose 0.05%, showing demand for both risky and safe assets. Bitcoin is also showing a recovery trend in between.

MACD -40.87 The daily MACD is -40.87, slightly down from the previous day, but the weekly basis is 1244.29, continuing an upward trend and maintaining medium to long-term upward momentum. From a short-term perspective, the momentum is slowing down.

❤️ Investor sentiment now

Dominance 62.9%(-0.1%) Bitcoin's market share recorded 62.9%, down 0.1% from the previous day. Some fund movement to other altcoins is detected, showing a diversification trend.

Fear & Greed Index 68 (Greed) The greed index slightly decreased from 71 to 68 but remains in the greed zone. Optimistic sentiment is maintained, but overheating concerns are somewhat easing.

Google Trend score 76 The Google Trend score on the 20th is 76, slightly down from 78 the previous day. Interest has entered a lull phase but remains at a high level.

🧭 Market now

SSR 17.95 The Stablecoin to Market Cap Ratio (SSR) for Bitcoin decreased to 17.95. Stablecoin liquidity capacity has slightly improved from the previous day, but limited buying capacity is still maintained.

NUPL 0.5671 The Net Unrealized Profit and Loss ratio slightly decreased to 0.5671. The proportion of investors in a profit state has slightly decreased, and the possibility of additional selling pressure remains mild.

Exchange balance 2,427,700 BTC (-0.37%) Exchange holdings decreased by 0.37% to 2,427,700 BTC compared to the previous day. Continuous outflow is interpreted as a positive signal reducing market supply pressure.

Exchange net inflow/outflow -9,131 BTC (-5.81%) 9,131 BTC was net outflowed in a day, with the outflow scale further expanded compared to the previous day. Long-term holders and OTC transfers are presumed to continue.

Active wallets 882,832 (-6.47%) The number of active wallets decreased by 6.47% to 882,832. User activity has somewhat slowed down, showing a short-term weakening of on-chain vitality.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>