Bitcoin, which had been rising strongly in recent days, experienced notable volatility after a strong surge on Sunday (18th) and then completely falling on Monday (19th).

Despite these fluctuations, hopes for recovery remain due to investors driven by FOMO (fear of missing out) and greed. These emotions can play a crucial role in Bitcoin price movements.

Bitcoin Investors Expect Bull Market

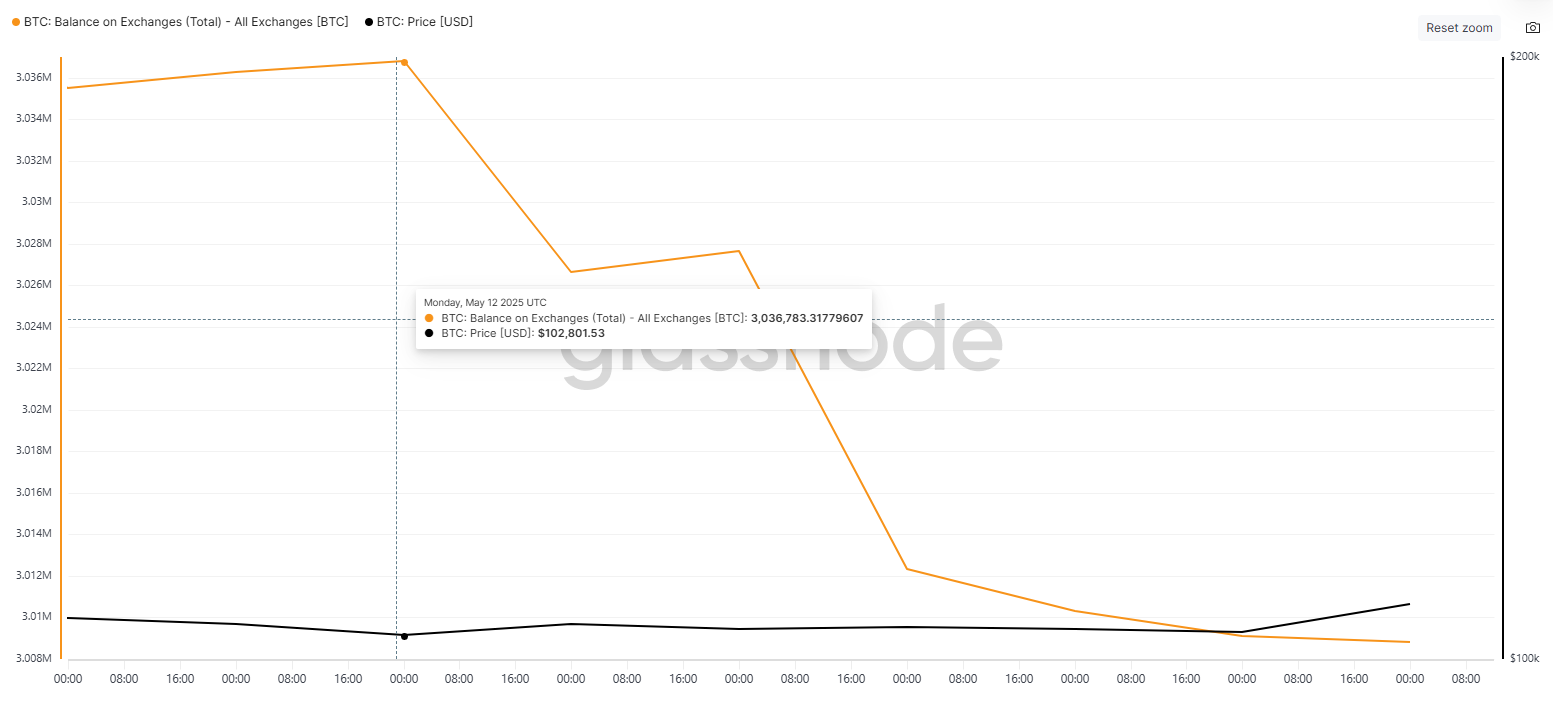

The continuous decrease in exchange balances indicates an accumulation pattern. Over the past week, more than 27,976 BTC, valued at over $288 million, was purchased by investors. This reduced the available supply to approximately 3 million BTC.

The belief that Bitcoin has not yet reached its all-time high (ATH) encourages additional investment. Many believe the current price level presents a short-lived opportunity. FOMO remains a significant driver, with both retail and institutional investors betting on Bitcoin's future potential.

The IOMAP (In/Out of the Money Around Price) indicator suggests Bitcoin has strong support in the range of $102,886 to $99,894. Here, investors have accumulated over 398,590 BTC, valued at more than $41 billion. This area is a strong buy zone, with many investors maintaining positions while expecting Bitcoin's next upward movement.

A drop below this support is unlikely, as investors are waiting for price increases rather than selling. Beyond the strong accumulation zone, the general market sentiment is bullish. This continued support at these levels strengthens the possibility that Bitcoin will continue rising.

BTC Price May Rebound

Bitcoin is currently trading at $102,907, just above the critical support level of $102,734. Despite today's 3.3% decline, additional price drops seem unlikely due to the strong demand zone just below this level. Buyers' willingness to intervene at this price point suggests short-term stability.

Since Bitcoin briefly rose to $107,108, the cryptocurrency appears likely to recover its losses. Investor accumulation is expected to push Bitcoin higher, potentially breaking through the $105,000 level again. This will create a base above the $102,734 support. This will continue to drive Bitcoin's growth, bringing it to within 6.5% of its ATH of $109,588.

However, if long-term holders (LTH) decide to sell positions to secure profits, the bullish outlook could lead to a reversal with price decline. In this case, Bitcoin's price could slip below the critical $102,734 support, potentially dropping to the $100,000 range.