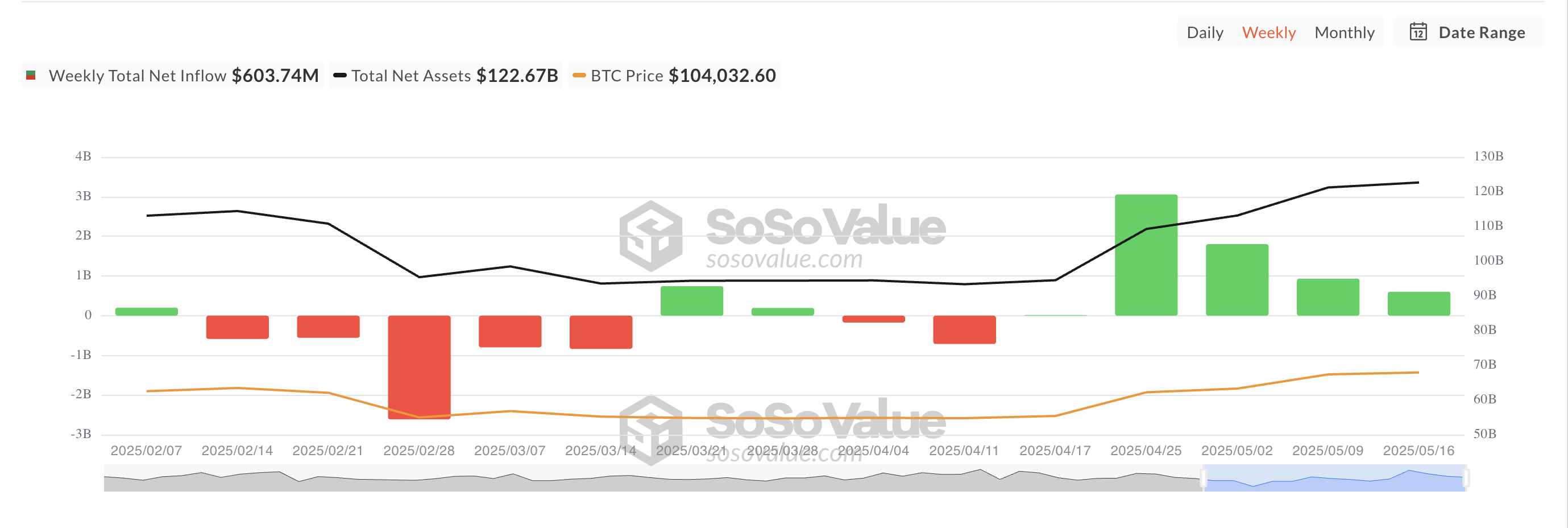

Last week, the US-listed spot Bitcoin ETF recorded net inflows exceeding $600 million.

This indicates a continued positive capital movement into digital asset products, but it represents the lowest weekly inflow of the month, suggesting investor caution or profit-taking at higher levels.

ETF Inflow Slowdown…Decreased Investor Interest in Price Adjustment

From May 12 to May 16, the inflows into spot BTC ETFs totaled $637.4 million. While this was net positive in terms of inflows into these funds, the weekly figure was the lowest of the month, emphasizing a more cautious but continuous capital movement into the market.

The slowdown in ETF inflows is related to BTC consolidating during the five-day review period. During that time, BTC faced resistance around $104,971 and continued support at $102,711.

The lack of clear movement made some investors more cautious, leading to decreased capital inflows into BTC ETFs last week.

BTC Aiming for New Highs

Nevertheless, BTC market momentum remains strong. The coin briefly reached a three-month high of $107,108 in early Asian trading on Monday. Although it later adjusted to $104,956, the bullish bias for the coin remains significant.

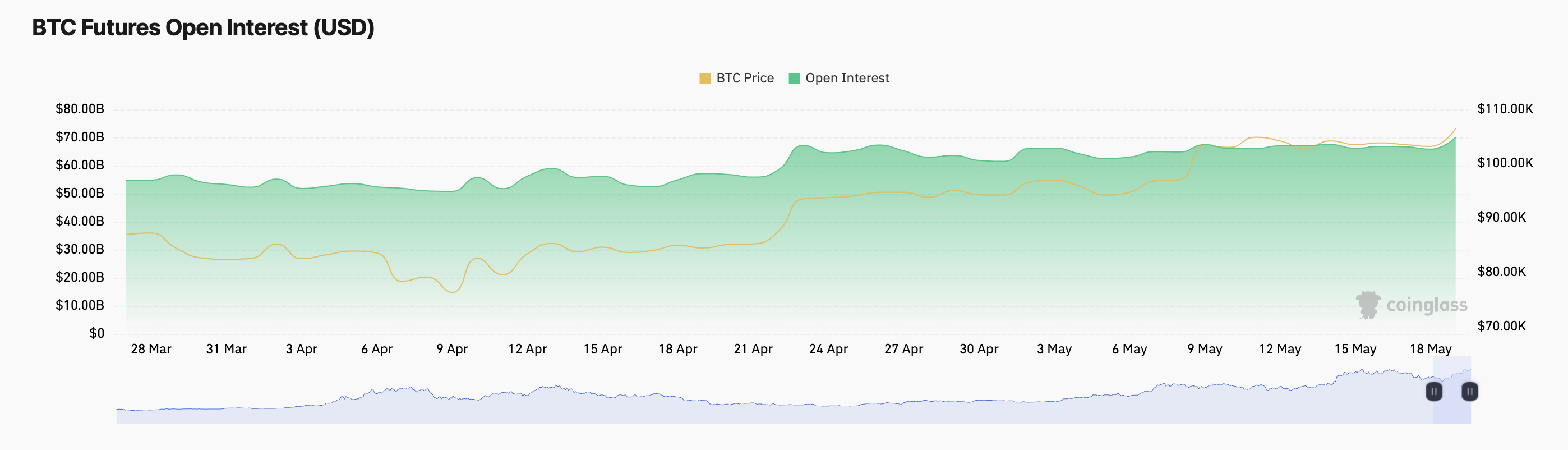

BTC's price increase is accompanied by an increase in futures open interest, which reached $70.03 billion at the time of reporting, rising 7% in the past day.

Open interest represents the total number of unsettled derivative contracts like futures or options. When open interest rises with price, it typically indicates new funds entering the market. This supports the strength of BTC's continued trend and could trigger sustained price increases in the short term.

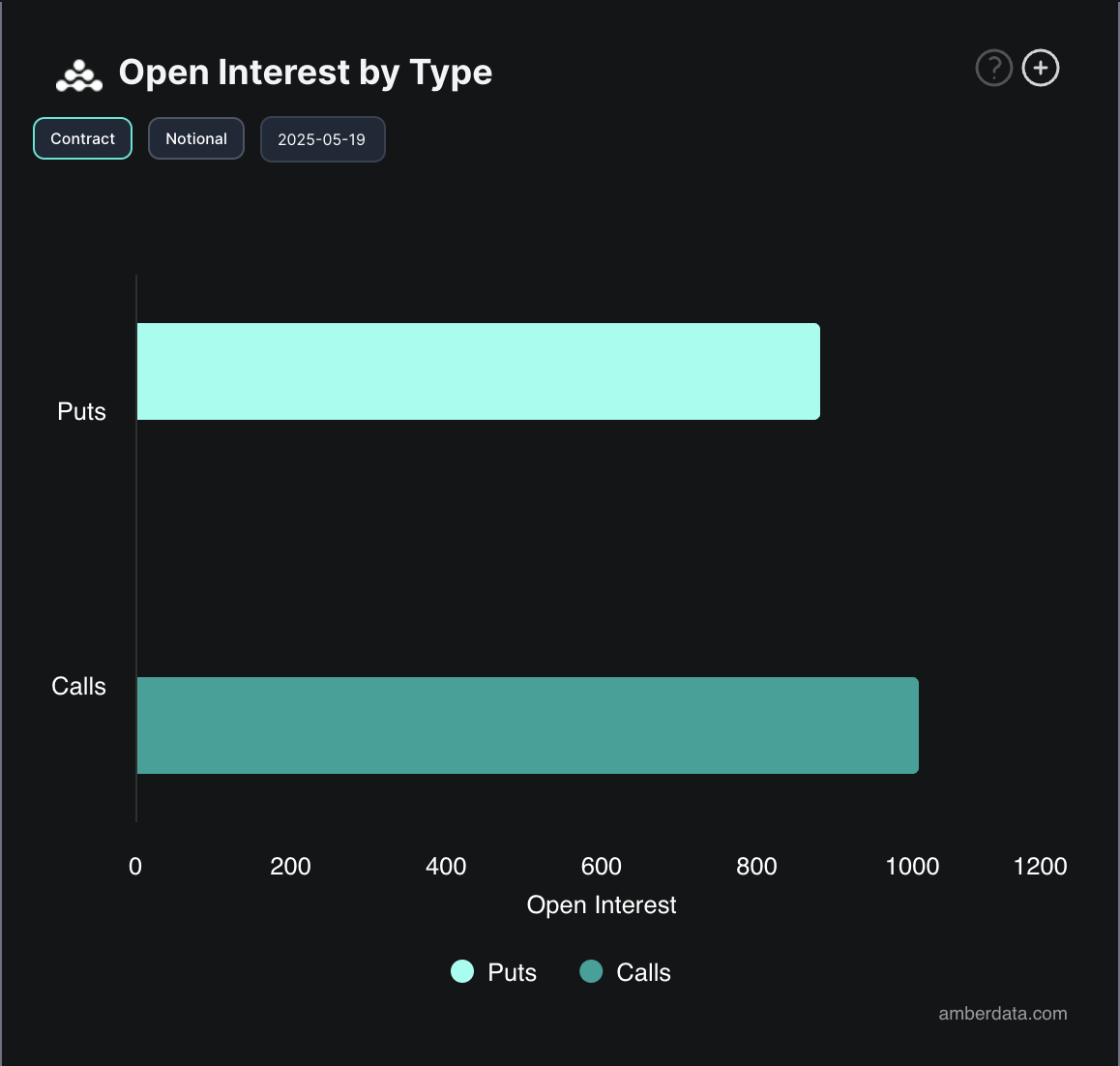

Moreover, options market data further supports this optimistic outlook. Today, call option demand exceeded puts, indicating increased demand for bullish positions.

Nonetheless, as derivative activity surges and BTC recovers higher price levels, the coin could potentially reach new highs in the short term.