Author: Nick Shaheen, Bankless Author; Translated by: AIMan@Jinse Finance

Stablecoins have been slowly developing and ultimately becoming the largest use case in the cryptocurrency field. Although progress seemed slow, things are accelerating, and it feels like we are at a "tipping point".

The past month has made this clearer than ever before.

Stripe and Meta, two of the world's largest tech companies, have both joined the stablecoin arena. Stablecoin transaction volume has officially surpassed Visa. Despite political resistance, regulation is now just a matter of time, not a question of whether it will happen.

The stablecoin era has arrived. It was originally progressing slowly, but now seems to have happened in an instant.

1. Stripe's Stablecoin Accounts Launched in Over 100 Countries

Stripe quietly launched stablecoin financial accounts, enabling businesses in over 100 countries to hold, send, and receive funds in USDC or USDB (Bridge's infrastructure stablecoin).

It is essentially a dollar account without a bank.

Behind the scenes, Stripe is using its acquired Bridge to handle stablecoin custody and fund operations. Crucially, these accounts are backed 1:1 by US dollar reserves held at BlackRock.

No ACH delays, no foreign exchange fees, no local banking infrastructure needed. Just programmable, internet-native dollars.

This is what PayPal should have built.

2. Meta's Stablecoin Revival: WhatsApp Payments Coming Soon

Reports suggest that Meta is in talks with cryptocurrency companies to reintroduce stablecoins on its platforms, including WhatsApp.

Yes, the same Diem that Congress embarrassed and forced Meta to shut down three years ago.

Scale is key. WhatsApp has over 2 billion users. If Meta can pull this off, stablecoin adoption will no longer be a trickle, but a flood.

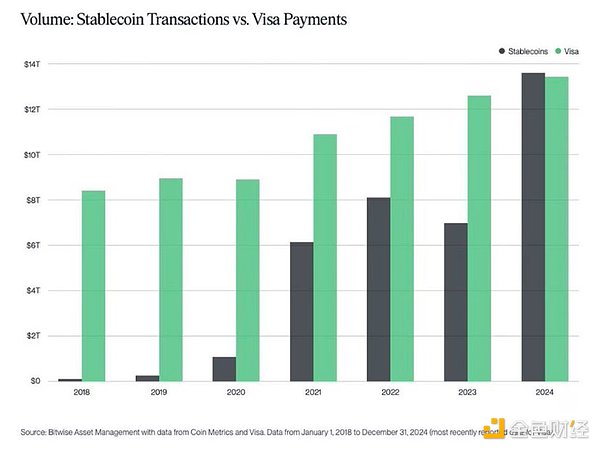

3. Stablecoin Transaction Volume Surpasses Visa

According to Bitwise's Q1 2025 Crypto Market Commentary, stablecoins processed $27.6 trillion in transactions in 2024, surpassing Visa and Mastercard.

95% of these transactions were settled on Ethereum. That's right, Ethereum is now one of the most important financial channels on Earth.

Let that sink in.

4. Developer Gold Rush: Bridge and USDB

Bridge's USDB is rapidly becoming the most developer-friendly stablecoin in the market.

Unlike traditional issuers who keep reserve earnings, Bridge shares its profits—both developers and users can participate. Developers can earn rewards simply by switching to USDB via API.

Can it be exchanged for USDC? Free.

Minting and redemption? Global.

Treasury collateral? Stored at BlackRock.

If stablecoins are the new dollars, Bridge is building the Stripe of programmable money.

5. GENIUS Act Failed, But Not Dead

Last week, the US Senate failed to pass the GENIUS Act, the first serious attempt at federal stablecoin legislation.

The bill failed in a procedural vote of 48 to 51, not due to lack of support, but because of last-minute changes by Republicans that caught key crypto-friendly Democrats off guard.

Even some co-sponsors voted against it, citing concerns about hasty amendments and transparency issues.

Nevertheless, interest remains. Senator Warner called stablecoins "undoubtedly part of the financial future" and promised to revise and pass the bill as soon as possible.

The GENIUS Act would:

Establish federal oversight for stablecoin issuers

Set capital and liquidity standards

Enforce anti-money laundering compliance under the Bank Secrecy Act

Critics argue the provisions are too lenient—precisely meeting what crypto companies hoped for. But undoubtedly, this is the US choosing to regulate stablecoins onshore rather than letting them develop overseas.

This vote may have failed, but the next vote could pass as early as this week.

️Most Importantly

Stablecoins are no longer just a "crypto use case", they are the use case.

Institutions are emerging everywhere.

Stripe is building wallets.

Meta is constructing interfaces.

Ethereum is the backend.

Developers are building everything else.

In 2020, stablecoins were just a novelty. By 2024, they have developed into a trillion-dollar industry. Now, in 2025, the world's largest enterprises and legislators are putting stablecoins to the real-world test.

The financial system is changing. First slowly, and then suddenly.