Bitcoin Breaks Through $100,000 Milestone

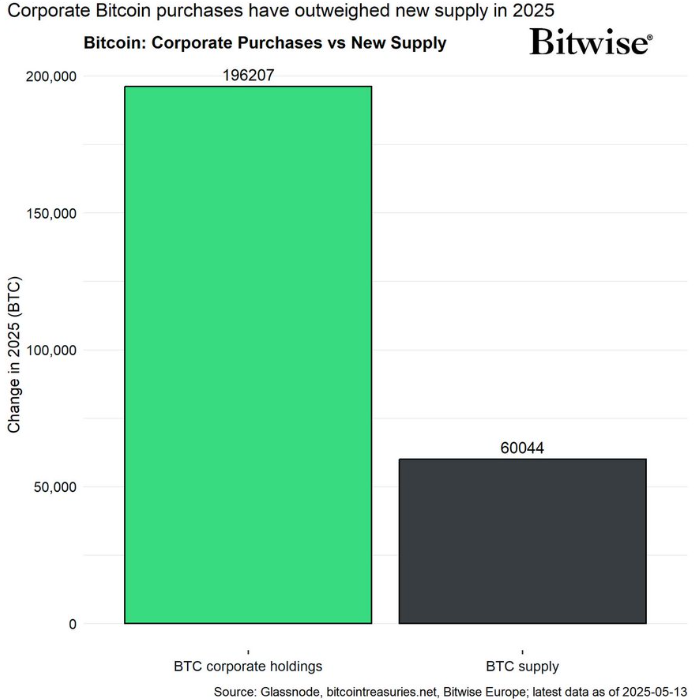

Enterprise Demand Reaches 3 Times New Supply

The United States is Building Strategic Reserves

While Traditional Finance Remains Bewildered - One Analyst Even Compared Bitcoin's Scarcity to... Her Teeth

Clearly, This is Far from the Peak

But the Beginning of a Value Revaluation Wave

Since January 2024, Signals Have Continuously Been Released:

• Spot ETF Approved

• Fourth Halving Completed

• Trump Building Bitcoin Reserves

• National Debt Companies Established Weekly

This is Not Hype, But Capital Flowing into the Hardest Asset on Earth

Bitwise Data Shows Enterprise Buyers Will Absorb Bitcoin 3 Times the New Supply in 2025

Saylor Model No Longer Marginalized

Becoming the New Standard

Scarcity Intensely Colliding with Institutional-Scale

Bitcoin National Debt Companies Emerging Almost Weekly.

This Pushes the Potential Peak of This Bull Market Higher...

...But Also Brings Leverage Risks.

Some Companies Will Go Bankrupt,

Others Will Become Pillars of Bitcoin Enterprises.

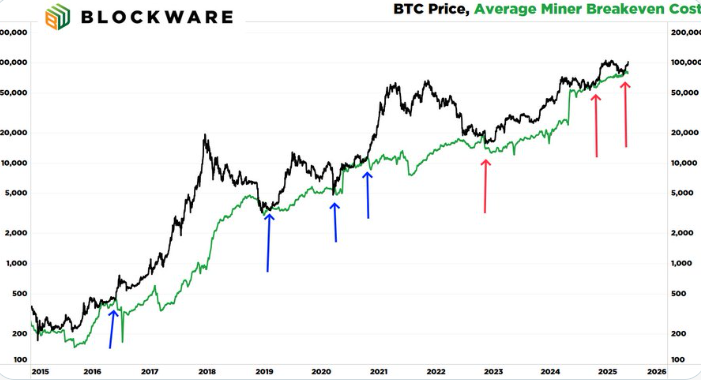

Now Focus on This Chart:

When Bitcoin Price Approaches Miners' Break-Even Cost, Miners Are Forced to Sell.

But as Price Accelerates, They Will Become Long-Term Holders (HODLers).

Healthy Miners = Reduced Selling Pressure = Explosive Price Increase.

We've Just Broken Through Miners' Break-Even Cost...

But More Shockingly:

Even at $100,000, Bitcoin Has Not Truly Broken Through.

Not When Measured in Gold.

Bitcoin's Price in Gold Remains Below 2021 High.

This is a Four-Year Buildup—

An Epic Hard Currency Integration.

If Bitcoin Breaks Through in Gold Terms - Especially After Gold's Historic Rise in 2025 - This Will Be More Than Just Another Surge.

It Means Bitcoin is Surpassing the Best-Performing Hard Assets...

And the Hardest Currency of the Past 5,000 Years.

This is a Monetary Value Revaluation.

Meanwhile, Financial Times Attempts to Interpret Bitcoin, Michael Saylor, and His Company Strategy (MSTR).

But They Still Don't Get It.

"My Teeth Are Quite Scarce Too..."

When Top Analysts Can Be So Spectacularly Wrong,

This is Not a Danger Signal - But Proof We're Still in the Early Stages.

History Will Not Wait for Financial Times to Slowly Understand.

It is Being Written by Those Who Understand the Essence of Change - And Dare to Act Before the Trend is Clear.

This is More Than a Market Cycle.

It's a Once-in-a-Generation Opportunity.

Seize It.

Want to Participate in Shaping Bitcoin's Future?

This September, at the Most Critical Moment,

"BTC in DC" Event Will Bring Together Bitcoin Developers, Thinkers, and Advocates in Washington.

Policy Making. Education. Signal Release.

Here, Bitcoin Will Meet Power Head-On.