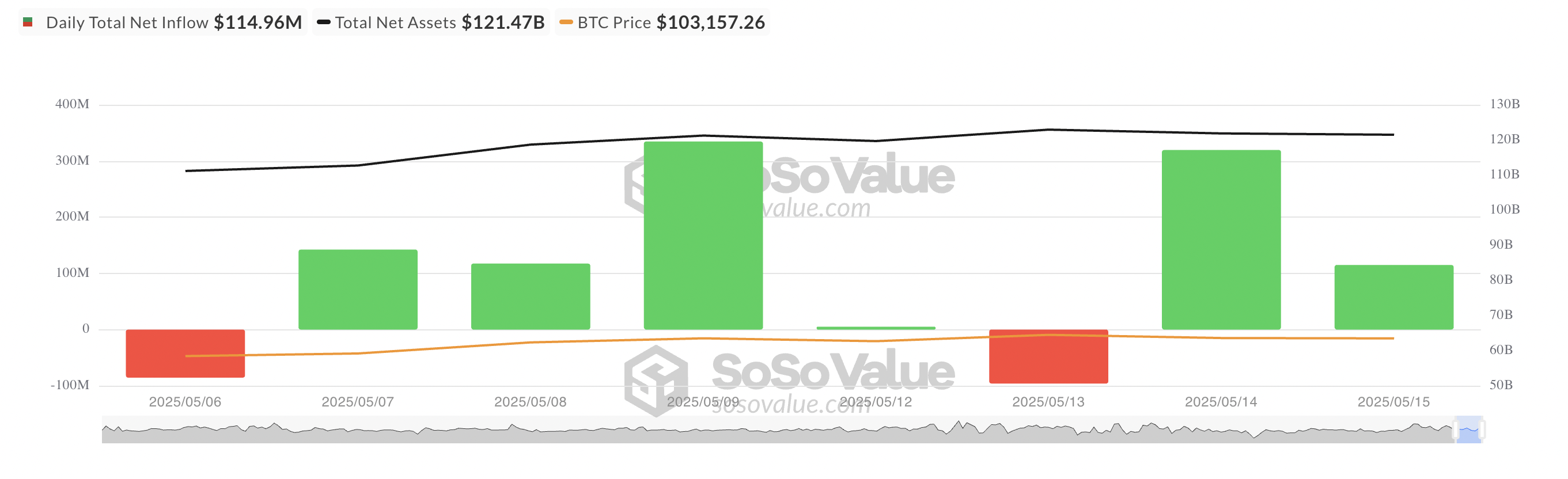

On Thursday, institutional investors continue to show ongoing interest in cryptocurrencies by injecting capital into US-listed spot Bitcoin ETFs.

The total net inflow of US-listed Bitcoin ETFs is approximately $115 million, reflecting a continued upward trend despite short-term market volatility.

Maintaining Institutional Demand... BTC ETF Inflow of $115 Million

On Thursday, the net inflow of BTC ETFs was $114.96 million, a 64% decrease from Wednesday's $319.56 million. This indicates continued institutional interest, but the sharp decline from Wednesday's inflow suggests a temporary cooling of momentum.

BlackRock's IBIT ETF continues to lead, recording the highest daily net inflow among its peers. The fund recorded a daily net inflow of $497.02 million on Thursday, increasing its total historical net inflow to $4.542 billion.

Meanwhile, the ARK 21Shares Bitcoin ETF (ARKB) recorded the highest net outflow among all issuers on Thursday, with $132.05 million leaving the fund. ARKB's total historical net inflow remains at $2.57 billion at the time of writing.

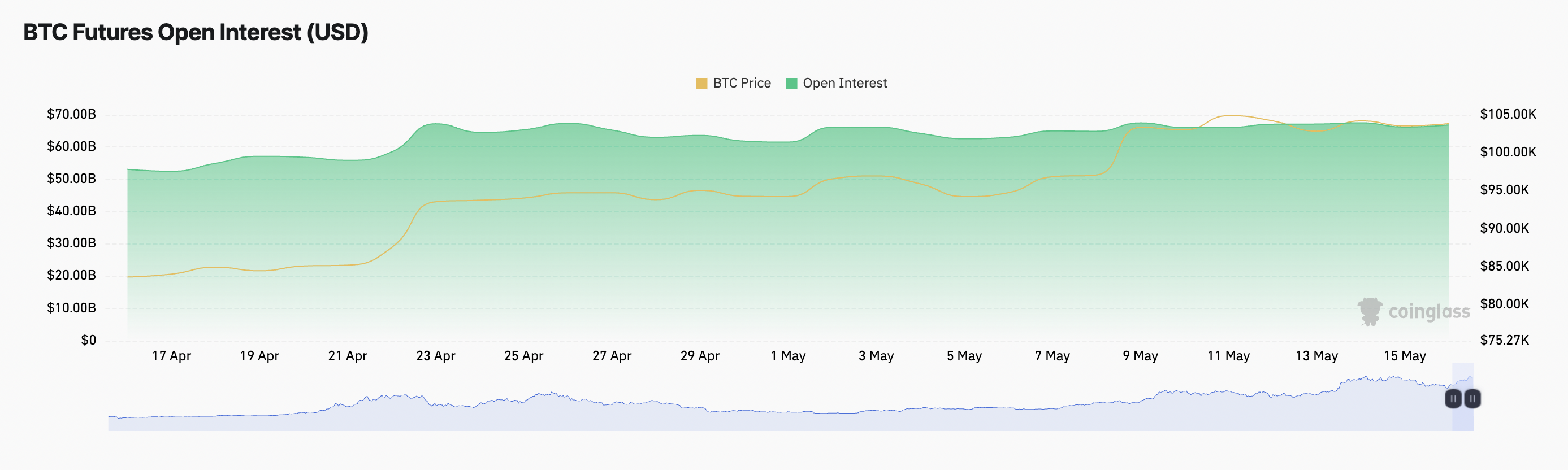

BTC Futures Open Interest Slightly Increases

At the time of reporting, the major coin is trading at $104,007, recording a 2% price increase during the broad market rally over the past day. During the review period, the coin's futures open interest (OI) increased slightly by 1%, indicating a slight increase in leveraged positions.

Open interest represents the total number of outstanding futures contracts not yet settled. When OI increases with price appreciation, it indicates new capital entering the market and the current trend being reinforced.

In the case of BTC, the slight increase in OI suggests that market participants are maintaining a somewhat cautious attitude while forming an upward momentum. The slight increase represents limited confidence among traders, with many still adopting a "wait and see" approach.

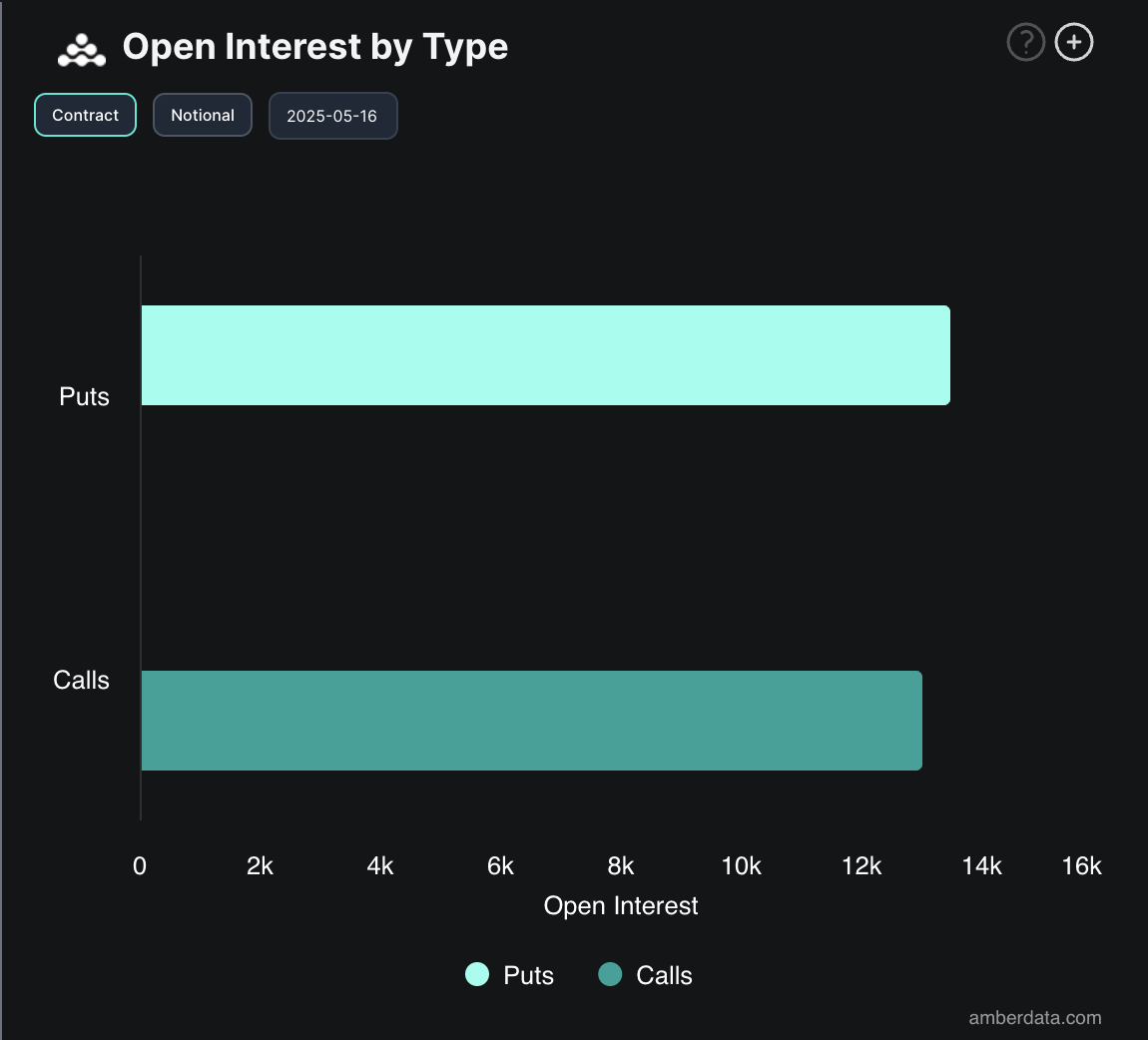

Moreover, in the coin's options market, demand for put contracts is increasing today.

This indicates increased hedging activity and a continued downward trend, suggesting a lack of optimistic sentiment among BTC options traders.