In the past 24 hours, a significant number of leveraged positions were liquidated in the cryptocurrency market.

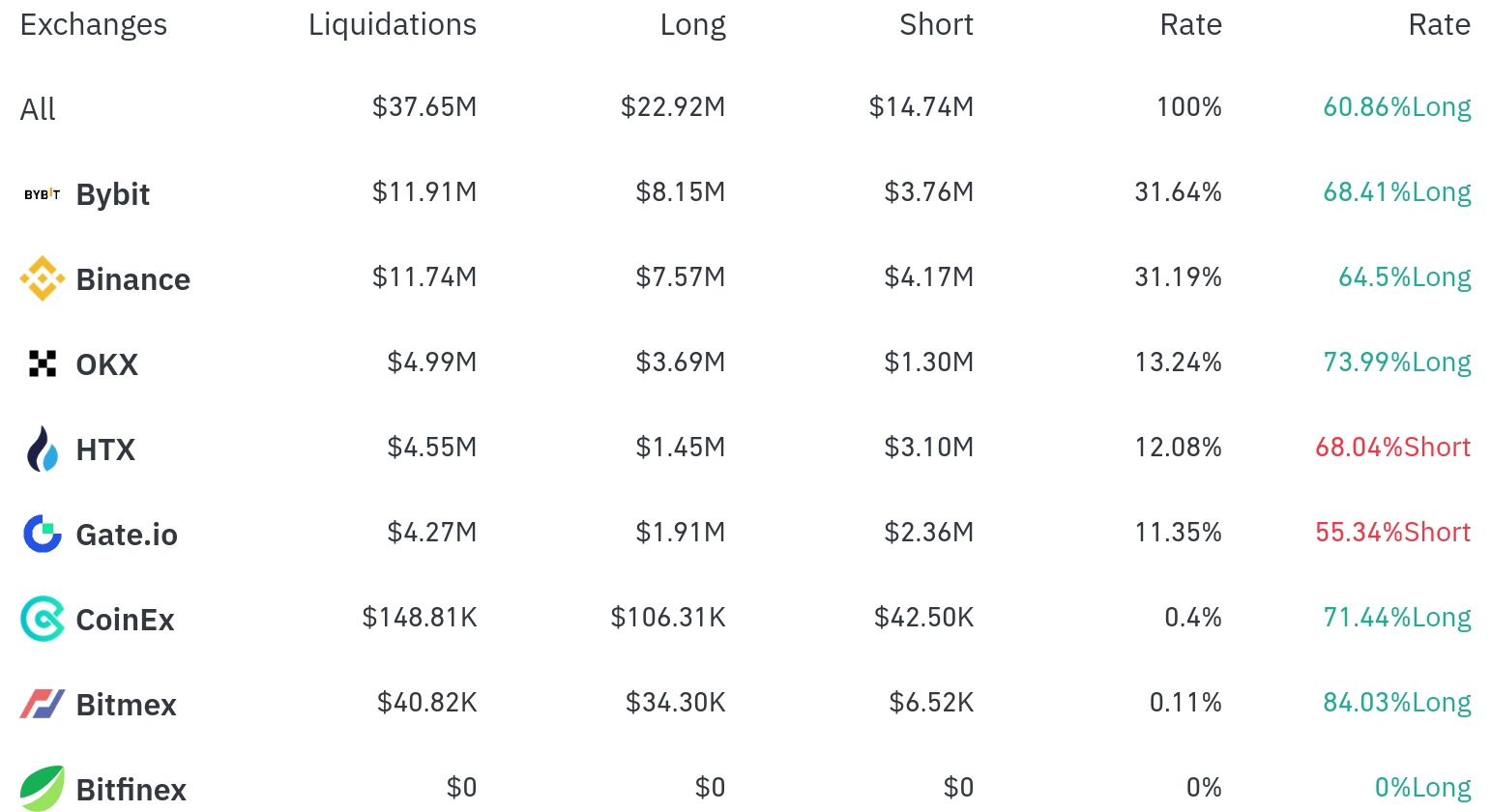

According to current aggregated data, Bybit and Binance were the exchanges with the most liquidations over a 4-hour period. On Bybit, approximately $11.91 million (31.64% of total) was liquidated, with long positions accounting for $8.15 million or 68.41%.

On Binance, $11.74 million (31.19%) of positions were liquidated, with long positions making up $7.57 million (64.5%).

On OKX, approximately $4.99 million (13.24%) was liquidated, with long positions at 73.99%. Interestingly, HTX and gate.io showed higher short position liquidations. On HTX, out of the total liquidation of $4.55 million, $3.10 million (68.04%) was from short positions, and on gate.io, $2.36 million (55.34%) out of $4.27 million was short position liquidations.

By coin, ETH recorded the most liquidations. Over 24 hours, approximately $101.47 million in ETH-related positions were liquidated, with $7.67 million in long positions and $8.37 million in short positions over 4 hours. This is related to ETH's 3.21% price increase over 24 hours.

BTC saw about $56.19 million in positions liquidated over 24 hours, with $5.72 million in long positions and $1.49 million in short positions over 4 hours. Bitcoin is currently trading at $103,768.6, up 1.79% over 24 hours.

SOL had approximately $11.51 million liquidated over 24 hours, and among other major altcoins, XRP ($18.54 million) and Doge ($14.36 million) saw significant liquidations.

A particularly notable coin was SUI, which experienced over $5 million in liquidations alongside a 6.03% price increase over 24 hours. The HYPE Token also saw substantial liquidations with a 9.38% surge.

The TRUMP Token saw about $1.80 million in liquidations despite a 3.85% price increase, and meme coins like FARTCO also recorded significant liquidation volumes.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. This liquidation pattern shows increased bidirectional volatility in the market, with the high short position liquidation rates on some exchanges likely related to recent price rebounds.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>