Author: Bobby Ong, Coingecko; Translated by: Tao Zhu, Jinse Finance

Hope you buy at the dip when panic sentiment reaches its peak!

Every time the stock market plummeted this year was due to President Trump's trade policies. On April 2nd, also known as "Liberation Day", Trump pressured global trade by imposing staggering tariffs on every US trading partner, with the harshest tariffs targeting China.

This immediately devastated financial markets, and the cryptocurrency market was also impacted. Only when the bond market faced serious problems did Trump retract his stance on April 9th (less than 24 hours before the original tariffs took effect), changing to impose a 10% tariff on all global countries and suspending the "Liberation Day" tariffs for 90 days. As expected, this brought a "whiplash effect", and after a relatively calm period, the market returned to a "waiting" state.

Currently, gold is undoubtedly the most actively traded, being a long-standing volatility hedging tool and safe-haven asset. Gold has been the best-performing asset in 2025, continuing its strong momentum since 2024.

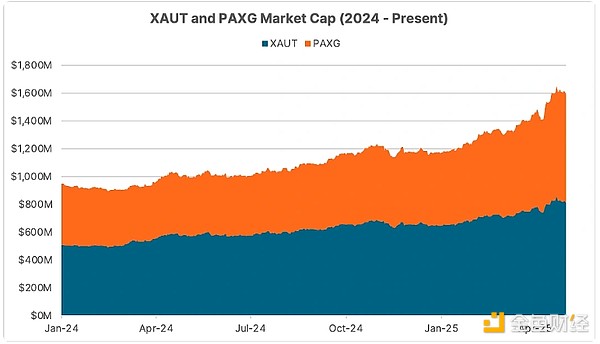

Cryptocurrencies have also benefited from this trend, as our market already has tokenized gold, primarily Tether Gold (XAUT) and PAX Gold (PAXG). Although the circulation of XAUT and PAXG has only slightly increased, their market caps have grown by 59% and 78% respectively since the beginning of 2024, reaching $1.6 billion by the end of April.

Where are cryptocurrencies heading? If you bought BTC during its downturn, congratulations, your gains might be as high as 25%! BTC's performance is far better than other risk assets like US stocks, and many are speculating whether this is the turning point for Bitcoin to finally prove its strength as a store of value.

For a long time, the cryptocurrency industry has been advocating that "Bitcoin is digital gold" and claiming its unique advantages of being easy to transfer and store. With increasing gold demand and Trump's tariffs, there are reports that the Bank of England has extended gold bar withdrawal times. If physical gold demand continues to rise with market uncertainty, this issue will only intensify.

It is now very clear that the market will be influenced by Trump's whims for quite some time. Although we now have a 90-day suspension period, it is certain that there will be some twists and turns in this process, which means market volatility will be more intense.

Even if Trump ultimately cancels most tariffs, the current uncertainty has likely already caused costly impacts on US businesses. Decisions to relocate production facilities or restructure supply chains take months to implement, and costs may take years to recoup. With no clear progress in sight, management teams are struggling to plan their future path, especially considering that some policies might be overturned during Trump's remaining term or by the next US president four years later.

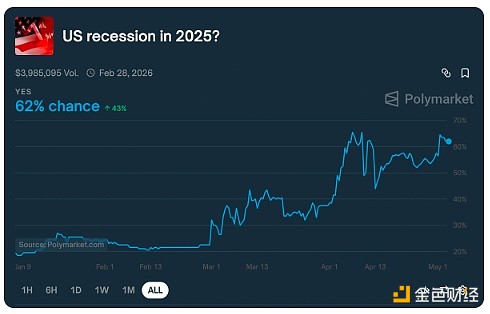

Entering May, the old adage "sell in May and go away" seems particularly important, as this month has historically been a poor performance month for the cryptocurrency market. We just released the first quarter 2025 US GDP data, which showed a contraction of 0.3%, which is not a good omen for the US economy, as the full impact of tariffs has yet to be revealed. Rumors about "economic recession" and even more worrying "stagflation" are rampant.

However, given Trump's many weaknesses, there might be opportunities for traders seeking to "buy the dip". An important milestone to watch is July, when the US economy will feel the impact of tariffs on prices and employment, until the 90-day "Liberation Day" tariff suspension ends and the second-quarter GDP data is released at the end of the month.

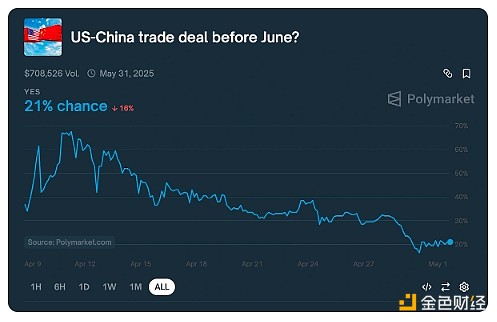

By then, will the US reach positive trade agreements with allies and trading partners? Will China surrender as Trump hopes and ultimately reach a major agreement? Or will the US economic condition be so poor that Trump is forced to change course? All of these are possible, and if you're a gambler, Polymarkets offers choices for all these outcomes.

Currently, long on gold seems to be the only surefire trade in the market. As for other aspects, if you're still investing in the stock market, buckle up, because we'll be experiencing more volatility brought by Trump.