Get the best data-driven crypto insights and analysis every week:

Stablecoin Sector Analysis

By: Tanay Ved & The Coin Metrics Team

Introduction

In this issue of Coin Metrics’ State of the Network, we’re excited to release the first installment of our “Sector Analysis” series, starting with Stablecoins.

With the widening breadth and complexity of the crypto ecosystem, we aim to provide data-driven overviews of key verticals shaping the market, from on-chain infrastructure like Layer-1s to applications like stablecoins. Through these reports, we will understand the relative size and composition of these sectors, and contextualize their evolution through fundamental metrics capturing their usage, adoption and economic significance.

Stablecoin Sector Report: Overview

As the stablecoin sector reaches new heights with over $230B in issuance across public blockchains, it has become central to conversations among crypto natives, payments networks, fintechs, banks and policymakers in Washington DC. Stablecoins stand first in the ladder towards achieving regulatory clarity in the U.S., with the proposed GENIUS Act laying the groundwork for the sector's sustained growth.

While formal legislation has recently stalled, the velocity of stablecoin-related developments has accelerated rapidly. In just the past few months, we’ve seen Visa partnering with stablecoin infrastructure provider Bridge, Stripe announcing stablecoin financial accounts and Fidelity revealing plans for its own stablecoin. With the culmination of better on-chain infrastructure, reduced transaction costs, and regulatory clarity, stablecoins are well-positioned to serve as the rails for global finance, powering everyday payments, remittances, and on-chain financial infrastructure at scale.

Source: Coin Metrics Network Data Pro and Stablecoin Sector Report

The report provides a comprehensive breakdown of:

Key metrics outlining stablecoin growth and adoption.

The different types of stablecoins, from fiat-backed to crypto-collateralized and interest-bearing models.

Major stablecoin issuers across categories, like Tether, Circle, Ethena and Sky, and the reserve composition of their respective stablecoins.

Blockchains competing for stablecoin dominance and the patterns of stablecoin usage across networks like Ethereum, Solana and Base.

Network Data Insights

Summary Highlights

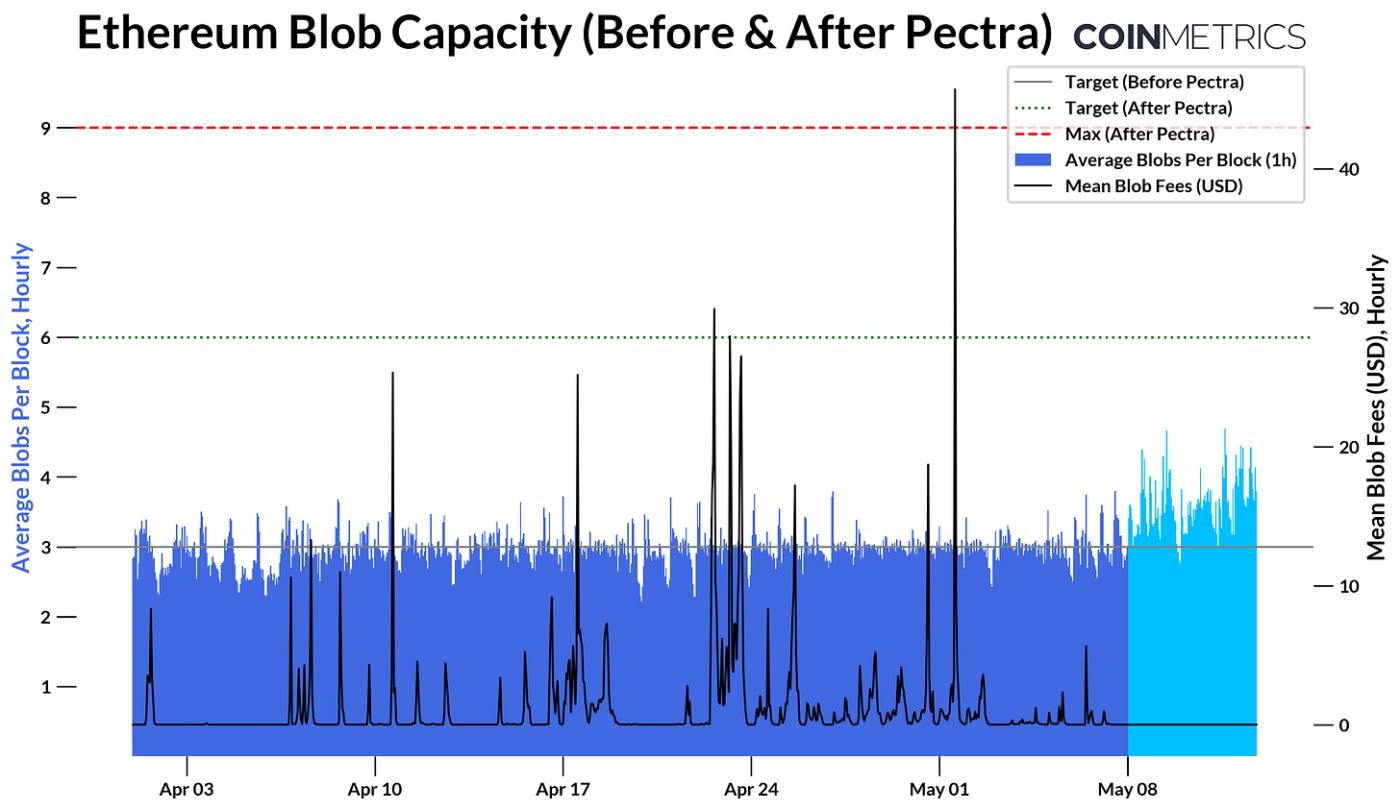

Ethereum’s Pectra hard fork successfully went live on May 8th, implementing a range of upgrades including validator improvements (EIP-7251), user experience UX enhancements with smart-accounts (EIP-7702), and blob scaling. EIP-7691 doubled Ethereum’s blob throughput, increasing the target to 6 and maximum of 9 blobs per block.

Source: Coin Metrics Network Data Pro

Since Pectra’s activation, daily blob count has risen from ~21K to over 26K, while the hourly average number of blobs per block has increased from ~3 to over 4. As a result, blob fees have declined further, incentivizing greater usage from rollups like Base Arbitrum and Optimism. As Layer-2s ramp up utilization of newly unlocked blobspace, the pace at which they approach the new target and the responsiveness of blob fees will both be key metrics to watch.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.