Bitcoin's recent upward trend is attracting investors' attention. The price is approaching $105,000. Major cryptocurrencies have shown an upward trend over the past month, driven by strong institutional interest and new market optimism.

However, conflicting market conditions may prevent Bitcoin from reaching a new all-time high.

Bitcoin Holders Accumulating in Large Quantities

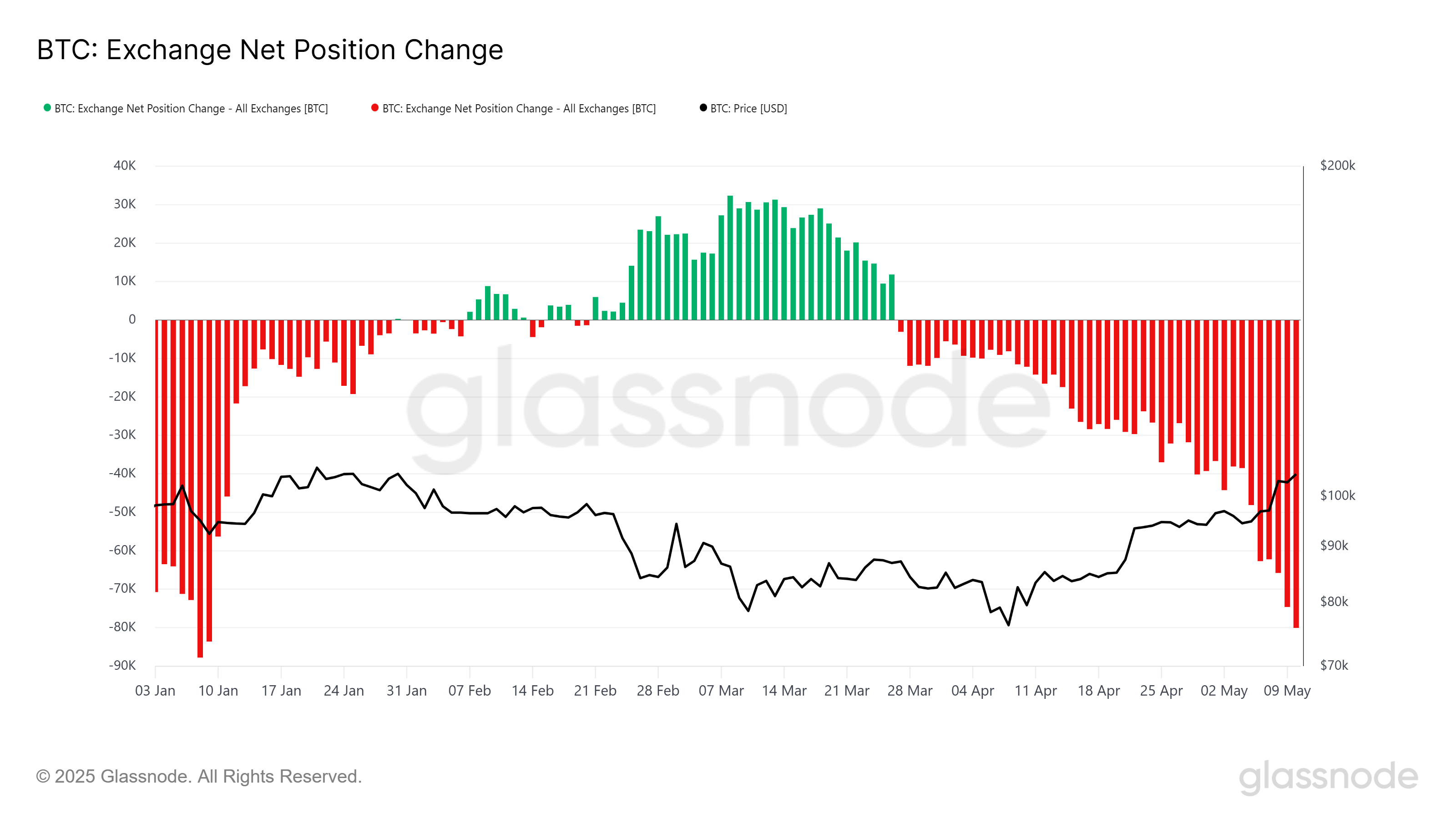

Investor activity is very strong. Over the past week alone, more than 30,072 BTC were purchased. This is worth over $3.13 billion. This surge in purchasing activity has driven the exchange net position to its lowest level in four months.

This indicator suggests that more coins are being withdrawn from exchanges than deposited. This is a typical sign of accumulation.

Bitcoin holders are quickly accumulating, fearing missing out on potential gains. As Bitcoin approaches record highs, long-term investors seem to be adding positions in anticipation of a new breakthrough.

While accumulation remains strong, the macro trend shows a mixed picture. The key on-chain indicator, Liveliness, has noticeably surged since early May. Currently reaching its highest level in weeks, it suggests long-term holders have started selling.

The increase in Liveliness typically means dormant coins are being reactivated. This indicates early adopters are realizing profits. Such behavior could create new selling pressure in the market.

If Bitcoin long-term holders continue to sell their holdings, it could weaken the bullish sentiment driven by new accumulation.

BTC Price, Targeting New High

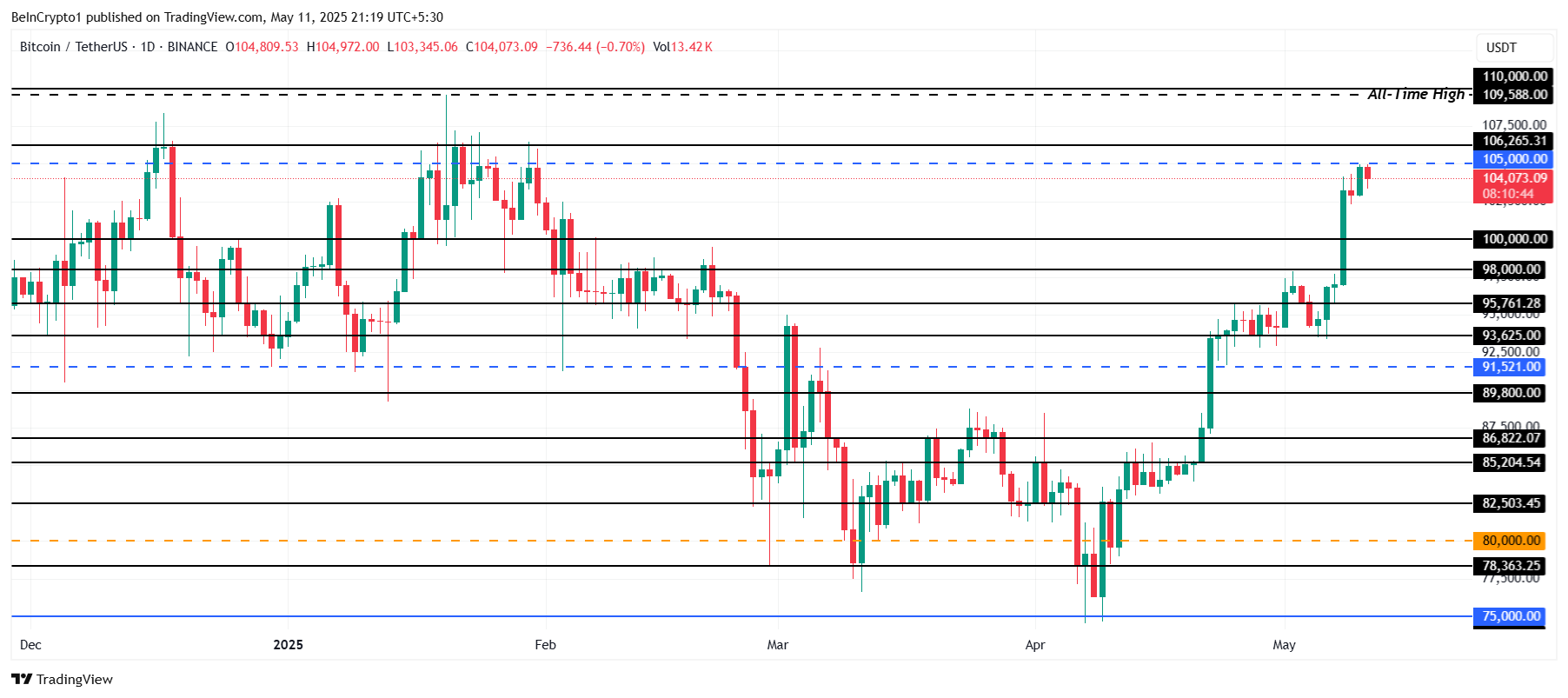

Bitcoin is currently trading at $104,231. This is just below the major psychological resistance of $105,000. However, technical data shows the actual resistance is at $106,265. This price level has been acting as a ceiling since December 2024, preventing Bitcoin from further rising.

The all-time high is at $109,588, but $106,265 is the immediate obstacle for Bitcoin. Market dynamics, especially long-term holders' selling and conflicting investor sentiment, make it difficult to break through this level.

If Bitcoin fails to overcome this resistance, the price is likely to adjust to the $100,000 range.

Conversely, if Bitcoin breaks through $106,265 and can use it as a support level, it could reignite bullish momentum. Such a move could help Bitcoin recover to $109,588 and potentially form a new all-time high.

Exceeding this level would invalidate the bearish outlook and set the stage for a potential rise to $110,000.