Over the past 24 hours, approximately $262.64 million (about 384 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

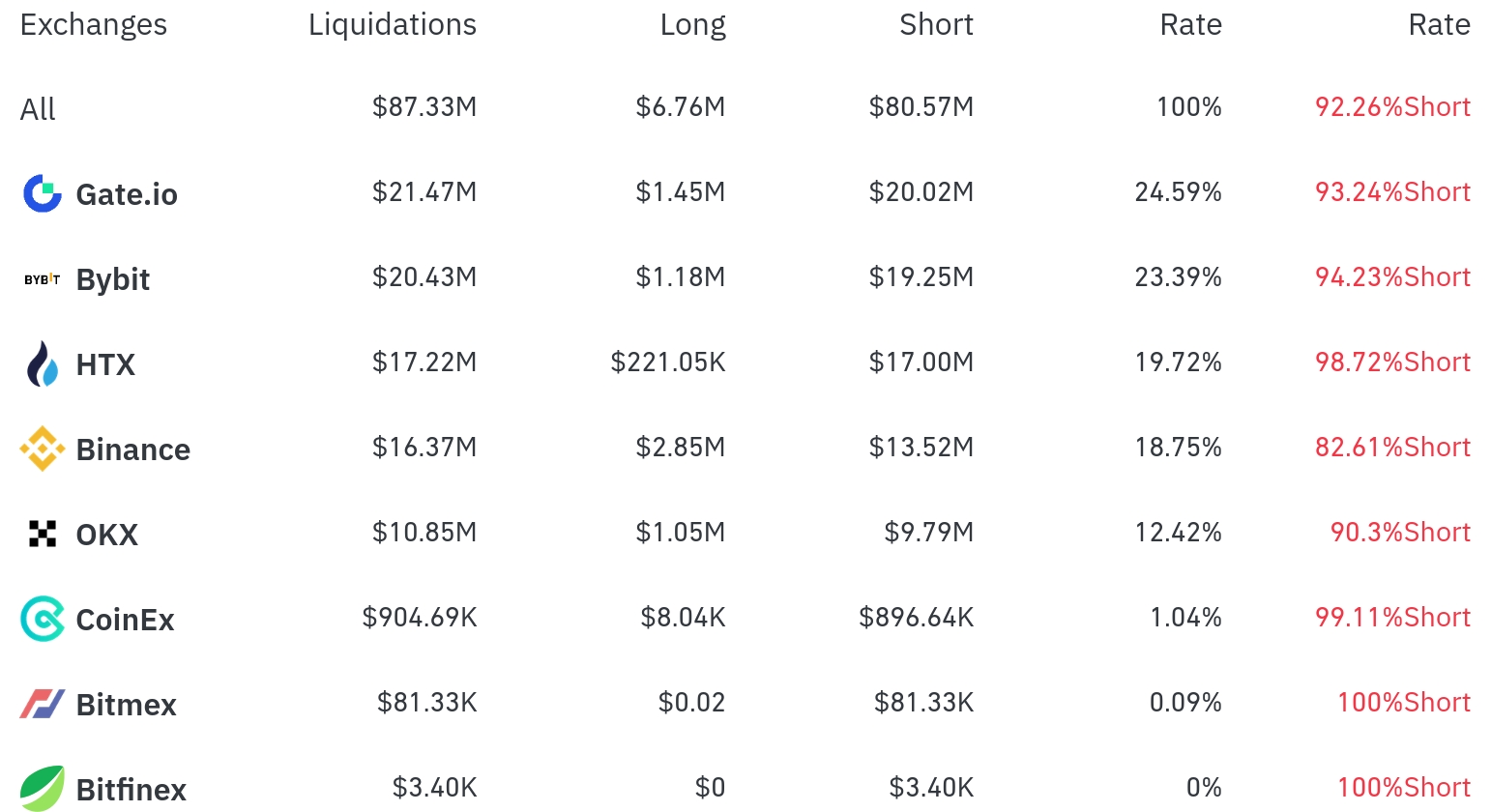

According to the currently aggregated data, short positions overwhelmingly dominated the liquidated positions. Particularly, excluding Bitfinex, major exchanges saw a total liquidation of $87.33 million within 4 hours, with short positions accounting for $80.57 million, or 92.26% of the total.

Gate.io experienced the most position liquidations over the past 4 hours, with a total of $21.47 million (24.59%) liquidated. Among this, short positions were $20.02 million, accounting for 93.24%, indicating massive losses for traders who anticipated a decline in an upward market.

On Bybit, $20.43 million (23.39%) of positions were liquidated, with short positions at $19.25 million, representing 94.23%. HTX saw approximately $17.22 million (19.72%) in liquidations, with short positions at an overwhelming 98.72%.

Binance experienced about $16.37 million (18.75%) in liquidations, with short positions at 82.61%. OKX saw approximately $10.85 million (12.42%) in liquidations, with short positions at 90.30%.

Notably, BitMEX had a 100% short position liquidation rate, while CoinEx also saw an overwhelming 99.11% short liquidations.

By coin, Bitcoin (BTC) had the most liquidated positions. Over 24 hours, approximately $134.66 million in Bitcoin positions were liquidated, with $22.22 million in long positions and $18.59 million in short positions within 4 hours. Bitcoin's price is currently at $99,711.8, a 2.82% increase over 24 hours.

Ethereum (ETH) saw about $100.49 million in positions liquidated over 24 hours, with $37.62 million in long positions and $17.77 million in short positions within 4 hours. Ethereum's price rose 6.92% to $1,959.49.

Solana (SOL) had approximately $12.23 million liquidated over 24 hours, with $3.40 million in long positions and $2.42 million in short positions within 4 hours. Solana's price increased by 4.84%.

Dogecoin (DOGE) saw $4.46 million in liquidations over 24 hours with a 6.44% price increase, including $930,000 in long positions and $1.14 million in short positions within 4 hours.

Notably, the TRUMP Token experienced a significant 12.63% price increase, with $490,000 in long positions and $760,000 in short positions liquidated within 4 hours, and $3.36 million in liquidations over 24 hours.

Meme coins like PEPE and 1000PEI also saw substantial short position liquidations alongside price increases of 13.01% and 13.02% respectively.

This large-scale short liquidation demonstrates that investors who anticipated a decline have incurred significant losses as the cryptocurrency market shows an overall upward trend. Particularly, with Bitcoin approaching $100,000, the potential for additional upward momentum is drawing attention.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>