On Tuesday, the Bit coin spot ETF recorded net outflows, breaking the trend of over $1 billion in net inflows over three days.

Due to uncertainty about the Federal Reserve's policy decision, institutional investors appear to be reducing their held positions while anticipating increased market volatility.

Institutions Reduce BTC ETF Positions… Federal Reserve Decision Imminent

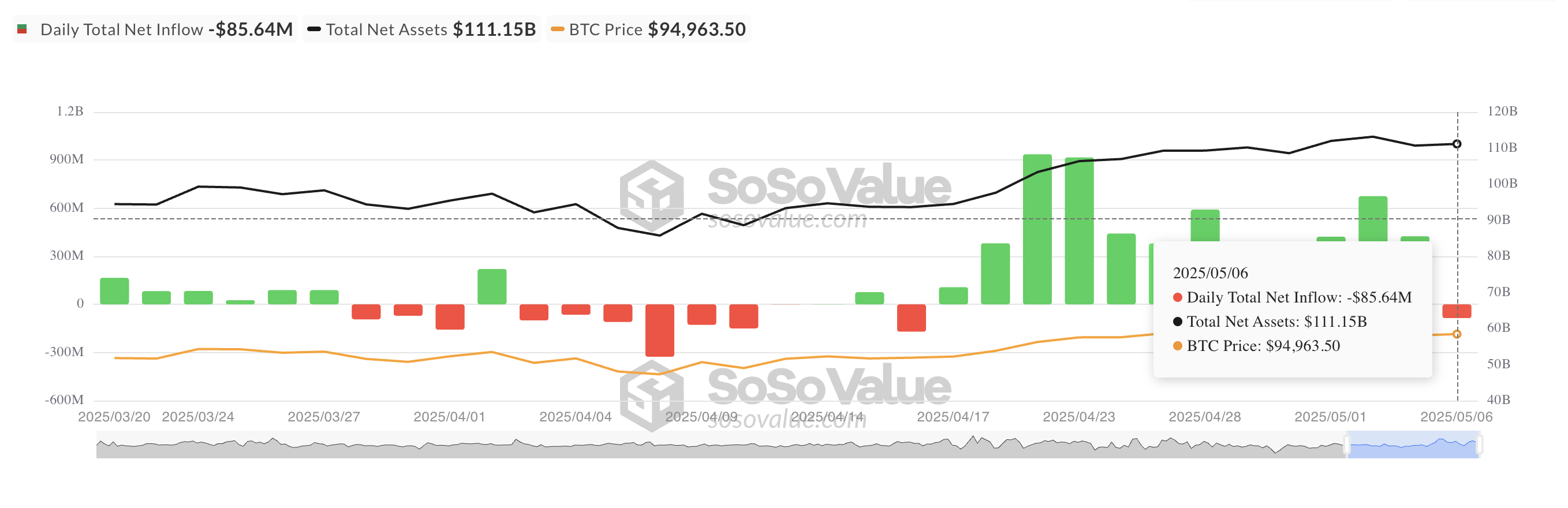

The BTC spot ETF recorded net outflows of $85.64 million on Tuesday. This reflects a change in institutional investor sentiment ahead of the latest policy meeting of the US Federal Reserve today.

These outflows occurred after three consecutive strong inflows, with over $1 billion flowing into these BTC-supported funds. This suggests market participants are preparing adjustments in anticipation of potential volatility with today's FOMC announcement.

This can also be seen as a strategic move to avoid short-term losses in case of unfavorable policy signals or unexpected market reactions.

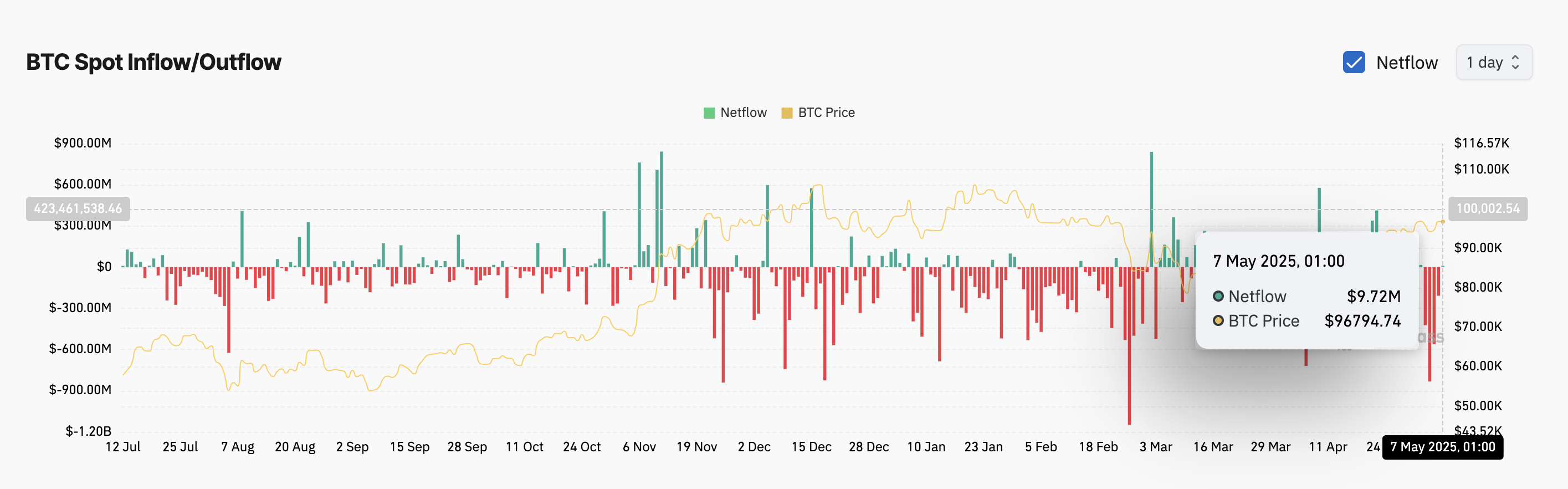

Despite ETF outflows, on-chain data shows a surge in spot net inflows today. This suggests that institutional investors might be rotating capital into direct spot positions while reducing ETF exposure. This could be to leverage short-term price movements before and after the Federal Reserve announcement.

According to CoinGlass, BTC's spot net inflow is $9.72 million. When assets show spot inflows, it indicates increased purchasing of coins or tokens and movement into the spot market, signaling increased demand.

This indicates a rapidly increasing accumulation among BTC spot market participants, which could drive price increases if buying pressure continues.

Bit coin Rises with Buying Pressure

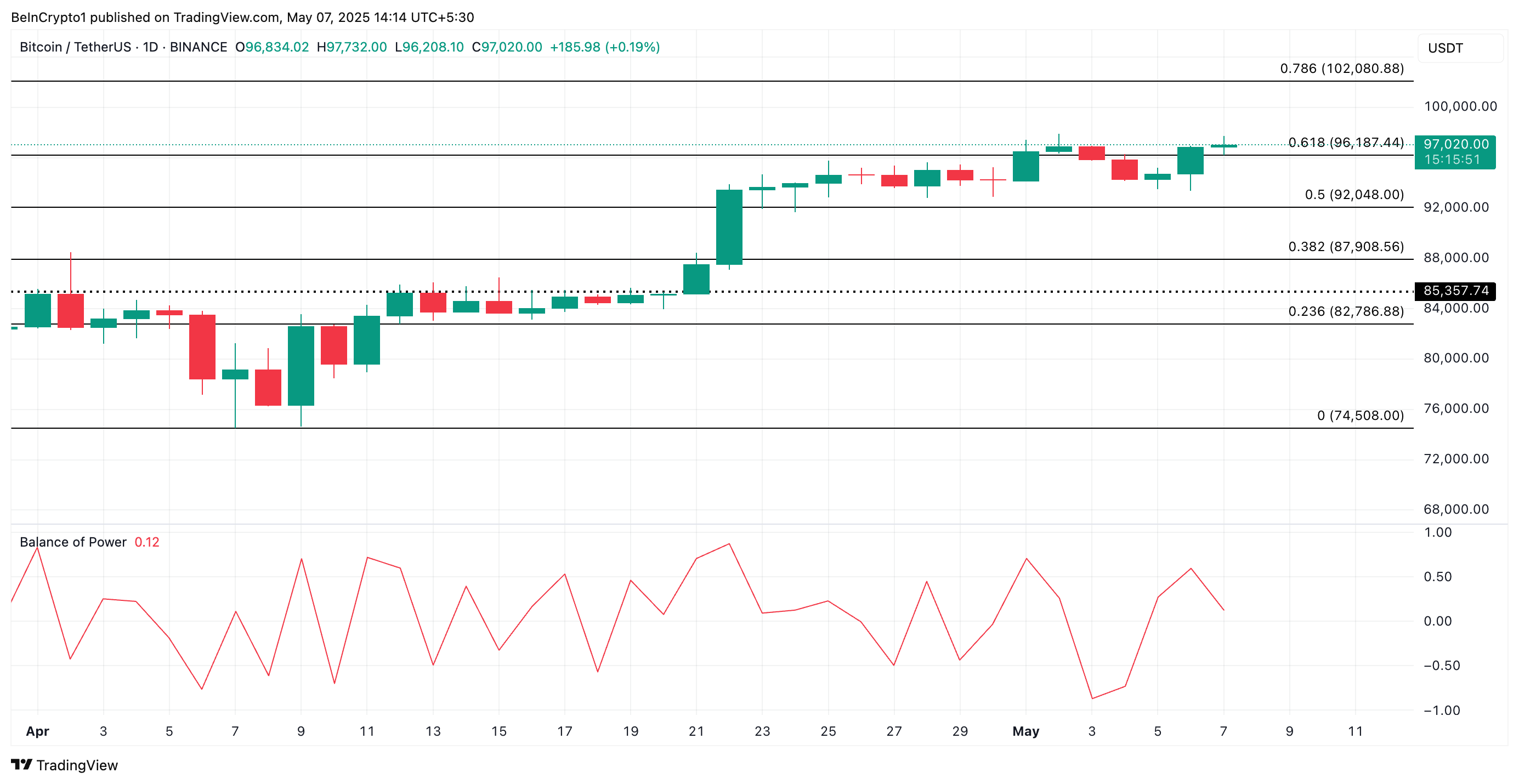

BTC is trading at $96,679 at the time of reporting, rising 2% over the past day. The coin's positive Balance of Power (BoP) reflects steady increases in spot buying activity ahead of the FOMC meeting. The current value is 0.10.

This indicator measures the strength of buyers and sellers by comparing the trading range and closing price during a specific period. When the value is positive, buyers dominate the market, suggesting bullish momentum and upward price pressure for the asset.

If BTC demand surges and market conditions remain favorable after the FOMC meeting, it could rise to $102,080.

However, if market volatility leads to a decline, BTC could lose recent gains and drop below the support level of $96,187 to $92,048.