Cryptocurrency inflows continued a positive trend last week, with total inflows reaching $5.5 billion over the past three weeks.

This comes as market optimism grows, with macroeconomic data acting as a positive factor for leading cryptocurrencies.

Cryptocurrency Inflows of $2 Billion Last Week

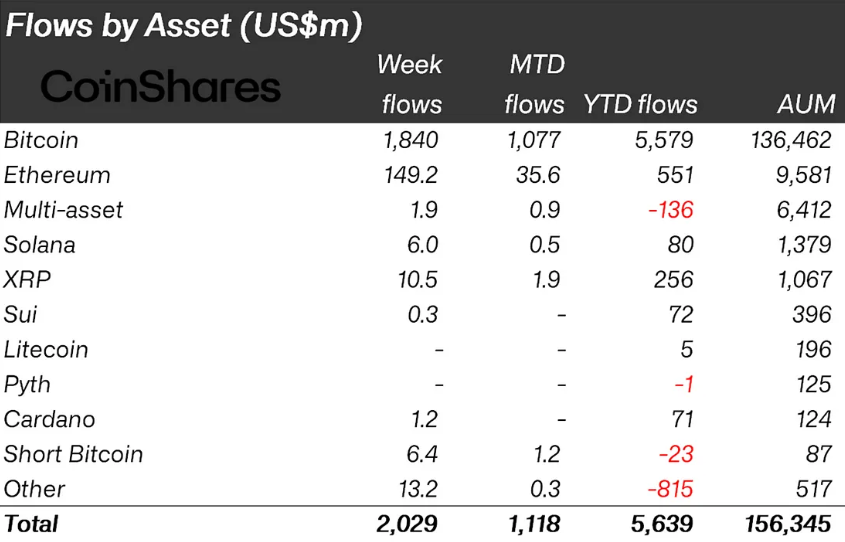

According to the latest CoinShares report, cryptocurrency inflows reached $2 billion last week, marking a third consecutive week of positive trends.

The previous week, cryptocurrency inflows amounted to $3.4 billion. This was because investors chose digital assets as safe-haven assets. Before that, inflows into digital asset investment products were $146 million, with XRP being an exception to this trend.

Last week, Bitcoin was the main beneficiary, recording $1.8 billion in inflows. Ethereum also saw a strong inflow of $149 million for the second consecutive week. Meanwhile, peers like Solana showed small inflows of $6 million.

CoinShares explains the market optimism is due to positive U.S. economic indicators, despite Trump's tariffs.

Notably, despite the U.S. first-quarter GDP contraction, the market closed optimistically, supported by strong employment data. The main GDP declined by 0.3% due to export reduction from U.S. tariffs. However, the core GDP, reflecting private sector strength, rose by 3.0%.

Partially, CoinShares researcher James Butterfield explains this as companies preparing for tariffs in advance. Futures markets now expect an 86bp rate cut in 2025. However, strong payrolls (177k vs. 135k expected) and high core PCE inflation reduce the likelihood of a rate cut at Wednesday's FOMC meeting.

"Current data is likely insufficient to trigger a rate cut at next Wednesday's Federal Open Market Committee (FOMC) meeting." – James Butterfield, CoinShares Researcher

Service inflation shows weakness, suggesting cautious consumer behavior. Stocks and Bitcoin are sensitive to tariff developments, and employers are delaying job cuts.

Against this backdrop, digital asset investment products continue to show positive sentiment, with Bitcoin's momentum particularly looking positive in the U.S.

"The latest digital asset manager fund survey reflects these changing sentiments. Investor preference for Bitcoin has strengthened after the U.S. election, with 63% currently holding it. This is a 15 percentage point increase since January. Digital asset allocation reached a one-year high of 1.8%, driven by price increases and improved sentiment. Institutional allocation increased to an average of 2.5%." – James Butterfield, CoinShares Researcher

However, despite improved Bitcoin sentiment, CoinShares emphasizes that both new and existing investors cite volatility as their biggest concern.

According to Butterfield, this highlights the ongoing discrepancy between perceived risk and actual market behavior.

According to BeInCrypto data, BTC was trading at $93,997 at the time of writing. This represents nearly a 2% decline over the past 24 hours, falling below the $94,000 range on Monday.