Bitcoin has been continuously declining over the past 3 days, with the price dropping below the psychologically important level of $95,000.

As the downward trend continues, this coin could fall to $90,000, indicating additional downward momentum for major cryptocurrencies.

BTC, Accumulating Decline Signals

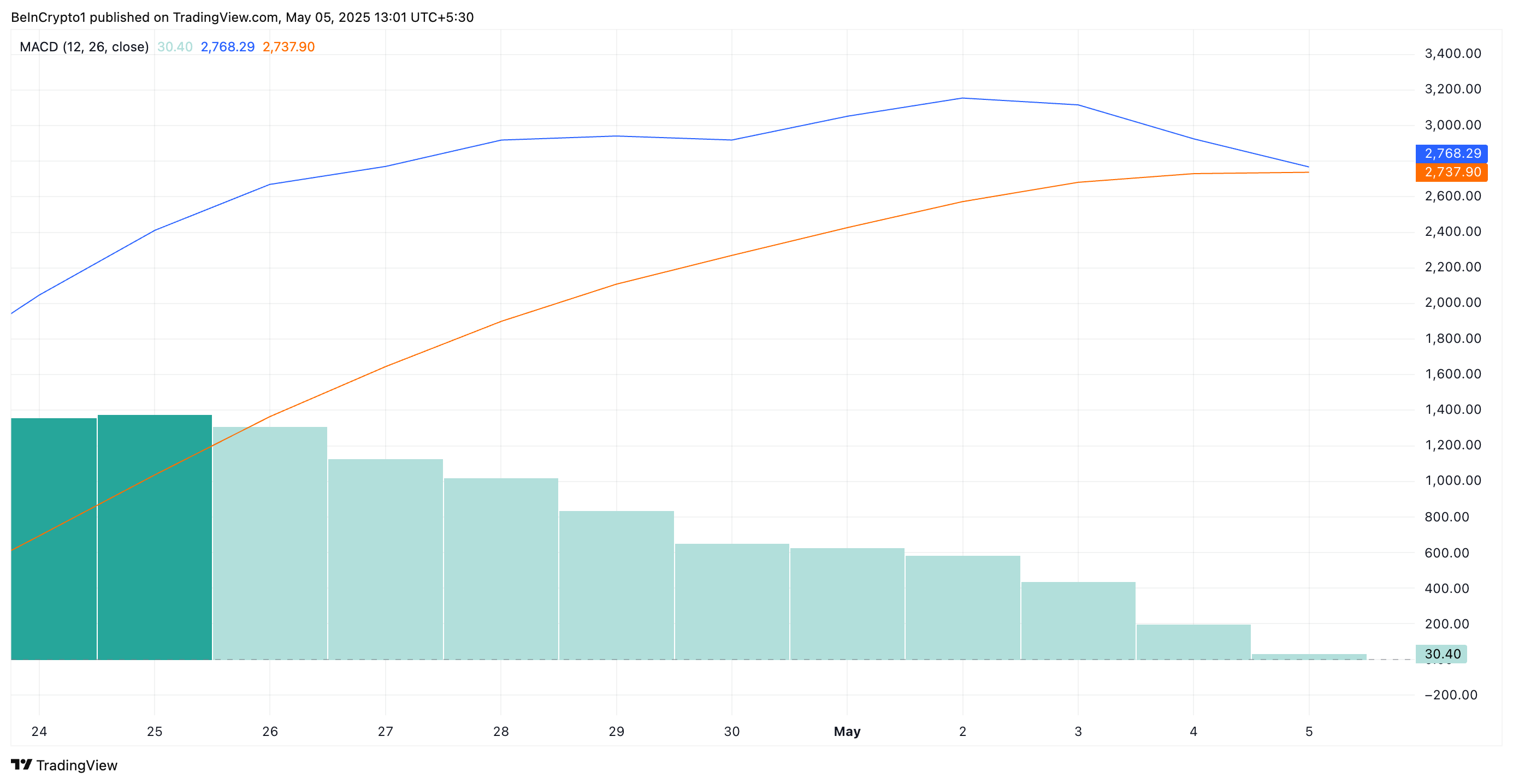

BTC's Moving Average Convergence Divergence (MACD) indicator is attempting to form a death cross. This is a technical pattern that occurs when the MACD line crosses below the signal line.

The MACD indicator tracks the price trend of an asset and identifies buy or sell signals based on trend direction and momentum changes.

BTC's current MACD setup is noteworthy. The death cross appearing on the indicator usually signals the beginning of a long-term price decline. This adds to concerns about the coin's short-term price movements.

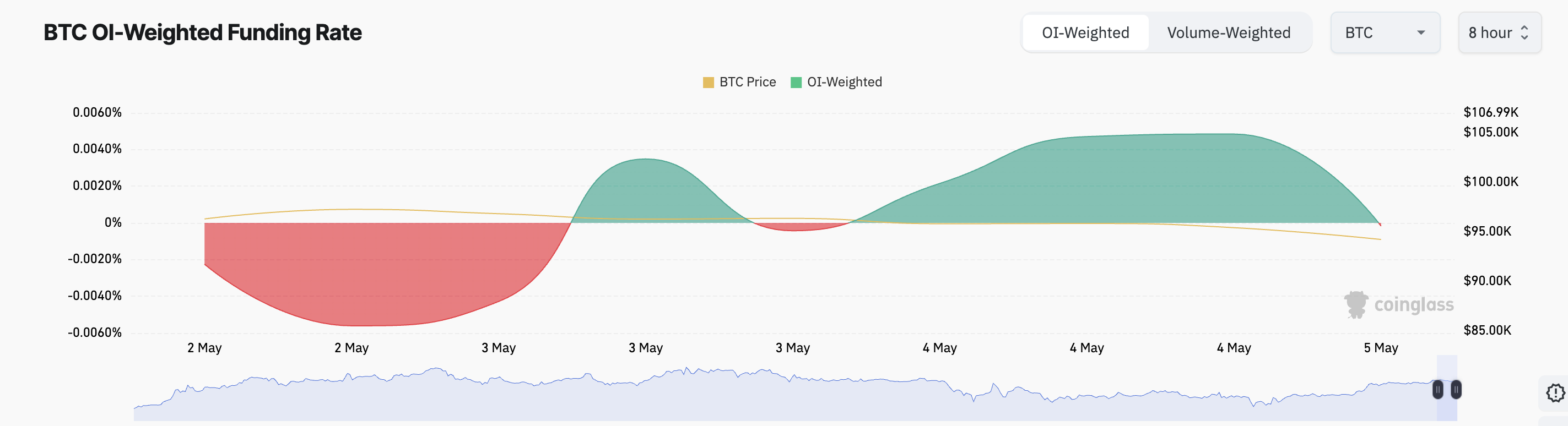

Moreover, BTC's persistent negative funding rate further reinforces this downward outlook. According to Coinglass data, since May 1st, the coin's funding rate has been more red than green. This reflects an increasing preference for short positions among futures traders.

At the time of reporting, the funding rate is -0.0002%, indicating that most traders are expecting a price decline rather than a recovery.

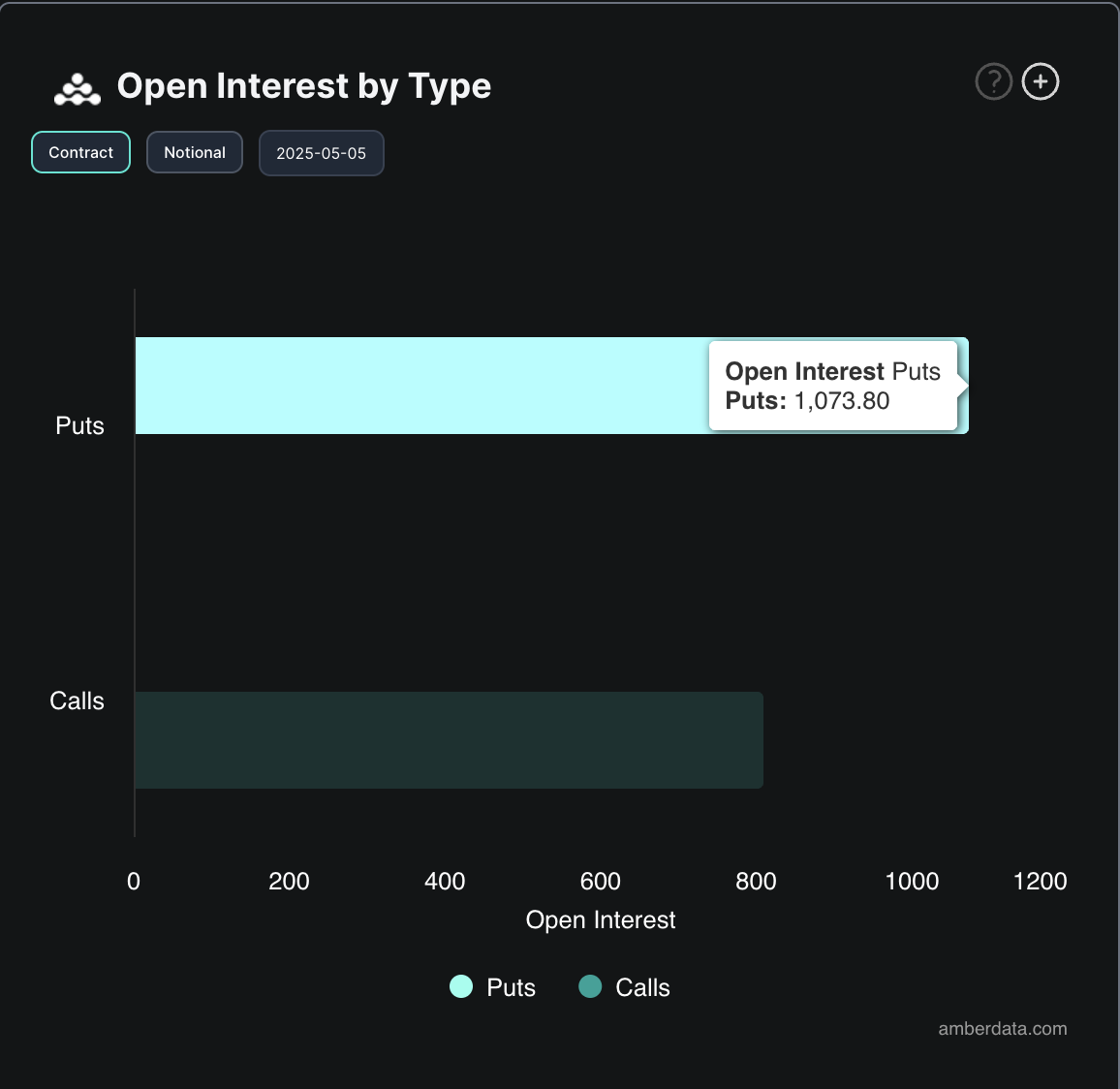

The options market is also painting a gloomy picture of BTC's short-term price performance. At the time of reporting, BTC's put-call ratio is 1.33.

This means that put contracts, which bet on BTC's price falling, are significantly more open than call contracts. A ratio above 1 indicates that BTC is preparing for additional decline or expecting short-term price drops.

Bitcoin: Will It Crash to $87,000 or Rebound to $96,000?

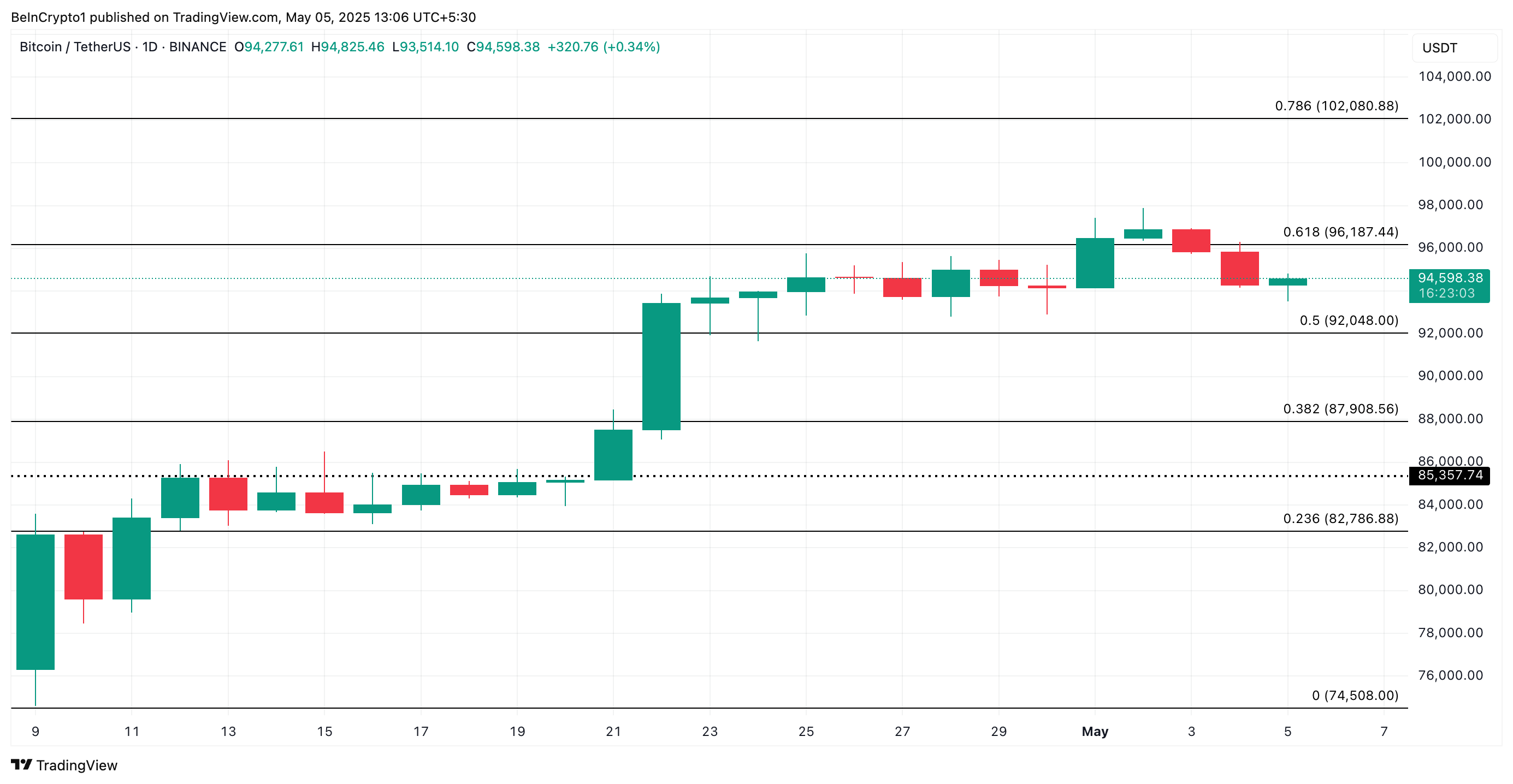

BTC is currently trading at $94,598 and has transformed the $95,000 price level into a resistance level. As the downward trend intensifies, this coin could fall to $92,048.

If buying pressure fails to defend this resistance, the price could drop below $90,000, trading as low as $87,908.

However, if buying pressure regains control of the market, this downward outlook could be invalidated. In this case, BTC could recover above $95,000 and rise to $96,187.