In the cryptocurrency market over the past 24 hours, approximately $1.434 billion (about 2 trillion won) worth of leverage positions were liquidated.

According to the currently aggregated data, long positions accounted for $132.97 million, representing 92.7% of the total liquidations, while short positions were $10.43 million, accounting for 7.3%.

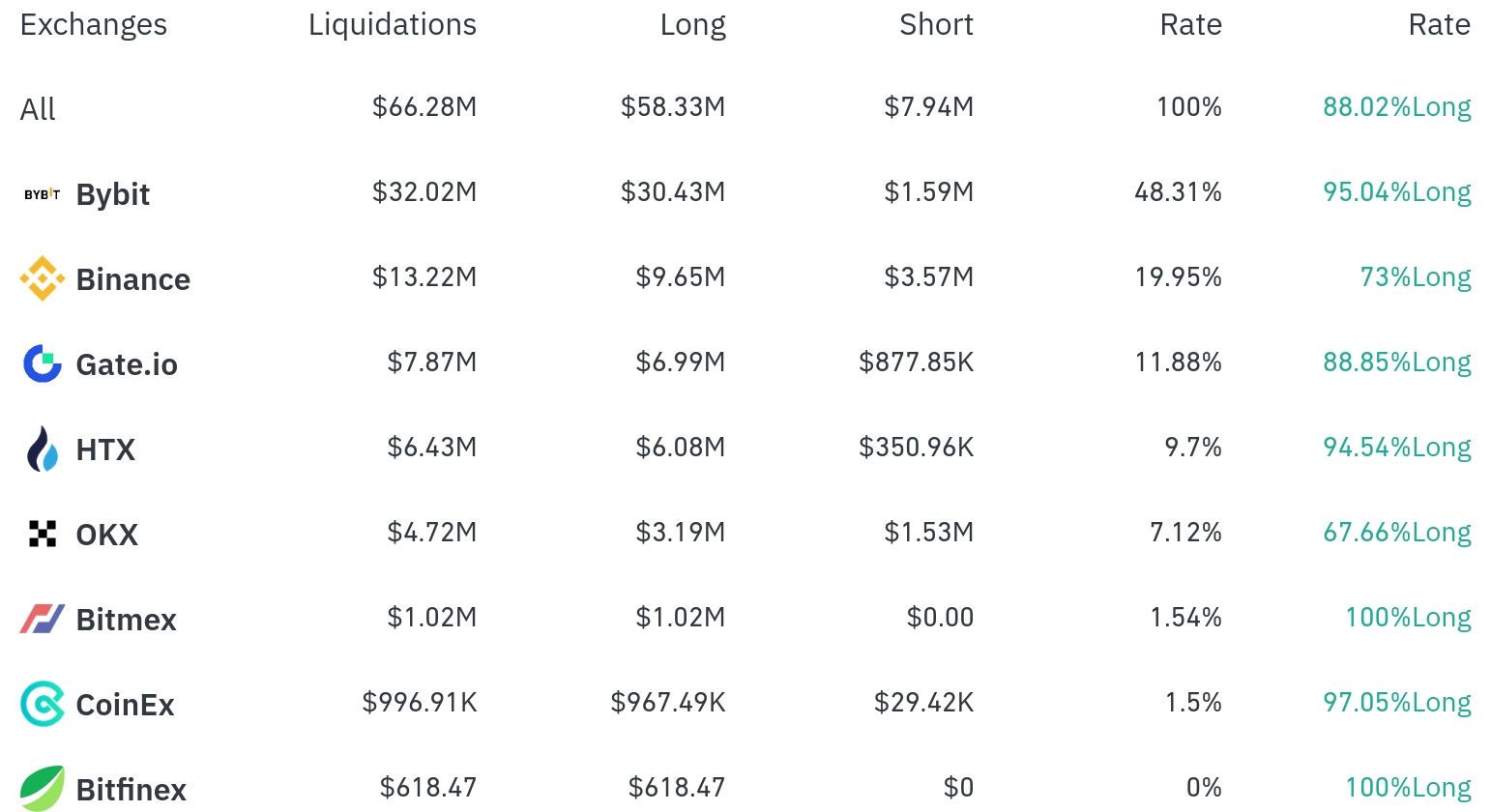

Bybit had the highest position liquidations over the past 4 hours, with a total of $32.02 million (48.31%) liquidated. Among these, long positions accounted for $30.43 million, or 95.04%.

Binance was the second-highest, with $13.22 million (19.95%) of positions liquidated, of which long positions were $9.65 million (73.00%).

Gate.io saw $7.87 million (11.88%) in liquidations, with long positions at 88.85%. HTX also experienced $6.43 million (9.70%) in liquidations, with a very high long position ratio of 94.54%.

OKX had approximately $4.72 million (7.12%) in liquidations, with a relatively lower long position ratio of 67.66% compared to other exchanges.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $83.62 million in Bitcoin positions were liquidated over 24 hours, with $27.09 million in long positions and $1.08 million in short positions liquidated over 4 hours.

Ethereum (ETH) had about $33.74 million in positions liquidated over 24 hours, with $16.71 million in long positions and $1.40 million in short positions liquidated over 4 hours.

Solana (SOL) saw about $7.66 million liquidated over 24 hours, and among other major altcoins, XRP ($5.24 million) and SUI ($4.32 million) followed.

Dogecoin (DOGE) saw approximately $870,000 in long positions liquidated over 4 hours, accompanied by a 1.57% price drop, with a total of $2.82 million in liquidations over 24 hours.

Notably, the TRUMP Token, despite a 1.06% price increase, had $170,000 in long positions and $480,000 in short positions liquidated over 4 hours, with a total of $2.29 million in liquidations over 24 hours.

Meanwhile, the FARTCO Token saw about $1.46 million in positions liquidated over 24 hours, with a 4.66% price increase, and SUI showed an unusual pattern of similar levels of short and long position liquidations, despite a 3.78% price increase.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. It is analyzed that large-scale long position liquidations occurred as Bitcoin experienced adjustments around the $90,000 level.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>