Despite the widespread market downturn, the Federal Reserve does not seem to view the situation as serious enough to implement quantitative easing.

To understand the timing of quantitative easing by the Federal Reserve to address market instability and its potential impact on Bitcoin prices, BeInCrypto interviewed experts from 22V Research, the on-chain cryptocurrency platform CryptoQuant, and BingX.

Overcoming Market Headwinds in 2025

From the beginning of 2025, the market has faced serious challenges. Various concerns have unsettled investors, from the possibility of trade wars between the US and other major global economies to economic growth slowdown, recession concerns, and rising inflation.

Two days ago, the US stock market recorded the worst first 100 days of any presidential term since Gerald Ford's inauguration in 1974. The cryptocurrency market was also affected in this process. Despite subsequent price recovery, Bitcoin's value fell below $77,000 last month, and altcoins suffered even greater losses.

Trump's 90-day extension on most tariffs calmed investors and restored market confidence. However, what will happen when this period ends remains a significant stress factor. Simultaneously, concerns about inflation and economic recession are amplifying these fears.

"Due to the uncertainty brought by this change, [investors] have lost confidence in the future. Investors need to have a vision for the future, and currently, it is so uncertain that it is similar to a situation where companies find it difficult to make decisions about the future." – Jordi Visser, Head of AI Macro Nexus Research at 22V Research

Now, people are watching what strategy the Federal Reserve will consider to alleviate uncertainty and economic pain. Some analysts are predicting a shift to quantitative easing (QE).

Central Bank Liquidity Tool

QE is a tool used by central banks to inject liquidity into the financial system during specific periods of economic uncertainty.

When implementing this measure, banks primarily purchase government bonds in the open market from commercial banks and other financial institutions. This aims to lower long-term interest rates and encourage consumer spending.

The effects of QE can significantly impact Bitcoin prices through market liquidity, investor sentiment, and perceived value of fiat currency. The coronavirus pandemic served as a prime example of these dynamics.

In March 2020, as the pandemic triggered a global financial crisis, Bitcoin prices plummeted from around $8,000 to $3,800. However, the Federal Reserve's aggressive QE measures coincided with a significant recovery and ultimate surge in Bitcoin prices.

"In the most concise way, quantitative easing (QE) acted as a catalyst by increasing liquidity, lowering yields, and creating a risk-preference environment that strengthened Bitcoin's appeal as a hedge and speculative asset. The 2020 surge set a precedent showing the impact of macroeconomic policy changes on the cryptocurrency market, and it continues to be popular with the new QE speculation in 2025." – Vivian Lin, Chief Product Officer at BingX

With access to low interest rates and increased liquidity, investors willing to take risks became more inclined to purchase assets. Investors often seek alternative assets instead of fiat currency when uncertainty increases.

Bitcoin's Role as an Alternative Asset

Recent volatility and geopolitical pressures have dramatically increased investor interest in cryptocurrencies.

"Institutional investors are leveraging market volatility to increase their cryptocurrency allocations and using digital assets as a hedge against geopolitical risks. Meanwhile, individual investors are maintaining a stable approach, emphasizing long-term strategies and selective rebalancing." – Lin

Lin added that institutions are increasingly considering cryptocurrencies as a key portfolio component.

Michael Saylor's strategy has been to become an aggressive Bitcoin accumulator, and other companies like GameStop and Fold Holdings have also recently begun diversifying their assets, including Bitcoin.

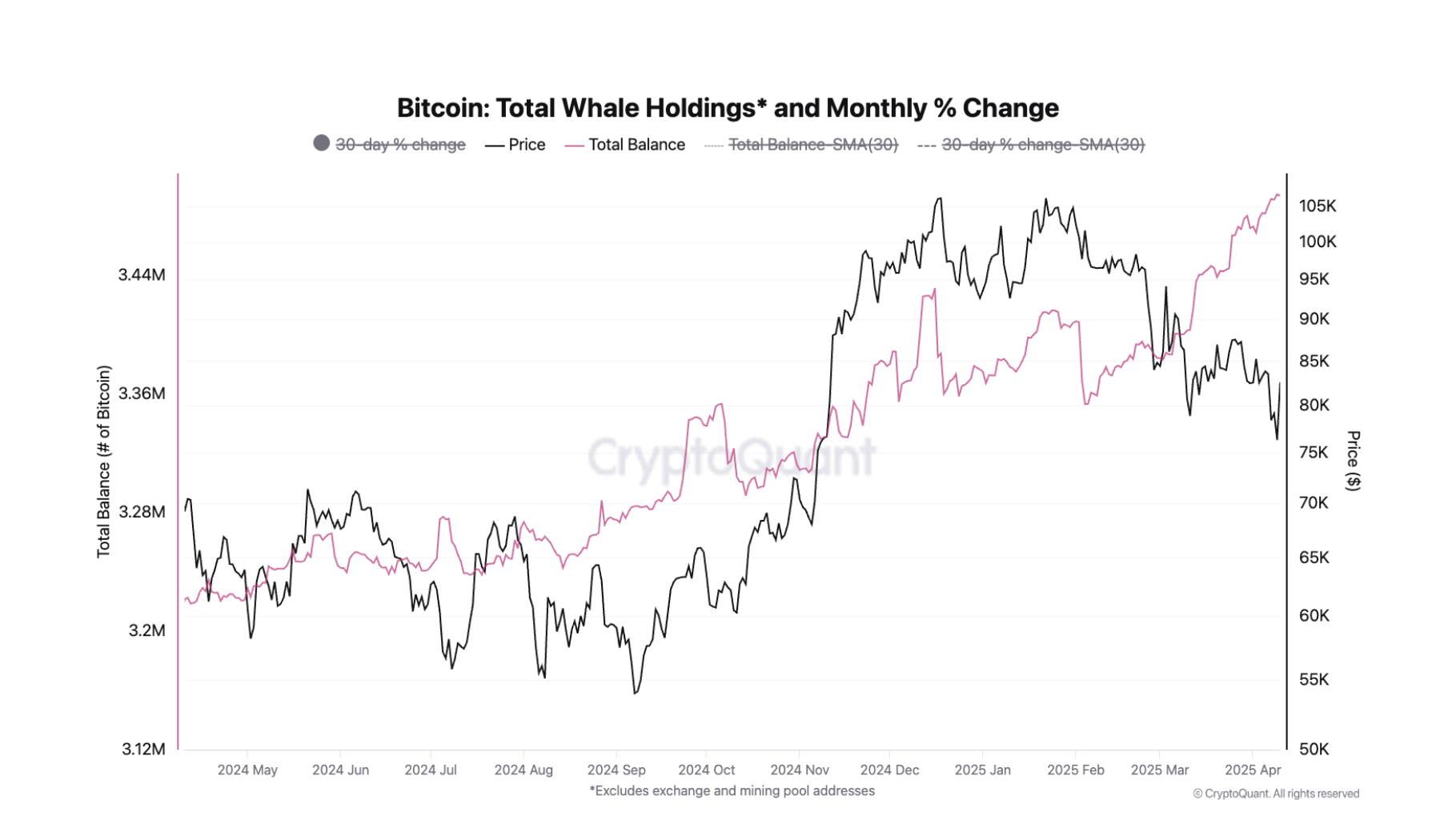

Julio Moreno, Research Director at CryptoQuant, discovered similar trends among large holders.

"We definitely saw large holders accumulating Bitcoin after the price fell below $90,000 in late February. The total balance of large Bitcoin holders (holding 1,000-10,000 Bitcoin) increased from 3.39 million Bitcoin to 3.49 million Bitcoin since late February, representing an increase of about 110,000 Bitcoin. This indicates that large investors are buying Bitcoin during price declines." – Julio Moreno, Research Director at CryptoQuant

With Bitcoin already demonstrating clear value as an alternative asset, the Federal Reserve's quantitative easing (QE) strategy could have a positive impact on prices.

Bitcoin Bullish Outlook

Last month, BitMEX's former CEO Arthur Hayes predicted that Bitcoin could reach $250,000 by the end of 2025 if the Federal Reserve switches to QE to support the market.

Visser agrees with this view, suggesting that implementing QE now would further increase interest in Bitcoin.

"Bitcoin has three elements. First, it exists outside the legal currency system. So when doubts arise about the current financial system, investors are looking for alternative investments that can serve as a store of value. Second, like a legal currency risk asset, it historically benefits during periods of increased global liquidity. This can occur when QE is needed. Lastly, it is a digital asset and part of the growth of the digital economy. Stablecoins continue to increase in trading volume and are supported by the US government, helping Bitcoin's network effect." – Secretary

However, experts acknowledge that the current economic situation is not serious enough to adopt QE.

Quantitative Easing (QE) Not Imminent

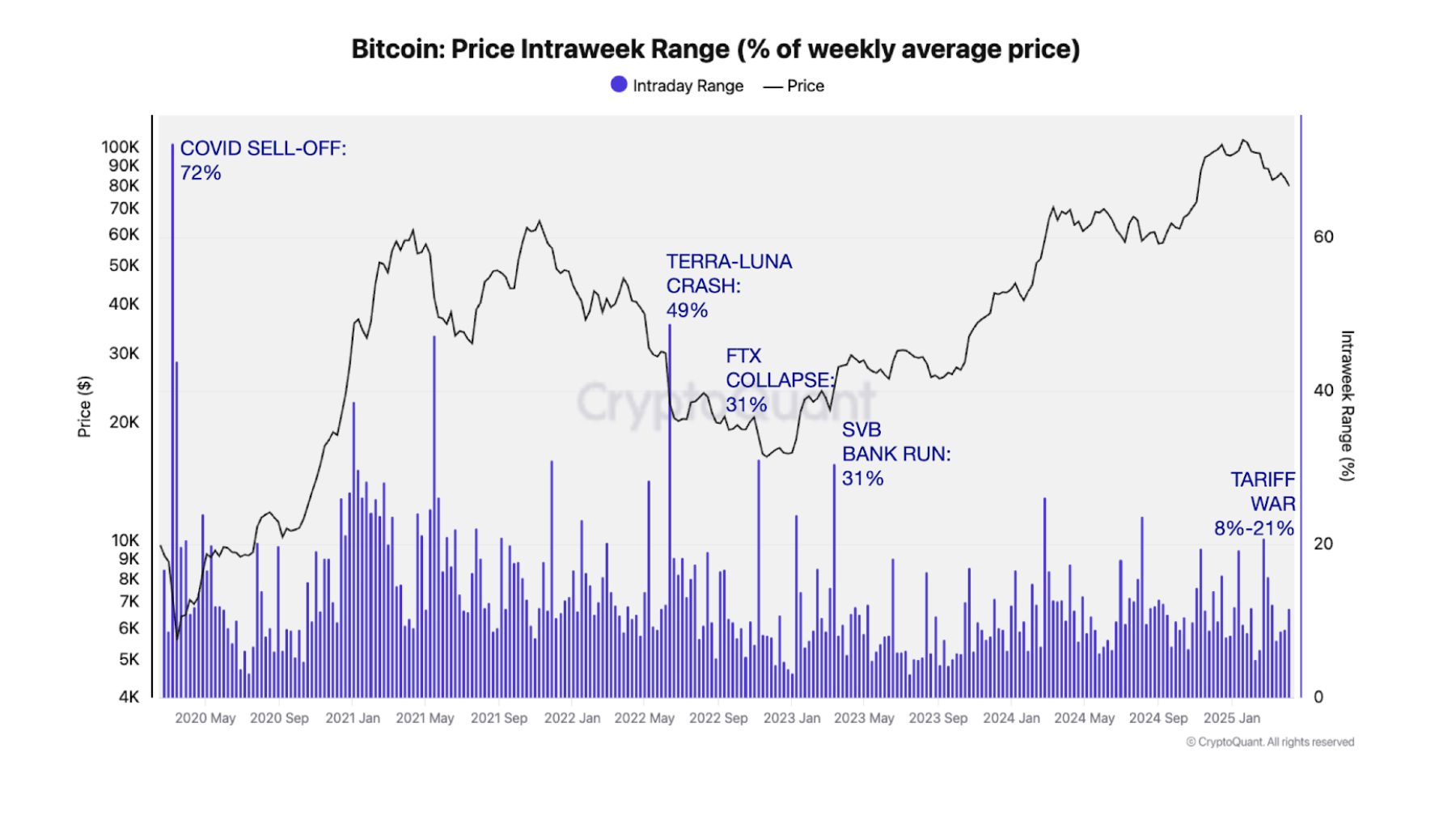

Moreno explained that Bitcoin's current volatility is higher than the previous week, but still far from other periods when the market faced uncertainty.

"For example, during the COVID market collapse in March 2020, Bitcoin's weekly price volatility surged to 72%. This indicator increased to 49% after the Terra-Luna collapse in May 2022, and increased to 31% due to the FTX collapse in November of the same year. In March 2023, volatility reached 31% due to the SVB bank failure. In comparison, since February, as announcements about US tariffs became more frequent, volatility fluctuated between 8% and 21%." – Moreno

The Secretary agreed and added:

"[QE] would require a significant decrease in economic activity or stronger turmoil in the US bond market." – Secretary

According to Lin, now is not a good time to inject liquidity because the Fed recently lowered its GDP growth forecast for the US economy.

"The Fed recently lowered the 2025 GDP growth rate from 2.1% to 1.7% and raised inflation expectations, suggesting a cautious approach. However, Chair Powell emphasized flexibility in this assessment, stating that 'the policy is not on a predetermined path'." – Lin's explanation

This flexible approach allows for QE implementation if the situation worsens.

QE Strategy's Impact on Institutional Adoption?

The current US economic state does not require the Fed to adopt a QE strategy, but it remains a valid option if the situation deteriorates during Trump's presidency.

"Immediate quantitative easing is unlikely, but labor market weakness, deflationary signals, and liquidity tensions could invalidate the current QT path. This is especially true if geopolitical risks lead to broader economic repercussions." – Lin's explanation

In addition to affecting prices, another QE could significantly impact institutional adoption, regulatory oversight, and the general perception of Bitcoin and other cryptocurrencies.

"Quantitative easing (QE) can serve as a means to test the decentralized foundation as cryptocurrencies become integrated into global finance. Institutions will use increased liquidity to develop infrastructure, and regulators will focus on implementing systematic safeguards. As a result, Bitcoin's identity will transition from a mere speculative asset to a core element of macroeconomic strategy." – Lin's conclusion

Ideally, economic conditions would not require such intervention. However, if QE becomes necessary, it could create positive momentum for the digital asset industry.