Kraken, one of the oldest cryptocurrency exchanges in the United States, has announced its first-quarter 2025 financial results.

Revenue was $472 million, a 19% increase compared to the same period in 2024. However, behind these impressive figures, Kraken and the cryptocurrency industry as a whole still face many challenges, which require careful analysis to understand.

Kraken's Q1 2025 Performance Overview

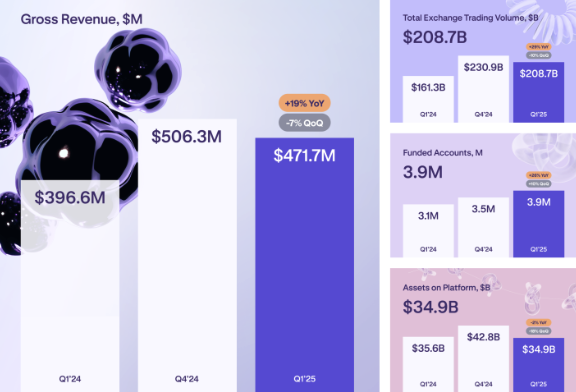

According to Kraken's data, total revenue reached $472 million, recording a 19% year-on-year growth rate. The company's adjusted EBITDA was $187.4 million, a 17% increase compared to the same period.

This growth occurred amid significant cryptocurrency market volatility. Particularly, the pro-cryptocurrency policies during the first 100 days of President Donald Trump's second term stimulated active trading. Several factors contributed to this performance.

First, the price volatility of Bit and other major cryptocurrencies drove a surge in industry-wide trading volume. According to BeInCrypto data, Bit price increased by 35%, rising from $69,000 in early 2025 to over $94,000 by the end of March.

This growth was reinforced by the Trump administration's positive community atmosphere and plans to establish national Bit reserves. In this context, Kraken leveraged the increased trading volume, with platform trading volume increasing by 29%, directly contributing to revenue growth.

Additionally, Kraken showed strategic moves to expand operations. On May 1, 2025, the company's official blog announced the launch of an institutional-grade FIX API for futures trading, with monthly trading volume increasing by 250%.

Moreover, in March 2025, Kraken acquired Ninja Trader for $1.5 billion, attracting nearly 2 million new traders and expanding into non-cryptocurrency asset classes. These initiatives demonstrate Kraken's efforts to diversify services and capture market opportunities.

Challenges and Future Outlook

Despite positive results, Kraken faces several challenges ahead.

First, competition is intensifying as major exchanges like Coinbase and Binance expand their market share. This competitive pressure requires Kraken to innovate and improve services to continuously retain customers.

Second, generating revenue by relying on market volatility poses significant risks, especially if the cryptocurrency market enters a correction or declines. Lastly, regulatory pressures in the US and globally require monitoring potential policy changes that could impact Kraken's operations.

In terms of prospects, Kraken plans to expand into the Asian market, where cryptocurrency user growth is accelerating. The launch of Kraken Pay and on-chain staking expansion in Q1 2025 represent efforts to diversify the company's revenue streams. However, to maintain growth momentum, Kraken must develop long-term strategies to reduce market volatility dependence and enhance competitiveness.