1. Project Background and Core Positioning

Bitcoin, as digital gold, has long faced two core issues: performance bottlenecks (7 TPS, high transaction fees) and single functionality (lack of smart contract support). B² Network aims to build a Bitcoin Layer 2 using ZK-Rollup technology, improving transaction speed (300 times faster than mainnet) and introducing DeFi, Non-Fungible Token, and other application ecosystems, transforming Bitcoin from a "stored asset" to a "yield-generating asset".

1.1 Technical Architecture and Innovations

- ZK-Rollup Solution: Batch processing transactions and generating zero-knowledge proofs (ZKP), compressing data and anchoring to the Bitcoin mainnet (storing hash through Taproot script).

- Hybrid Verification Mechanism: Combining off-chain verification nodes with the Bitcoin mainnet's challenge-response model to ensure data integrity.

- Modular Design: Data availability layer (DA) maintained jointly by B² Hub (distributed storage) and Bitcoin mainnet, with mainnet only storing indexes, and complete data relying on off-chain storage.

1.2 Differentiation from Competitors

Compared to other Bitcoin Layer 2 solutions (such as Merlin Chain, Stacks), B² Network focuses on ZK technology narrative, theoretically offering higher security and scalability. However, its design compromises (like multi-sig bridging, off-chain DA) have sparked "pseudo Layer 2" controversy.

2. Technical Controversy and Security Analysis

2.1 Core Doubts

- Bitcoin mainnet cannot directly verify ZK proofs: Due to script function limitations, verification relies on economic game theory (similar to Optimistic Rollup), not cryptographic guarantees.

- Data availability compromise: Complete transaction data is not fully on-chain, risking user asset redemption if B² Hub nodes act maliciously or go offline.

- Centralized bridging risks: Withdrawals processed through multi-sig addresses, deviating from Bitcoin's trustless model.

2.2 Project Response and Improvement Directions

According to the whitepaper, future plans include:

- Introducing Bitcoin light nodes to verify ZK proof fragments.

- Gradually reducing multi-sig bridge dependence, moving towards a more decentralized custody solution.

- Enhancing B² Hub's redundant storage and censorship resistance.

Conclusion: Currently, B² Network is more of a "sidechain + Rollup" hybrid, which may evolve towards a pure Layer 2 if technology is successfully implemented.

3. Team Background and Financing

3.1 Core Team

- Kevin H. (CTO): Former Tendermint core engineer, 10 years of ZK/C++ development experience, but not actively involved in community activities.

- Jerry Z. (COO): Former OKX strategy lead, led OKX Web3 wallet, skilled in ecosystem collaboration.

- Team Anonymity: Except for two co-founders, other members remain faceless, with minimal Twitter interaction (only following 7 KOLs).

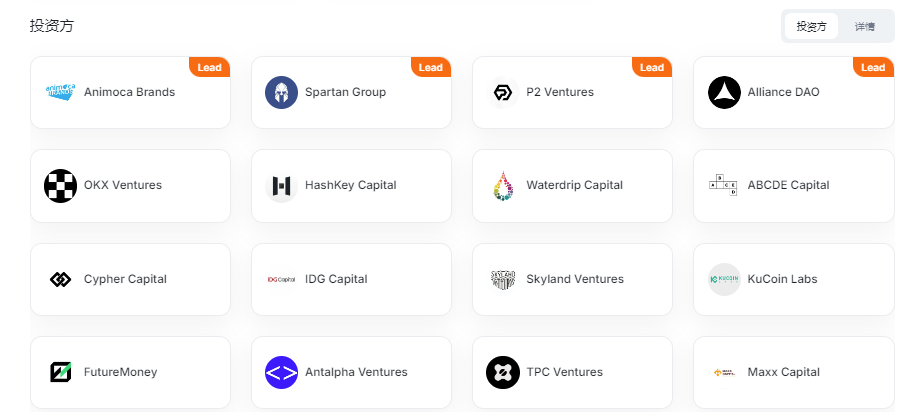

3.2 Financing and Capital Background

- Seed Round Financing: Officially announced in January 2024, investors include Hashkey Capital, OKX Ventures, but actual financing may have been completed in mid-2023.

- Investor Risks: Main investors are "Chinese funds" (such as ABCDE, Antalpha), with high overlap with investment institutions of projects like Merlin Chain, raising concerns about potential sell-offs.

4. Market Performance and Ecosystem Progress

4.1 TVL and User Data

- TVL: defillama shows $350 million (official claim of $600 million), previously leading the Bitcoin Layer 2 track, but partially suspected of inflating numbers.

- Community Engagement: Discord (2800 DAU), Telegram (1000 DAU) primarily Chinese users (over 60%), slow international expansion.

4.2 Core Products and Use Cases

- BTC Mining Pool: Supports miners in one-click staking and mining rewards, addressing miners' capital efficiency pain points.

- Yield Scenarios: Offering Bitcoin staking, liquidity mining, etc., claiming APY up to 10%, but actual returns depend on token inflation.

4.3 Exchange Listing Status

- Current Listings: Only second-tier exchanges like Gate, Kucoin, MEXC, without Binance/OKX spot support.

- Market-Making Strategy: On-chain data shows top 100 addresses hold 94%, with 68.3% likely project-related wallets, indicating high control.

5. Tokenomics and Investment Value

5.1 Token Allocation and Unlocking

- Total Supply: 210 million, initial circulation 22.3% (about 46.83 million).

- Key Unlocking Risks:

- Investors: 0.84% (176,400) released monthly after 12-month lock-up.

- Team and Advisors: Linear release over 36 months after 12-month lock-up, 0.58% (121,800) monthly.

- Airdrop: 5.5% (11.55 million) directly released at TGE, significant short-term selling pressure.

5.2 Token Value Capture Ability

- Gas Fees: B² Hub transaction fees priced in B2, but demand depends on ecosystem activity.

- Staking Rewards: 20% of tokens used for staking incentives, potentially trapped in "inflation → selling pressure → price decline" cycle.

- Governance Rights: Limited to protocol parameter adjustments, no substantial dividend rights, limited attractiveness.

5.3 Valuation Benchmarking and Price Prediction

- Similar Project Reference: Merlin Chain ($MERL) TGE FDV $2.2 billion, current MC $50M; B² initial FDV $2 billion, MC $52M, but in a worse market environment.

- Price Speculation:

- Optimistic Scenario: If ecosystem explodes or listed on top-tier exchanges, price may surge to $1-1.5 (FDV $210-310 million).

- Neutral Scenario: Long-term sideways in $0.6-0.8 range (corresponding FDV $120-160 million).

- Pessimistic Scenario: May drop below $0.4 if TVL declines or team sells.

6. Investment Strategy and Risk Warnings

6.1 Operational Suggestions

- Short-term (first week after TGE): Take partial profits above $1, beware of liquidity traps.

- Medium-term (1-3 months): Recommend clearing position if not breaking $1.2.

- Long-term: Need to observe technical upgrades and real ecosystem growth, otherwise no holding value.

6.2 Key Risks

- Token Economic Defects: Early concentrated selling pressure, unsustainable inflation model.

- Chinese Market Manipulation: Team-related addresses control 68.3%, potential pump and dump.

- Ecosystem Progress Lag: Current applications mainly imitative DeFi, lacking innovative use cases.

7. Conclusion and Outlook

B² Network partially achieves Bitcoin Layer 2 functionality, but its security model and token economics show significant compromises. It can be a short-term speculative target but requires caution long-term. If the project team fulfills technical optimization promises (such as on-chain verification, decentralized bridging) and attracts genuine ecosystem building, it may solidify its Layer 2 positioning; otherwise, it may become a "Chinese market" hype tool.