Welcome to the US Morning Cryptocurrency News Briefing. We will comprehensively summarize today's important cryptocurrency developments.

While having coffee, check out experts' opinions on the Ripple price as the possibility of XRP ETF approval increases. These financial products provide investors with opportunities to indirectly expose themselves to cryptocurrencies and are gradually attracting institutional investors to the digital asset space.

XRP ETF Approval Probability Rises to 85%

The cryptocurrency market is excited about the appointment of Paul Atkins as the SEC Chairman.

There are many hopes and expectations about what his appointment means for cryptocurrencies. This comes after the oppressive regulatory season of his predecessor Gary Gensler.

After positive outcomes in lawsuits against cryptocurrency companies and the withdrawal of oppressive bank regulations, what comes next?

One expectation is that the market anticipates the implementation of strategic Bitcoin reserves, and expects the US to become a global Bitcoin powerhouse.

Meanwhile, ETF analyst Eric Balchunas requested hints from Paul Atkins about when the US SEC might approve the first spot XRP ETF.

He and his colleague ETF analyst James Seyfarth are optimistic that approval of additional altcoin-related ETFs beyond Ethereum is just a matter of time.

"I want to hear directly from Atkins, but the likelihood of everything happening is high." Balchunas said.

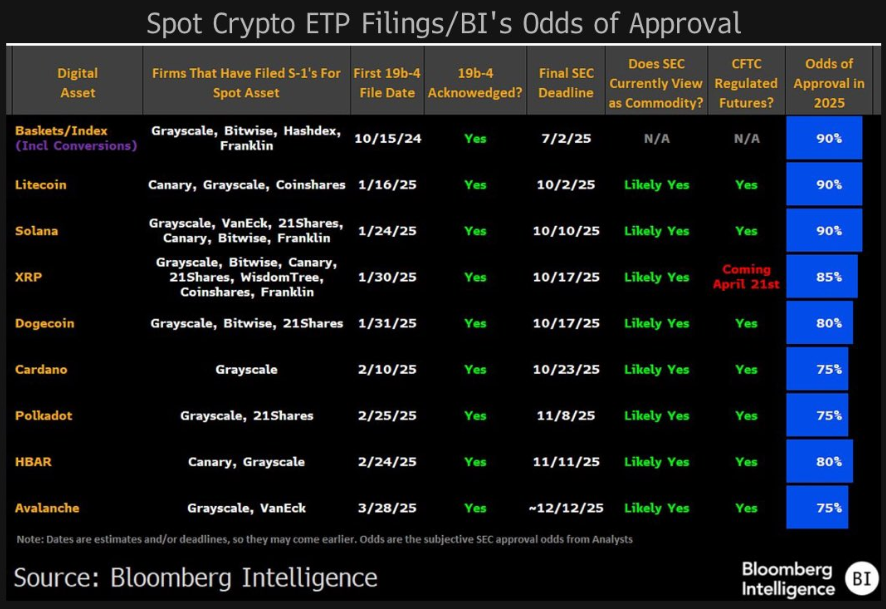

Specifically, they believe the XRP ETF has an 85% approval probability and is positioned as a regulatory approval frontrunner in 2025. Balchunas also shared a list explaining the approval probabilities of various spot cryptocurrency ETFs.

Meanwhile, Seyfarth mentions that a delay in approval is not surprising. He urges market participants to maintain hope and prepare for the worst-case scenario until late 2025.

"...Most final deadlines are after October 2025." Seyfarth said.

However, Balchunas acknowledges that Paul Atkins' confirmation as new SEC Chairman signals a beginning.

"...Nothing would have been approved until Atkins was confirmed... He was just confirmed, and they are having external meetings. They are probably strategizing. After that, the approval likelihood is high." Balchunas expressed his opinion.

Cryptocurrency traders and investors will welcome more altcoin-based ETFs beyond the Ethereum ETF. These financial products will provide more legitimacy to cryptocurrencies, open doors for institutional participation, and thus increase liquidity.

Recent US crypto news publications showed increasing BTC adoption as Bitcoin ETF inflows surpass gold ETPs.

ProShares Futures XRP ETP Begins Trading

These developments occurred after false rumors spread that the US SEC had approved the XRP ETF. However, BeInCrypto clearly invalidated these claims, stating that only leveraged and short XRP futures ETFs were permitted to trade from April 30.

Despite the false claims, ProShares' XRP futures ETF approval has sparked optimism. Experts now suggest a spot XRP ETF could follow, potentially attracting $100 billion to payment tokens.

"A spot XRP ETF could be next, creating real demand and potentially causing a price surge. Over $100 billion could flow into XRP soon." Industry expert Armando Pantoja wrote.

In this context, analysts suggest approval could increase XRP price by around 50%, potentially reaching levels around $3.40. Others also suggest XRP could surpass Ethereum in market capitalization.

Today's Charts

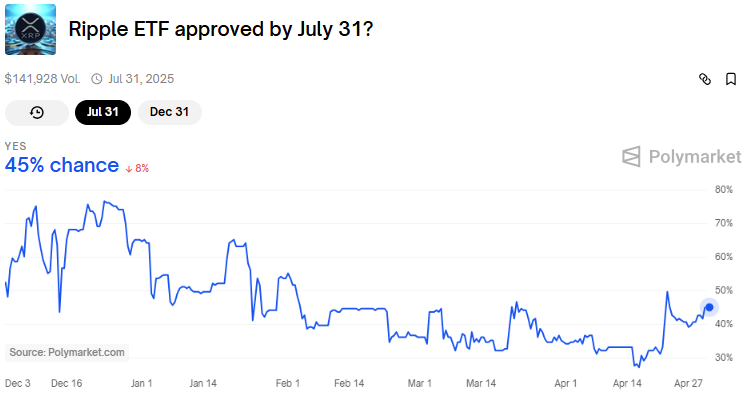

This chart shows Polymarket bettors see a 45% probability of the US SEC approving the XRP ETF by July 31.

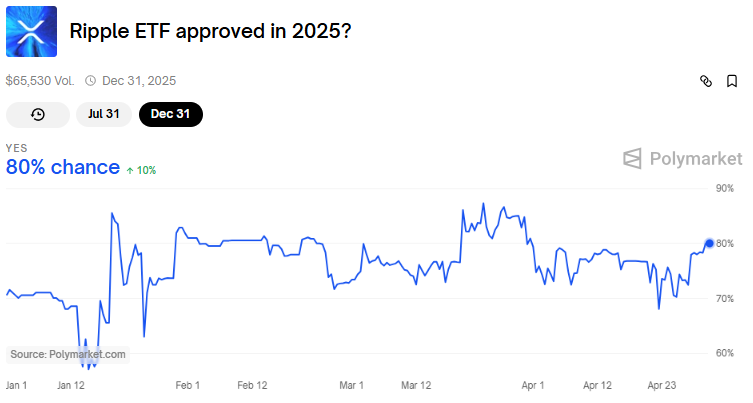

This chart shows Polymarket bettors see an 80% probability of the US SEC approving the XRP ETF by the end of the year or within 2025.

Today's Major News

- Trump Media & Technology Group (TMTG) is exploring utility tokens This is to strengthen the Truth+ platform and diversify revenue sources.

- US Spot Bitcoin ETF recorded $172.78 million in net inflows on Tuesday, indicating institutional strength for 8 consecutive days.

- Bitcoin supply on centralized exchanges hit a 7-year low, helping to alleviate selling pressure and support bullish price momentum.

- Cardano whales accumulated 420 million ADA in April, showing confidence despite ADA struggling below key resistance levels.

- Ethereum is facing a narrative crisis as the community debates whether to focus on revenue or store of value (SoV).

- Galaxy Digital's Alex Son warns that quantum computing is a much greater threat to Bitcoin, with uncertain solutions ahead.

- Peter Todd's OP_RETURN size limit removal proposal sparks heated debate. Supporters mention improving sidechain efficiency and use cases.

- Libra launches a $500 million Telegram bond fund on TON Blockchain, tokenizing Telegram's debt to provide a fixed income product.

Cryptocurrency Stock Market Overview

| Company | Closed on April 29 | Pre-market Overview |

| Strategy (MSTR) | $381.45 | $379.70 (-0.46%) |

| Coinbase Global (COIN) | $206.13 | $205.69 (-0.21%) |

| Galaxy Digital Holdings (GLXY.TO) | $21.09 | $20.97 (-0.57%) |

| MARA Holdings (MARA) | $14.22 | $14.16 (-0.42%) |

| Riot Platform (RIOT) | $7.42 | $7.38 (-0.54%) |

| Core Scientific (CORZ) | $8.29 | $8.25 (-0.48%) |