Although the cryptocurrency market has entered its 5th month of 2025, there have been no significant changes in individual investors' portfolios. So, in the 2025 market environment, what direction are venture capital (VC) companies heading?

The answer to this question could provide valuable insights for individual investors.

What areas are VCs focusing on during the remaining period of 2025?

Andy, the host, shared the key points of conversations with top venture capitalists. These insights allow us to identify the areas currently receiving significant attention.

According to Andy, the first area of interest is stablecoins.

Andy stated, "Stablecoin issuers have very high investment value and are likely to grow by more than 10 times."

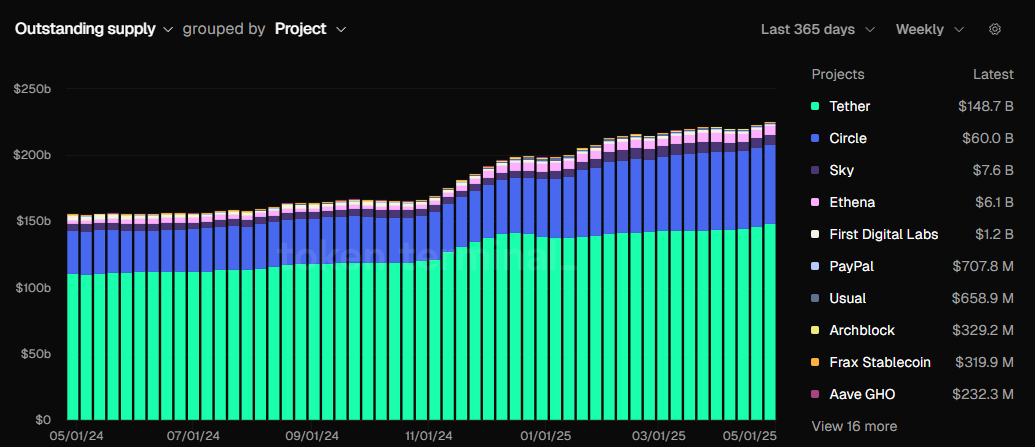

CoinMarketCap lists over 200 stablecoins, and CoinGecko tracks more than 300. According to Token Terminal's data, the stablecoin market capitalization has exceeded $225 billion, issued by over 50 institutions. However, Tether and Circle still dominate the market capitalization.

If this prediction is correct, the number of stablecoin issuers could increase to hundreds. This will open new investment opportunities for individuals through airdrops, stablecoin yields, and decentralized finance protocols.

Venture capitalists also find AI an interesting field. However, they recognize the differences in how AI applications are developed in Web2.0 and Web3.0.

Andy added, "The AI field is interesting, but currently it is better established in Web2.0."

According to a recent report by BeInCrypto, the number of AI agents is increasing by an average of 33% monthly. However, Web3-based AI solutions account for only 3% of the entire AI agent ecosystem. These figures align with the VC's observations. It may take more time for Web3 AI to be proven with practical and efficient use cases.

Anthony, founder of Blockchain121, also mentioned the trend of decentralized AI projects attracting top talents from the Web2.0 AI field.

Anthony said, "Legitimate DeAI projects are now attracting world-class engineers and researchers from the Web2.0 AI field for the first time."

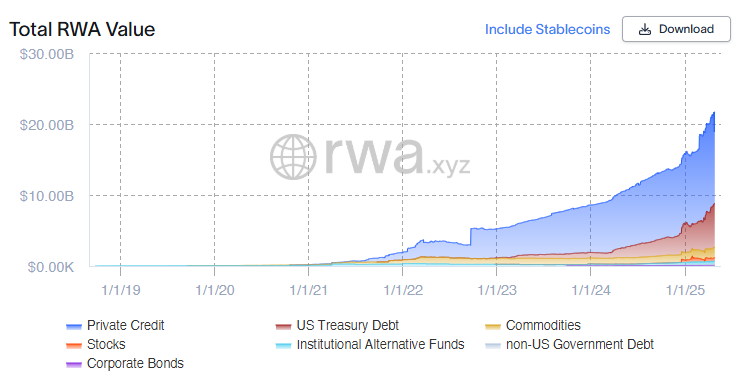

Andy also revealed that venture capitalists are particularly focusing on Real-World Assets (RWA).

Andy emphasized, "RWA, RWA, RWA is everything."

BeInCrypto reported that the RWA market capitalization exceeded $20 billion in April. At the time of writing, the RWA.xyz platform shows the current market capitalization at $18.9 billion.

The participation of major financial institutions like BlackRock and Fidelity has increased investors' confidence in the long-term potential of this field. Tren Finance predicted that the RWA market capitalization could exceed $10 trillion by 2030.

Lastly, Andy mentioned that in addition to stablecoins and RWA, the Bitcoin liquidity market is also a VC interest.

VCs Expected to Incur Losses in 2025 Due to Market Decline

With significant market capitalization drops, VCs cannot escape losses in 2025. Unpredictable macroeconomic policies like tariffs have added pressure, triggering harsh fluctuations.

Andy revealed, "Recently, the returns of crypto venture capitals have been under pressure. Many VCs are unable to return positive returns to LPs. Especially after tariffs, some are struggling to raise new funds. A significant number of tokens invested in the past two years have not been launched or have been severely impacted. The over-the-counter market has become much drier. There will be departures someday. Only the strong will survive."

According to CryptoRank, crypto VC funding in Q1 2025 was $4.8 billion, the highest since Q3 2022. This was mainly driven by major deals with MGX and Kraken. In April alone, $2.3 billion in VC funds were raised across 87 investment rounds.

Overall, despite investor departures and macroeconomic headwinds since early 2025, VCs are cautiously maintaining an optimistic outlook. This optimism is reflected in the increased funding scale and deal flow compared to 2023-2024.