XRP rose by 7% in the last week of April. However, there could be a larger movement when major catalysts line up in May 2025. Key indicators like NUPL and active addresses show a market crossroads with strong optimism and warning signals.

High interest in ETF approval caused volatility. Actual institutional fund inflows could determine XRP's next major trend. Traders should prepare for a month where both sharp rises and deep corrections are certainly possible.

XRP NUPL Rise Confidence Signal...ETF Rumor Volatility

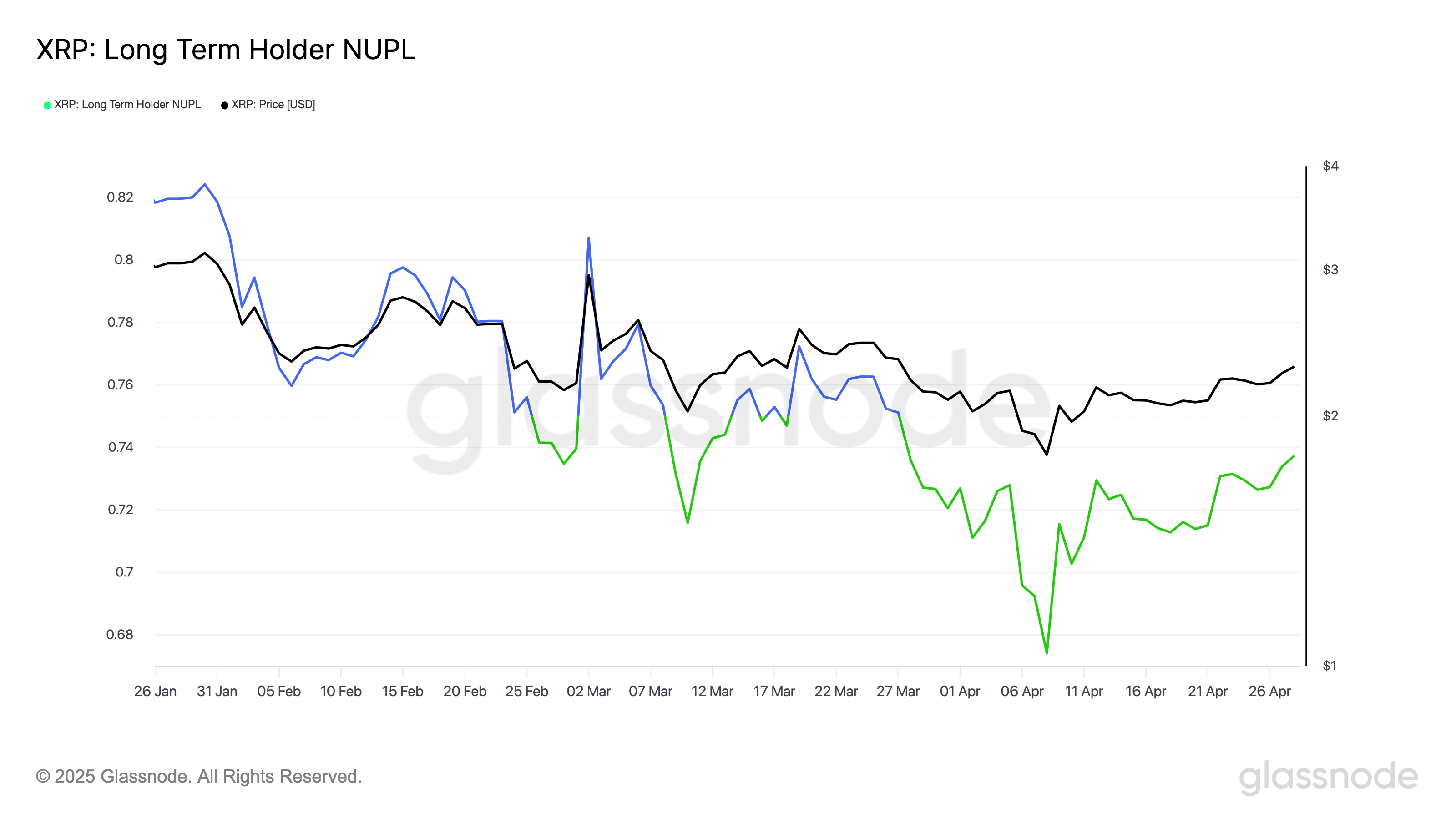

The XRP Long-term holder Net Unrealized Profit/Loss (NUPL) is currently 0.73, firmly positioned in the "Belief - Denial" stage of the market cycle. This indicator measures the average unrealized profit among long-term holders.

This indicator has been trapped in this zone since March 27. Generally, a NUPL value above 0.75 indicates "Euphoria—Greed".

Values between 0.5 and 0.75 show a belief that prices may rise, but there's also a risk of denial if momentum weakens.

The current value has risen from 0.68 three weeks ago to 0.73 today. Long-term XRP holders are seeing larger paper profits. However, the market may soon face a critical moment where continuation or correction could emerge.

Rumors about SEC-approved spot XRP ETF recently caused confusion, adding more fuel to market volatility. In reality, only ProShares' leveraged and short XRP futures ETF was approved to start trading on April 30. A true spot ETF was not approved.

Futures approval is considered a positive step for XRP's long-term legitimacy, but the spread of misinformation damaged investor confidence and caused unnecessary instability.

Nevertheless, analysts have suggested that XRP market cap could exceed Ethereum. Rumors about XRP and SWIFT partnership also increased last month.

Some experts predict that future spot ETF could drive up to $10 billion in capital inflows to XRP. However, until then, volatility from rumors and misunderstandings remains a major risk for the token.

XRP User Engagement Decreases...Active Addresses Below 200,000

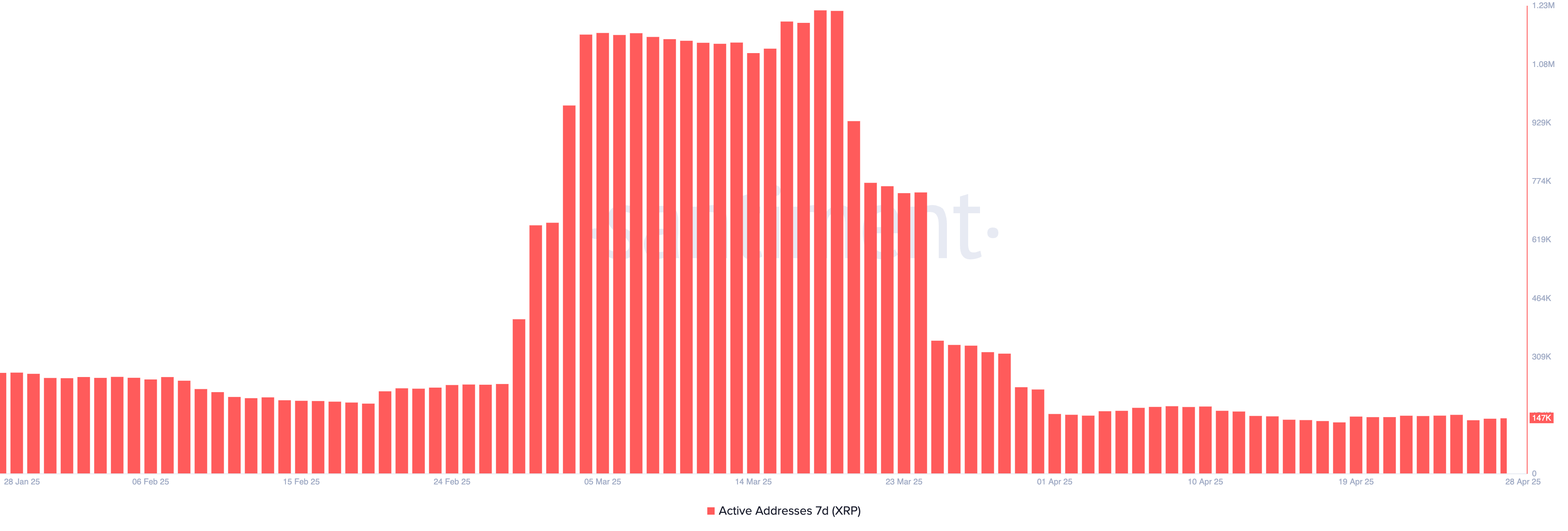

XRP's 7-day active addresses have significantly decreased, currently at 147,000. This compares to the all-time high of 1.22 million reached on March 19.

This sharp decrease reflects an overall cooling of network activity following the massive surge seen earlier this year.

Monitoring active addresses is important as it provides real-time insights into user engagement, transaction volume, and overall ecosystem health. Low address activity indicates decreased interest, reduced transaction flows, and a weak foundation for sustained price increases.

From April 1, XRP's 7-day active addresses have consistently remained below 200,000, reinforcing that user activity has not yet fully recovered.

This decrease does not necessarily mean a major price collapse is imminent, but it highlights the important point that strong upward trends are often supported by increasing network participation.

Without a meaningful increase in active addresses, XRP may struggle to maintain momentum or initiate a new upward phase soon.

49% Potential Rise if XRP ETF Approved...Downside Risk Remains

Final approval of a spot XRP ETF could be a major catalyst for token price. This would potentially drive substantial institutional fund inflows. Recently, the world's first XRP ETF started trading in Brazil.

Experts predict XRP price could surge dramatically if actual demand follows approval, similar to Bitcoin. The next major upside target is $3.40, a 49% increase from current levels.

This movement would be triggered by new fund inflows, greater mainstream adoption, and reduced supply as more investors gain direct exposure through regulated channels.

If downward momentum is not recovered and a strong downtrend continues, a sharp correction could occur. Falling below the psychological $2.00 could expose the token to greater losses, with the next major support line around $1.61.

This movement would represent a 29% drop from current prices, reflecting a scenario where ETF optimism fades and selling pressure increases.

In this case, XRP might remain trapped in a broader correction or downward phase until stronger catalysts emerge.