Bitcoin is an asset that has recorded the highest long-term returns, but shows strong volatility and seasonal patterns in the short-term flow. By organizing Bitcoin's weekly, monthly, quarterly, and annual returns, we will check the relative position of the flow based on indicators such as frequency of rises and falls, average returns, and median. [Editor's Note]

In April, which saw strong rises and adjustments intersecting, Bitcoin recovered its positive flow again. While successfully transitioning to a monthly rise, its annual performance still falls short of investor expectations.

Weekly Settlement

In the 17th week of this year (21st-27th), Bitcoin closed with a 1.24% increase. It recorded a weekly rise for the 4th consecutive week, following the first week (6.65%), second week (1.56%), and third week (10.33%) of this month.

Compared to the historical average rise rate (3.87%) and median (5.88%) for the same period, it showed a relatively low return.

A strong rise over two days (21st and 22nd) (+2.91%, +6.71%) led the weekly flow, while the remaining trading days mostly repeated minor fluctuations under 1% while exploring direction. On the 27th, it slightly turned downward and entered a consolidation phase.

Bitcoin, entering its 18th week, is showing an adjustment flow with repeated ups and downs. On the 28th, it rose by +1.36%, but as of the 29th, it is currently down by -0.1%.

Monthly Settlement

The cumulative monthly return so far is 14.69%. This is above both the historical April average (+13.11%) and median (+7.27%).

Out of 29 trading days this month, 19 days were up and 10 days were down. The largest single-day rise was on the 9th (+8.13%), and the largest fall was on the 6th (-6.17%).

After rising in January (+9.29%), and falling in February (-17.39%) and March (-2.3%), April has reversed the trend. In the past, April rose 7 times out of 12 and fell 5 times.

Looking at historical May records, 6 out of 12 times it closed up, and 6 times it closed down. The average return is +7.94%, and the median is +3.17%.

Quarterly and Annual Settlement

The cumulative return for the second quarter of this year, with two months still remaining, is 14.69%.

This is about 56.6% lower than the historical second quarter average return (+25.94%), but about 93.9% higher than the median (+7.57%). The second quarter has risen 7 times out of 12, fallen 5 times, indicating a 58% quarterly rise probability.

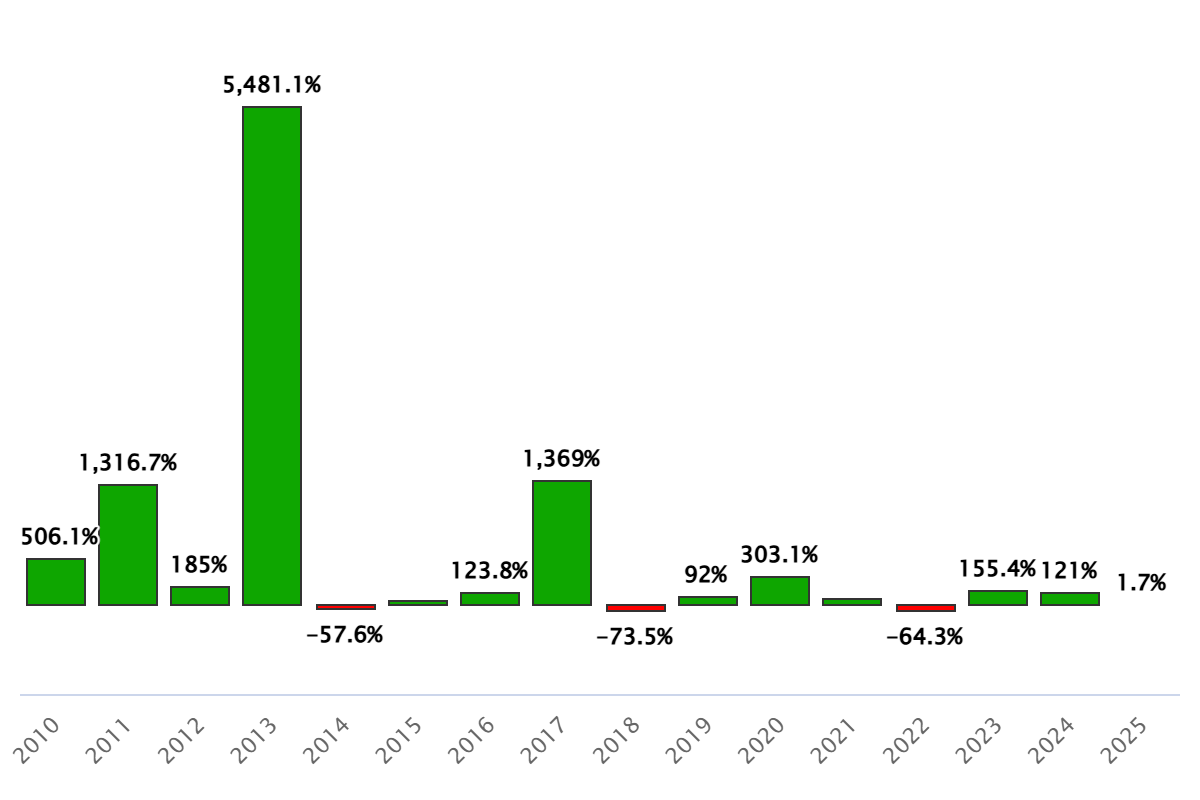

According to Statmuse, Bitcoin's year-to-date return is 1.66%. This appears low compared to the annual returns of the previous two years: +155.41% in 2023 and +120.98% in 2024.

Bitcoin remains the fastest-growing asset class. Since 2011, Bitcoin has exceeded a cumulative return of 20 million%, significantly surpassing the cumulative rise of the Nasdaq 100 index (541%) and major US stock indices (282%). On an annualized return basis, it recorded 230%, about 10 times higher than the second-ranked Nasdaq 100 index. During the same period, traditional asset classes such as US large-cap stocks (14%), high-yield bonds (5.4%), and gold (1.5%) recorded relatively low annualized returns.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>