Ethereum's major holders are returning to the market. During last week's market adjustment, key investors seized the opportunity to actively purchase ETH.

According to on-chain data, whale holdings are increasing, and the ETH-based spot ETF recorded its first weekly net inflow in 8 weeks, indicating a significant change in investment sentiment.

ETH Whale Accumulation and ETF Inflow Hint at Price Surge

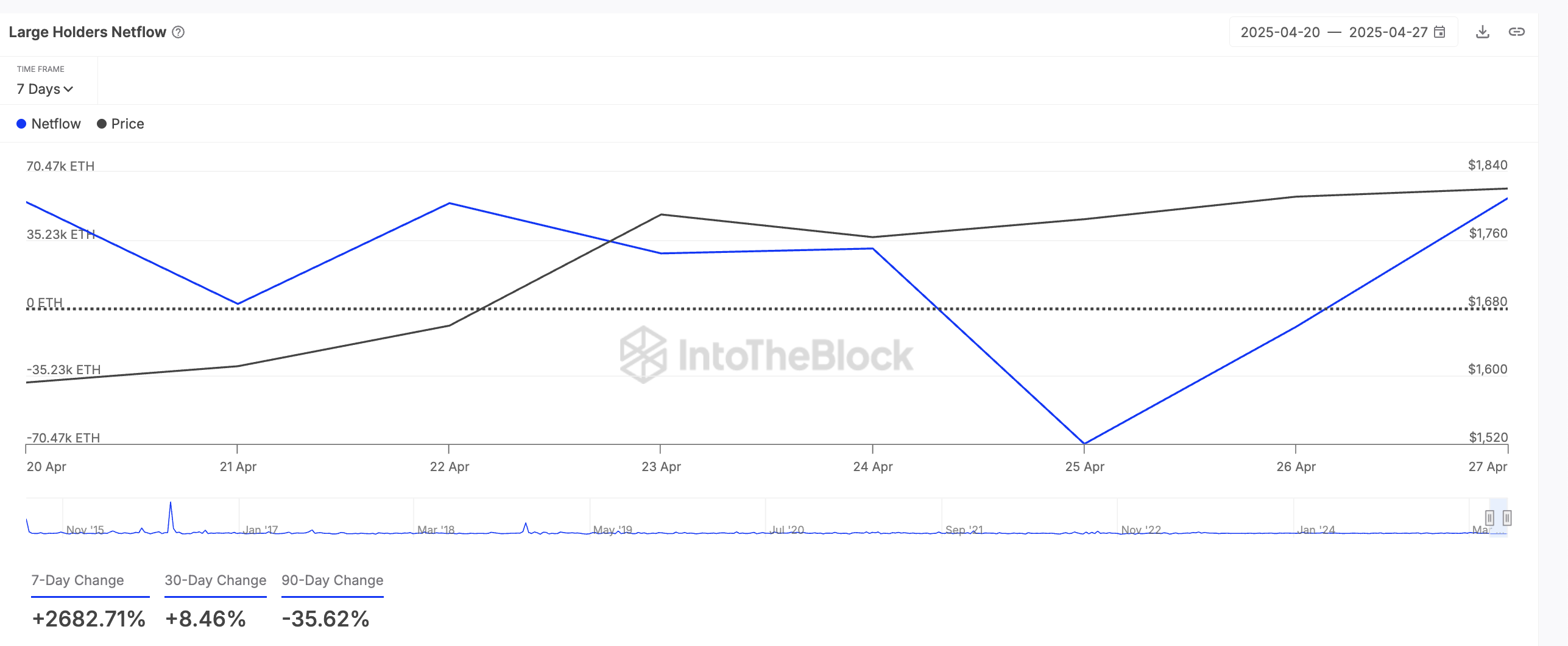

According to on-chain data, the major altcoin ETH saw a significant increase in net inflow from large holders over the past week. According to on-chain data providers, this surged by 2,682% over the past 7 days.

Large holders of an asset refer to whale addresses holding more than 0.1% of the circulating supply. The large holders' net inflow indicator tracks the difference between coins purchased and sold by these investors over a specific period.

A surge in an asset's large holders' net inflow indicates that whale investors are increasing their coin purchases. This buying trend reflects belief in ETH's future rise, with major holders acting when they perceive value at the current price level.

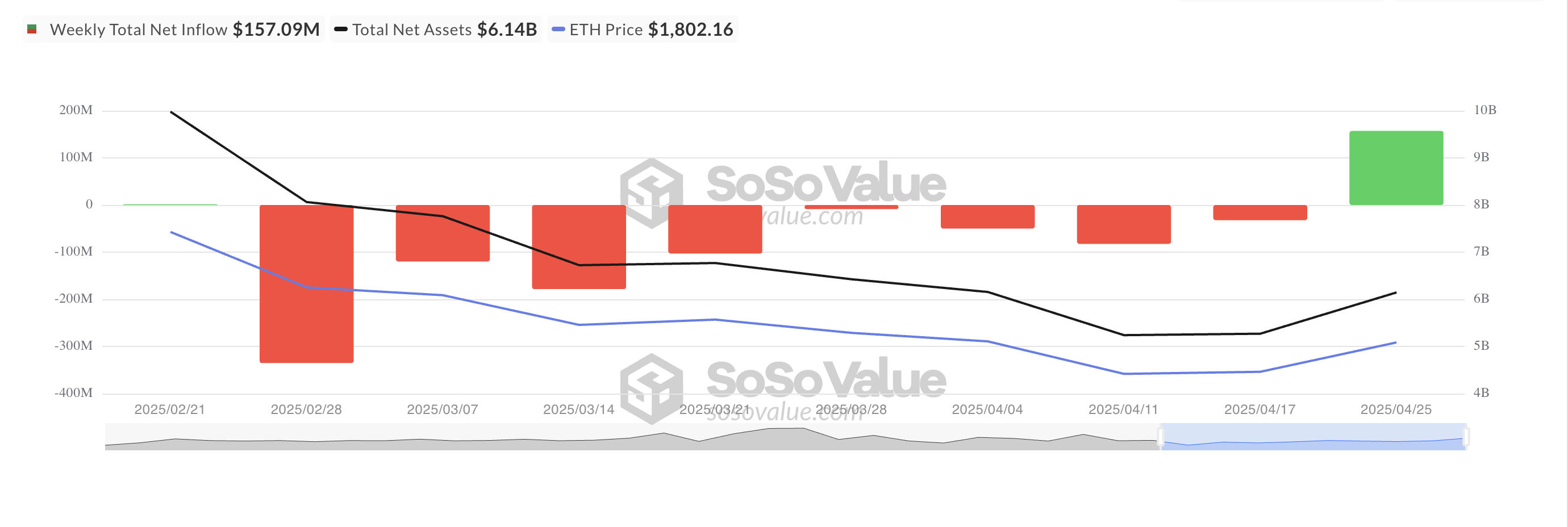

In addition to the positive narrative, ETH-based ETFs recorded their first weekly net inflow in 8 weeks. According to SosoValue, the net inflow of ETH-based ETFs from April 21 to April 25 reached $157.09 million, reversing the trend of over $700 million in outflows over the past 8 weeks.

With major investors re-entering the market, ETH has the potential for additional short-term growth.

Ethereum's Upward Momentum

From a technical perspective, ETH's positive Balance of Power (BoP) emphasizes the revival of demand for major altcoins. It is currently at 0.31.

This indicator measures the buying and selling pressure of an asset. When the value is positive, buying pressure exceeds selling pressure. This indicates strength in ETH's price movement and signals additional upward momentum. In this case, ETH could trade above $2,000, reaching $2,027.

However, if market sentiment deteriorates, ETH could drop to $1,385, losing its recent gains.