Famous on-chain analyst Willy Woo revealed that Bitcoin (BTC) could recover its all-time high if capital inflows continue.

He added that investors should view price drops as a healthy correction and buying opportunity, not a sign of market collapse.

Bitcoin, Breaking All-Time High Again?

Woo shared his insights through a detailed post on X (formerly Twitter). He believes strong fundamental factors support Bitcoin's upward trend.

This includes increased capital inflow to the Bitcoin network, with recent total and speculative capital flows hitting bottom. This alignment of flows creates a robust bullish environment for the asset.

"BTC's fundamental factors have turned bullish, and the environment is not bad for breaking the all-time high," he said.

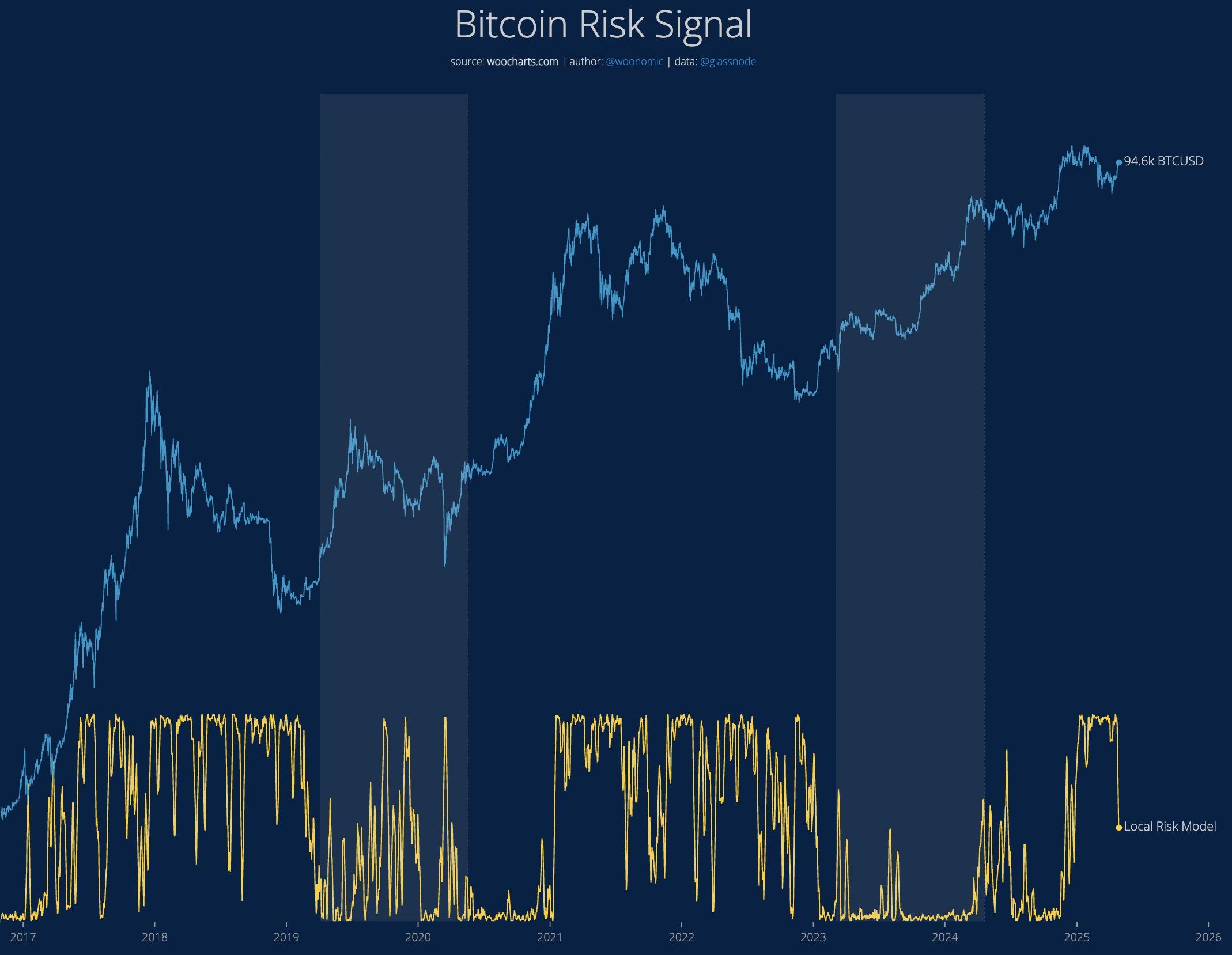

Additionally, Woo emphasized that Bitcoin's liquidity is deepening, proven by his downtrend risk model. This downtrend suggests market liquidity has returned. Therefore, future price drops are likely to be smaller and less severe, reducing the risk of sharp sell-offs.

"Under the current regime, every drop is a buying opportunity. Short-term drops are likely," Woo argued.

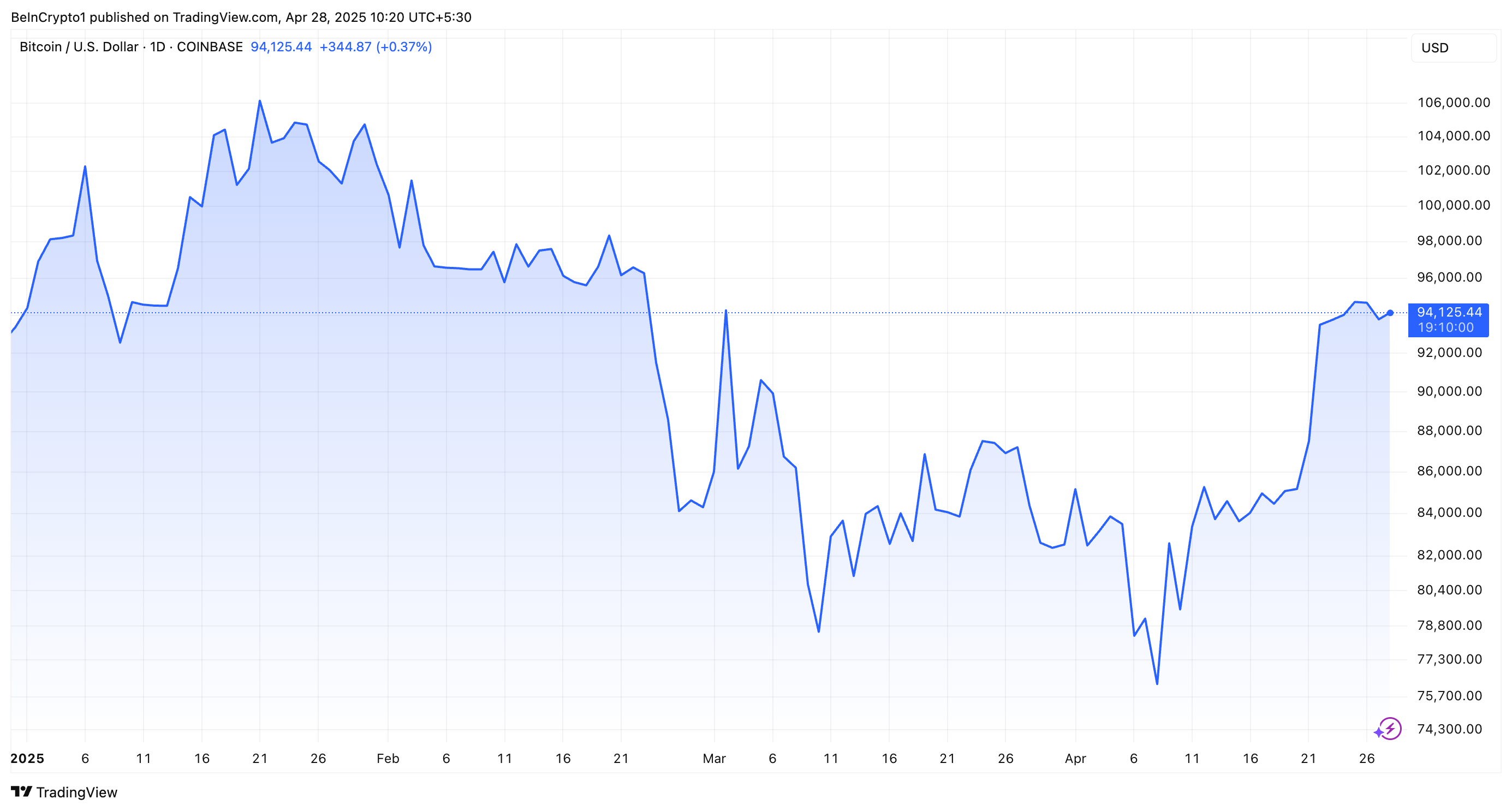

The analyst mentioned that Bitcoin has already recovered its medium-term price targets of $90,000 and $93,000. Additionally, a new intermediate target of $103,000 has formed, with a high likelihood of Bitcoin moving towards its all-time high of $108,000 after reaching this level.

He clearly stated that these targets are supported by continuous capital inflow, not mere speculative trading, strengthening the basis for a sustainable upward trend.

Despite the optimistic long-term outlook, Woo warned that short-term challenges could arise. Bitcoin's on-chain volume-weighted average price (VWAP) is currently at +3 standard deviations.

This means the coin's current price significantly exceeds the typical range. When an asset greatly surpasses the average, it is considered overly extended.

"Due to excessive extension, it will be difficult to rise with appropriate momentum," Woo explained.

According to Woo, this indicator suggests that upward momentum might be limited in the short term. Instead, the most likely outcome is sideways movement or a slow, gradual increase.

Previously, BeInCrypto explained three key signals reinforcing Bitcoin's recovery. In April, Bitcoin re-established its inverse relationship with the declining US Dollar Index (DXY) and disconnected from the Nasdaq.

Meanwhile, long-term investors are actively accumulating coins. These three differences indicate increasing market confidence and hint at a potential major Bitcoin rally. Indeed, BTC's recent market performance also strengthens this outlook.

According to BeInCrypto data, the coin's value recovered by 7.7% last week. At the time of writing, Bitcoin was trading at $94,125, showing a slight 0.07% drop over the past day.