Author: CoinMarketCap

Translated by: TechFlow

Market Overview

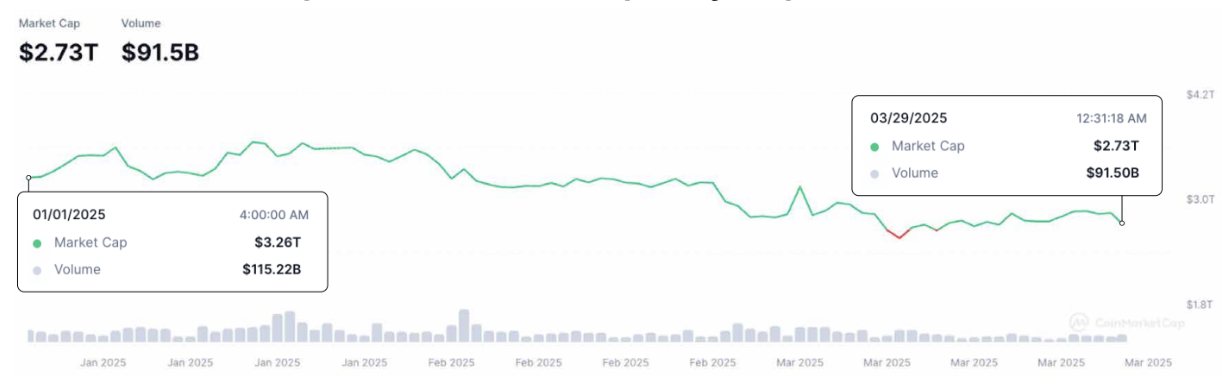

The global crypto market capitalization dropped by approximately 16% in the first quarter, remaining around $2.7 trillion.

Simultaneously, the daily trading volume in the crypto market declined by about 20% in the first quarter, totaling around $9 billion.

Total Market Cap Drops 16.2%; Liquidity Weakens

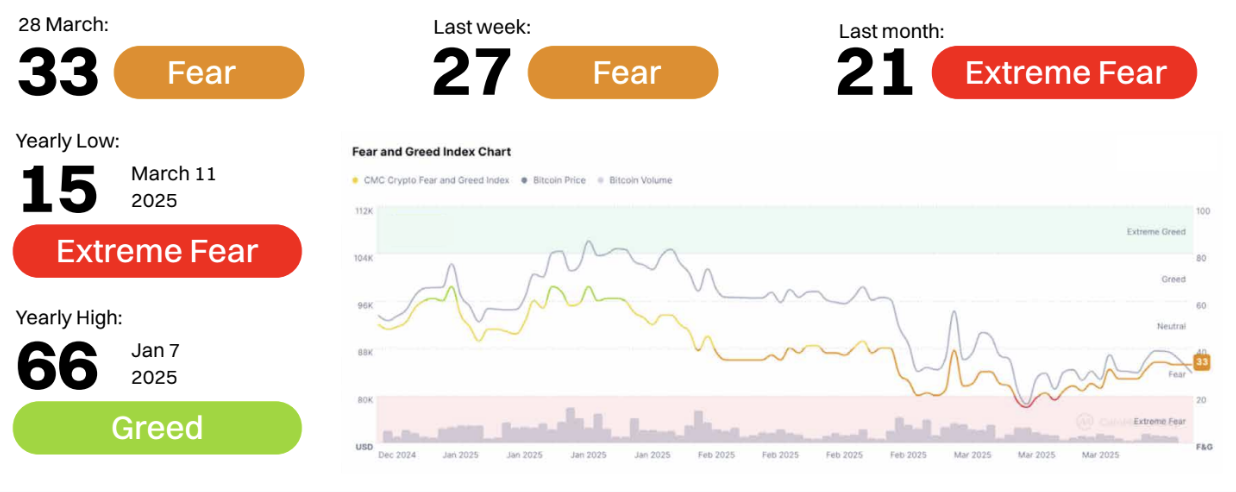

Q1 2025: Fear Dominates, Panic Evident

In early 2025, the market experienced intense speculative activity (driven by Meme coins, AI, and hype), followed by a return to infrastructure (BNB Chain, Solana, and DeFi) by late March. This indicates that after an exciting period, investors tend to return to verified ecosystems, seeking sustainable opportunities.

Reviewing the first quarter of 2025, we observed:

Surge of Meme Coins and Layer 1 (mid-January to February)

Market sentiment might be influenced by high volatility (Bitcoin volatility at 51.88, Ethereum volatility at 68.30), liquidity tightening, and declining altcoin interest. Historically, extreme fear often indicates accumulation opportunities. If macro sentiment improves, the March 11th low point might be seen as such a moment in retrospect. Bitcoin price remained relatively resilient above $78,000 to $80,000, but market sentiment was extremely negative, indicating trader confidence is lacking and potentially expecting a reversal or correction.

Peak of AI and Big Data (early February)

In the 5th week (February 3-9), interest in AI and big data rose, possibly driven by broader AI-driven narratives in tech and crypto. However, this enthusiasm seemed to slightly wane in subsequent weeks, suggesting AI's dominance in crypto discussions remains intermittent rather than continuous.

Stability of Solana and Ethereum Ecosystem

Solana's ecosystem remained strong, despite fluctuations in its relative share. The Ethereum ecosystem attracted significant page views due to the Bybit ETH hacker event and ETH's poor performance.

Real-World Assets (RWA) - Still Struggling to Attract Attention

Despite ongoing discussions about Real-World Assets (RWA) as a long-term crypto growth area, its share remained below 5%, indicating institutional adoption is still developing.

Late March (Week 12) - Return to Fundamentals?

By Week 12 (March 24-30), we saw strong growth in the BNB ecosystem (8.69%). Layer 1 (20.91%) consolidated its dominant position, suggesting the market might be shifting towards more fundamental crypto infrastructure rather than short-term hype cycles. Meme coins (13.33%) remained strong, showing speculative interest persists, while AI, gaming, and RWA still struggle to attract significant sustained attention.

BNB performed relatively well, with only a slight decline of 13%. This may be partially attributed to the recent success of on-chain meme coins, with several high-profile launches in the first quarter, including Tutorial (TUT) and CZ's Dog (BROCCOLI). The launch of a $100 million liquidity incentive program and the recent Pascal hard fork boosted confidence in the chain.

Despite the weak market environment, TRX has shown resilience. Zero-fee stablecoin transactions were enabled on-chain, with its leadership seeking to capture market share from Ethereum. With the growth of on-chain DeFi revenue and plans for a token-free payment fee upgrade and zero transaction fee meme coin trading in 2025, Tron largely defended against the downward trend.

Cardano failed to maintain momentum after benefiting from the excitement of incorporating native ADA assets into US digital asset reserves, dropping 33.3%. Solana experienced a sharp decline due to massive token unlocks and a significant decrease in meme coin trading volume, falling 36.1% year-to-date.

Ethereum encountered several adverse events in the first quarter of 2025, including the theft of approximately $1.5 billion in ETH and Ethereum-based tokens from the Bybit cryptocurrency exchange on February 21, with most tokens being laundered into Bitcoin (BTC). Additionally, outflows from the popular ETH ETF accelerated in the first quarter, with multiple consecutive weeks of net outflows observed. In total, at least $240 million was withdrawn from the ETH ETF in the first quarter. The long-awaited Pectra update was also delayed due to preparation issues and is now planned for mainnet deployment on April 30, 2025.

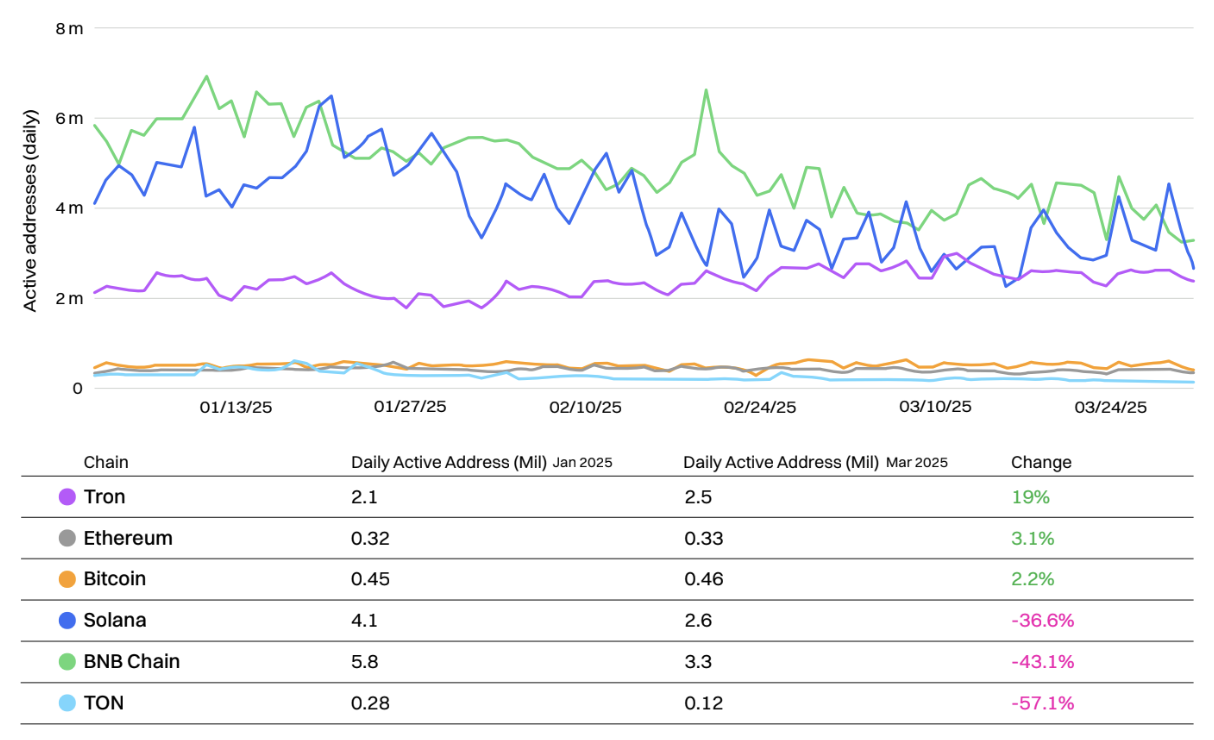

Daily Active Addresses of Major Layer-1 Platforms

Many smaller Layer-1 platforms experienced a decline in on-chain activity during the first quarter of 2025, starting strong but showing a downturn since February.

In terms of absolute active daily addresses, the BNB chain started strong at the beginning of the year and led competitors but was gradually overtaken by Solana by the end of March. The reduction in meme coin speculative activity on Solana and a brief outage in February may have contributed to this decline. The upcoming Firedancer upgrade remains eagerly anticipated by users.

The BNB chain experienced a brief surge in on-chain activity in February, especially around the release of the BNB chain 2025 technical roadmap and Pascal upgrade.

Bitcoin, TRON, and Ethereum successfully resisted the downward trend, growing in active addresses year-to-date. Tron led in this aspect, growing 19% year-to-date, followed by Ethereum at 3.1%, and Bitcoin at 2.2%, despite a decline in the value of these assets during the same period.

TON's on-chain active addresses dropped by over 50%, from 280,000 to 120,000, as most Telegram mini-apps lost users and the hype around agricultural projects diminished. Hamster Kombat, once the platform's most popular mini-app, lost nearly two-thirds of its active users year-to-date.

However, it's worth noting that one address does not necessarily equate to one user. Blockchains with lower fees often have more on-chain bot activity and more smart contract-controlled addresses, which can inflate the numbers.

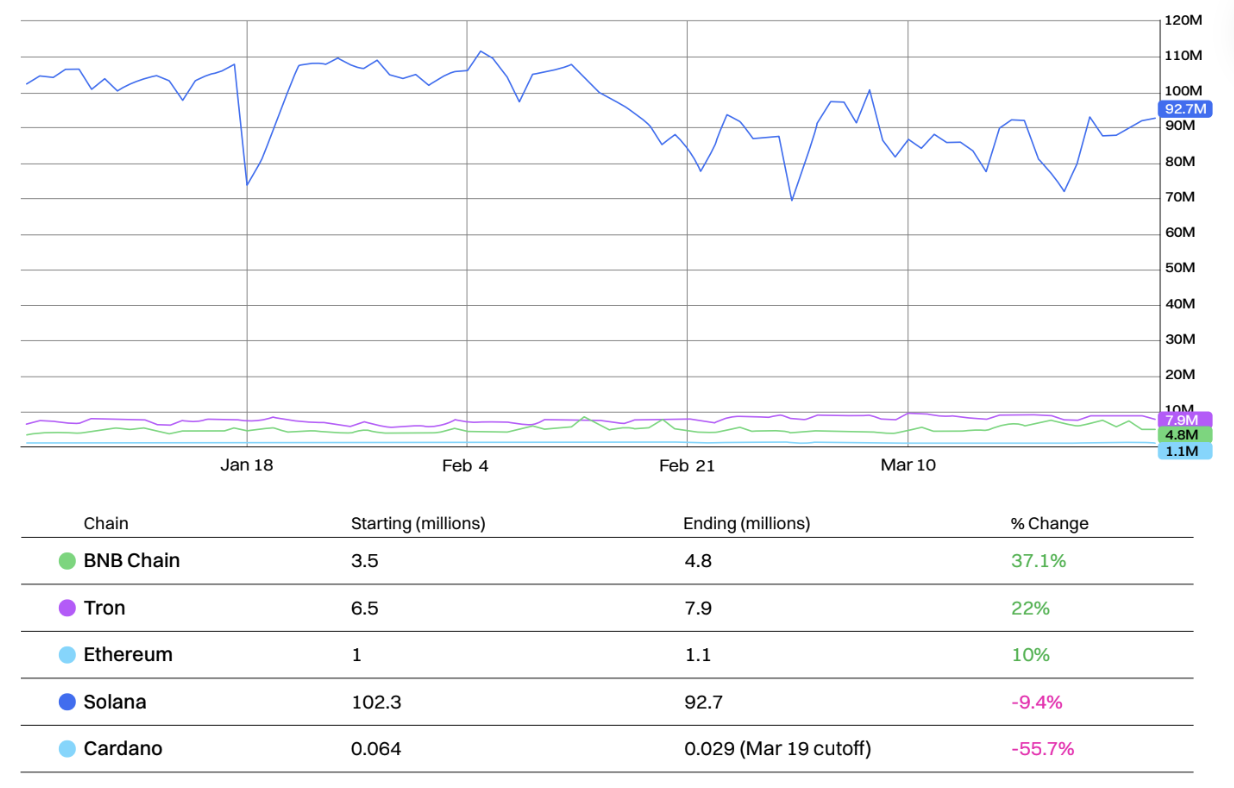

Daily Transactions of Top Five Layer-1 Platforms

Solana continues to lead all other major Layer-1 platforms in transaction volume, with a clear advantage. However, approximately 80% of transactions are attributed to on-chain voting activity, with another significant portion due to arbitrage bot activity.

Nevertheless, Solana's daily transaction volume declined by 9.4% year-to-date.

In the first quarter, the BNB chain saw the largest increase in daily transaction volume, growing by 37.1%, thanks to increased meme coin trading activity. TRON followed closely, growing by 22%, which is related to the recent increase in stablecoin activity.

Cardano experienced the most significant decline, at 55.7%. Cardano now has by far the largest transaction volume to market cap ratio among any major Layer-1, at 0.00000118.

It's worth noting that Ethereum's transaction volume grew by 10%, as DeFi activity continues to drive on-chain activity.

(Translation continues in the same manner for the rest of the text)Although the trading volume of stablecoins has grown, Tron's market share has dropped from 6.2% to 5%, becoming the chain with the largest market share decline. In contrast, the newly launched Berachain has captured 3.4% of the market share in less than two months after going live in February, thanks to its powerful airdrop strategy and yield opportunities.

Bitcoin's TVL has significantly grown, with its market share reaching 5.8%, mainly due to the promotion of BTC liquid staking solutions like Lombard.

Comparison of Top Five Layer-2 by TVL and Ethereum's Daily Active Addresses (Year-to-Date)

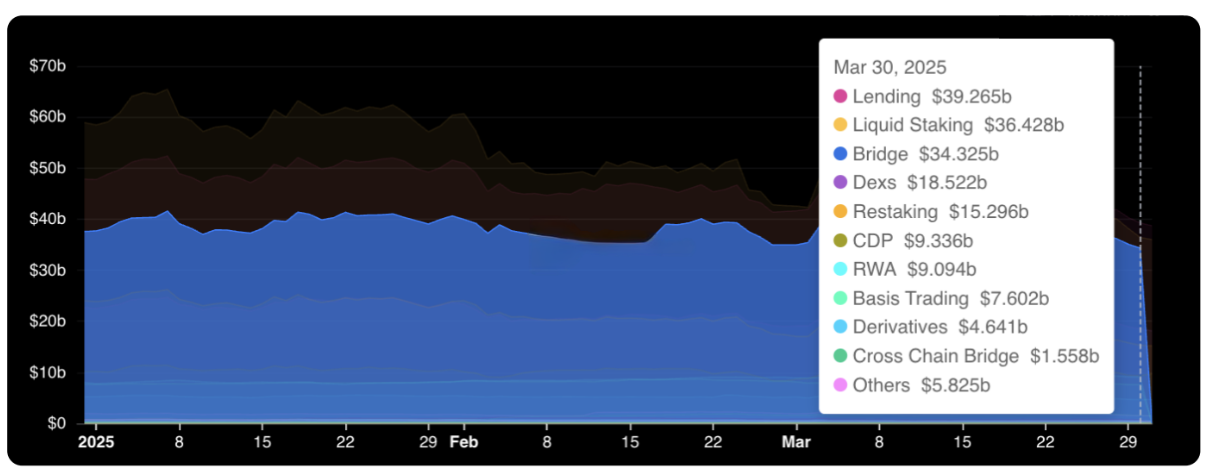

Lending is now the largest TVL sector, with over $38.9 billion locked in on-chain open lending platforms like Aave and Compound. The previously top-ranked liquid staking solutions now follow closely, occupying the second position with a TVL of $36 billion, primarily dominated by major players like Lido, Jito, and Rocketrool.

Most sectors have seen a decline in absolute TVL year-to-date, with the real-world assets (RWA) sector being a notable exception, growing its TVL thanks to BlackRock's BUIDL product and the success of Ethena's USDtb.

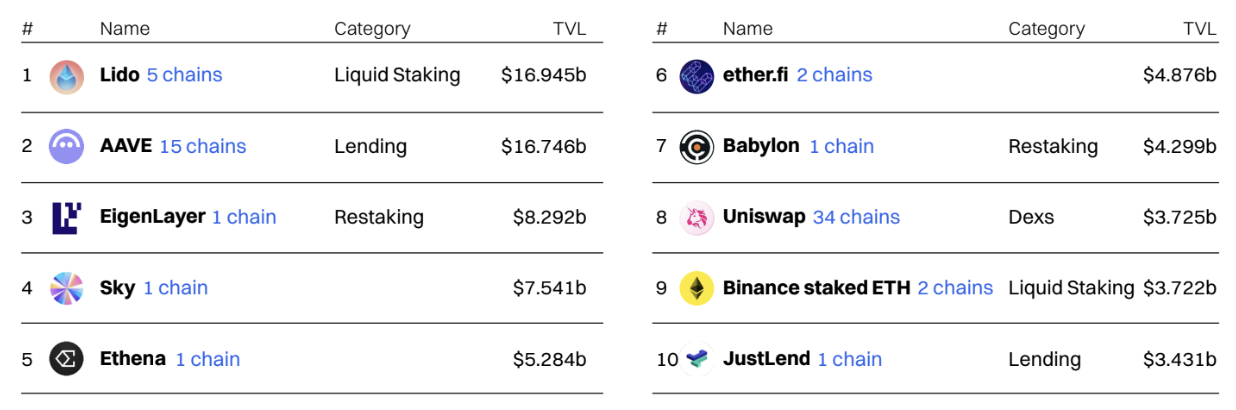

Top Ten DeFi Applications by TVL

Lido, the Ethereum liquid staking protocol, maintains its position as the largest protocol but was overtaken by AAVE multiple times in the first quarter.

Lido experienced several positive developments in the first quarter, including the approval of a new permissioned SSV network module and further integration of its liquid staking tokens (stETH and wstETH) in DeFi.

Aave also saw positive developments, including the introduction of liquidity mode to improve capital efficiency and expansion to the Celo network.

(Translation continues in the same manner for the rest of the text)

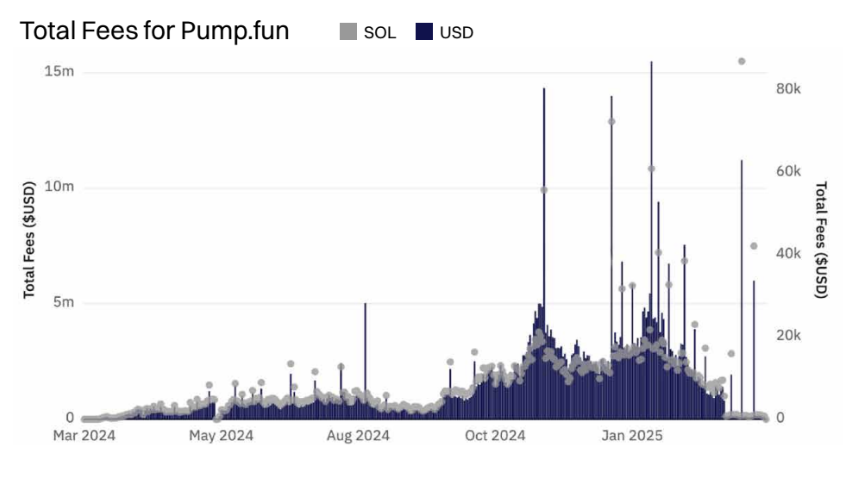

As enthusiasm for meme coins wanes, Pump.fun's revenue has significantly declined. The platform performed strongly at the beginning of the year, typically collecting over $3 million in fees daily, but by the end of March 2025, this number had gradually dropped to less than $100,000 per day.

Despite a revenue decrease of approximately 98%, Pump.fun remains one of the most profitable decentralized applications, ranking in the top ten by weekly revenue.

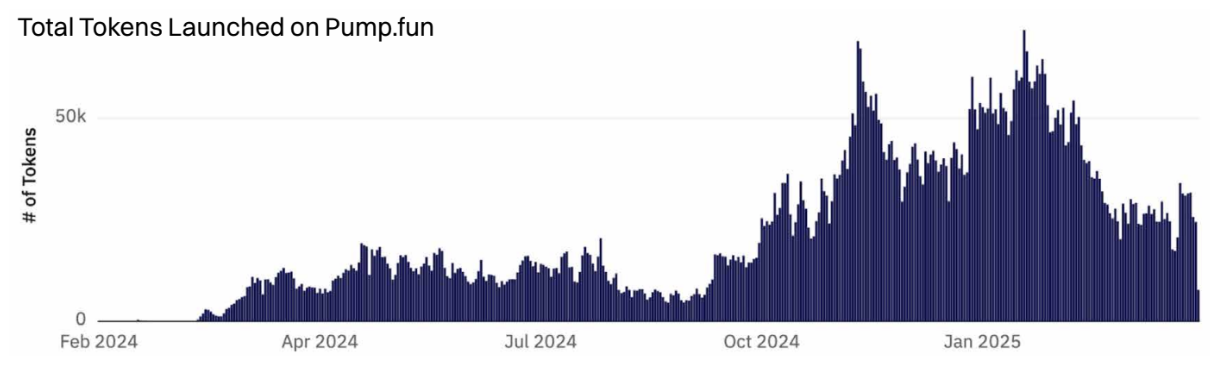

Pump.fun's Launch Volume Remains High, Graduation Rate Declines

Pump.fun reached its historical peak on January 23, 2025, issuing over 71,700 tokens. Since then, new issuance has declined, with an average of 26,400 tokens issued daily during March.

Although the issuance volume remains high, the proportion meeting graduation standards has significantly dropped, from 1.1% at the beginning of the year to 0.64%.

Pump.fun's success has also spawned numerous clone projects, including Raydium's LaunchLab, which offers flexible bonding curves, and PumpTires, built for the Pulsechain ecosystem, but none have replicated Pump.fun's success.

Despite several major updates, including the launch of PumpSwap decentralized exchange (DEX) and plans to enable creator revenue sharing, interest continues to decline.