The 'Kimchi Premium' for cryptocurrency prices in Korea compared to overseas markets has narrowed.

According to CryptoPrice at 8:50 AM on the 25th, the Kimchi Premium (Upbit<> Binance) is recording 0.14%.

The premium has decreased compared to the previous day (0.45%), showing that the price difference between domestic and international markets has narrowed again. Major altcoins such as Ethereum, SOL, and Doge have also seen their premiums drop from around 0.the.5%.to 0.2~0.3%.

Kimchi Premium Status by Coin

BTC $93,858.99 / 134,590,000 won / 0.14%

ETH $1,768.16 / 2,539,000 won / 0.28%

SOL $152.57 / 218,900 won / 0.19%

XRP $2.206 / 3,167 won / 0.24%

Decoge $.1824 / 261.8 won / 0.25%

Kimchi Premium is a phenomenon where cryptocurrency prices are higher in Korean exchanges, caused by a sudden increase in domestic demand or lack of overseas liquidity. An expanded Kimchi Premium indicates strengthened domestic buying pressure or relative strength of the domestic market compared to global prices.

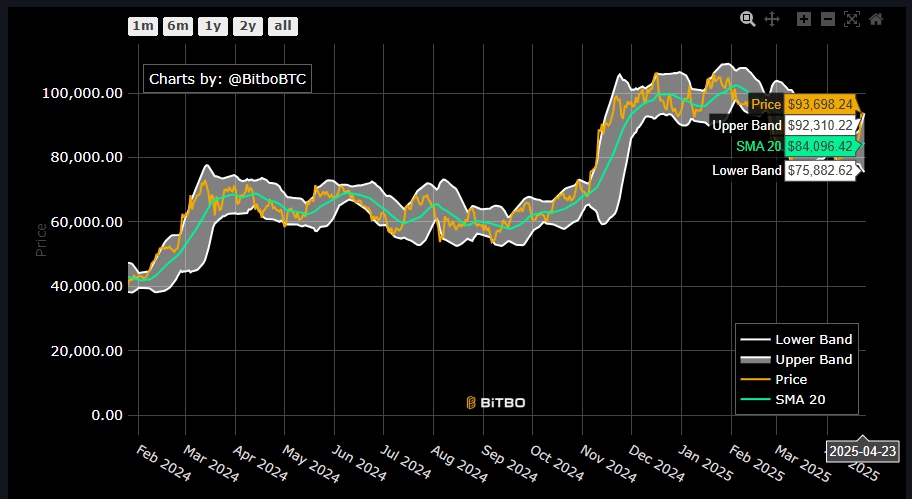

Bitcoin Technical Analysis

The upper Bollinger Band is at $93,739.78, and is,.02the upper an overheated (overb)verband potential for adjustment (decline), while breaking the lower indicates an oversld state with the possibility of a reboundacement.

Currently, Bitcoin is trading at $93,908,, close to the upper band. It has slightly increased compared to the previous day ($93,682) and continues continues its rebound trend, but the upward momentum has somewhat slowed. The overheating signal is maintained is maintained, and caution is needed for short-term selling pressure.

The widening band width suggests the possibility ofinger of volatility in the future. current section is the point where the directional momentum is fully launched, and a strong trend is likely to continue.

The 20-day moving average is located at $93,451.63. The current market price is about $400 higher, maintaining an upward trend.

The RSI (Relative Strength Index), which measures the strength of price increases and decreases, is 57.94, slightly down from the previous day (58.9). It still maintains a neutral to mild bullish trend, but the the entry into thehezone is somewhat delayed. The buying sentiment has somewhat calmed down down.

Currently, it is close to the section just before overheating, and in the short term, additional upmomentumward be if it breaks around $94,000,000. However, as the gap with the moving average is narrowing, there is also a possibility of technical adjustment in the early $93,000 .

[This This article provide financial advice, the investment results are the responsibility of the investor.]

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproductiontion prohibited>

금융위원회는 25일 가상자산 거래소의 불법행위 실태를 점검하기 위해 특별 조사를 실시했다고 밝혔다.

이번 조사사 근가산소 불위절을 해위시� 것자산 래소 불래법위실태 점검을 위한 것으로, 가상자산 거래소의 불법행위를 근절 투자 호를 강화하기 위한치.

주요 조사 는 대상은내 가상자산 거래소들로, 불들법 행위 유형과 자금용 위반 사항 등을 중점적으로 살펴볼 예정이다.금융위원회는 이번 특별 조사를 통해 가상자산 거래소의 불법행위를 근절하고 투자자 보호를 강화하는 데 중점을 p 두고 있다.

앞서 금융위원회는 가상자산 거래소의 불법행위에 대한 �한 �제재 를 예고한 바 있으며, 이번 특별 조사는 그 일환으로고로 해볼 수 있다.

Human将本�英语。 The Financial Services Commissionion conducted a special investigation into virtual asset exchanges to strengthen regulations on illegal activities in the cryptocurrency market. The Financial the 25th announced that it investigation the status of illegal activities at at virtual asset exchanges.asset. This investigation was conducted to check the the status of virtual asset exchanges to eradicate illegal activities and strengthen investor protection. The main targets are domestic virtual asset exchanges, focusing on examining types of illegal activities and violations of asset usage. The Financial Services Commission is is focusing on eradicating illegal activities of virtual asset exchanges and strengthening investor protection through this special investigation. Previously, the Financial Services Commission had warned of strict sanctions against illegal activities of virtual asset exchanges, and this special investigation can be seen as part of that.