According to on-chain analysts, the movement of inactive Bitcoin (BTC) increased by 121% in the first quarter of 2025 compared to the first quarter of 2024.

This change may indicate that long-term investors are responding to broad economic trends or anticipating market changes.

Moving Bitcoin... What's the Cause of the Phenomenon?

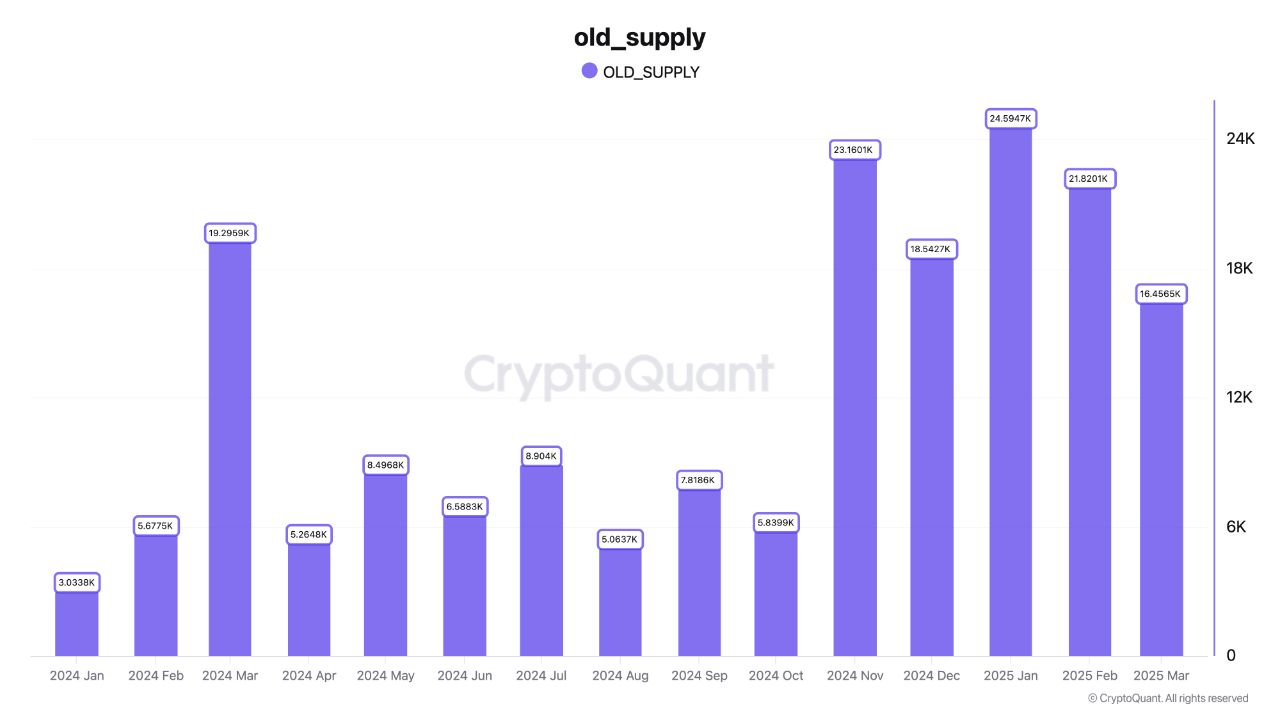

In a recent CryptoQuant post, analysts revealed that approximately 28,000 inactive Bitcoins were moved in the first quarter of 2024. Notably, around 19,296 BTC were moved in March. This is in contrast to the lower figures in January (about 3,034 BTC) and February (about 5,678 BTC).

"During the first three months of 2025, more than twice the amount of long-term inactive Bitcoin was moved compared to the same period in 2024," the post stated.

Compared to the first quarter of 2025, the total amount of moved Bitcoin was significantly high. More than 62,000 BTC that had been inactive for over 7 years were transferred. Specifically, investors moved 24,595 BTC in January, 21,820 BTC in February, and 16,456 BTC in March.

Analysts suggested that this surge in activity reflects a change in sentiment among long-term Bitcoin holders. This change could be triggered by macroeconomic factors, changes in price expectations, or institutional liquidity demand.

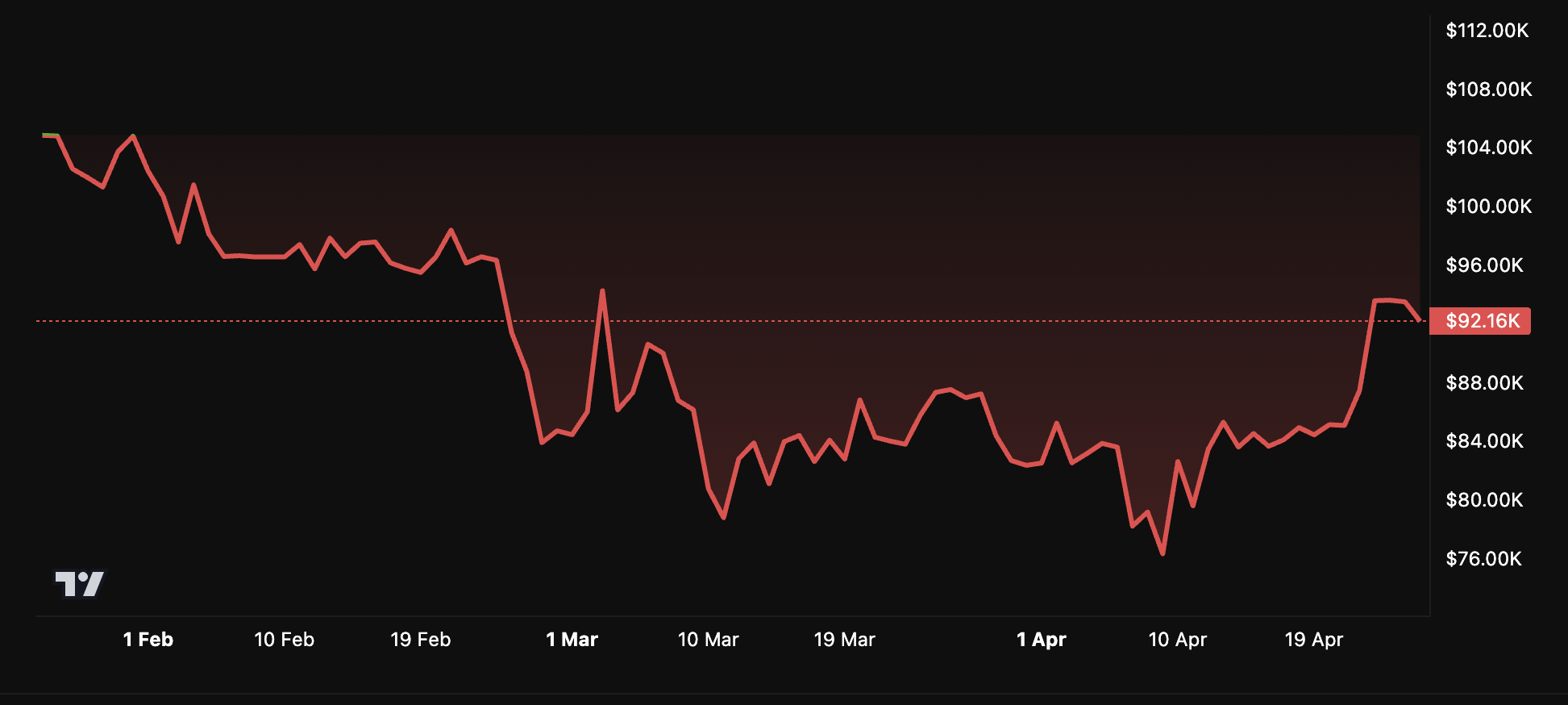

Particularly, 2025 has proven to be a turbulent year for Bitcoin. Geopolitical changes, increasing trade tensions, and economic concerns have had a significant impact on the market.

Recently, glassnode pointed out that Bitcoin has experienced the deepest trough of its cycle. In their weekly newsletter, the company emphasized that investors are under strong pressure. Additionally, many are currently experiencing their largest unrealized losses.

"Currently, unrealized losses are primarily concentrated among new investors, with long-term holders still maintaining an overwhelmingly profitable position. However, important nuances are emerging. As recent top buyers age into long-term holder status, the level of unrealized losses within this group is likely to increase," the newsletter stated.

However, glassnode mentioned that BTC's decline remains within the typical range of previous corrections in a bull market. Importantly, Bitcoin recently showed a recovery rally.

Over the past week, its value increased by 8.9%. However, daily losses reached 2.2%. At the time of writing, BTC was trading at $92,164. The decline was not isolated, with the broader cryptocurrency market also experiencing a correction.

Meanwhile, the increased movement of inactive assets is not limited to Bitcoin. A similar trend emerged in the Ethereum (ETH) market. According to data from Lookonchain, a whale deposited 77,736 ETH that had been inactive for 6 years to Bitfinex in early February.

In early April, Onchain Lens posted that a whale moved 11,104 ETH, worth approximately $19.97 million, that had been inactive for 8 years.

"Of this, 247.93 ETH was sent to Coinbase, and 10,856 ETH was transferred to a new wallet. The whale had withdrawn ETH for $2.51 million from Kraken and Gemini 8 years ago," Onchain Lens added.

These asset movements reflect investors' strategic repositioning amid economic uncertainty.