According to the latest Financial Times report, Cantor Fitzgerald, a financial services company led by Brandon Routnick, son of US Secretary of Commerce Howard Routnick, is forming a $3 billion Bitcoin (BTC) investment group together with SoftBank, Tether, and Bitfinex.

This plan is proceeding amid BTC's recent recovery rally, showing significant gains over the past day.

Cantor Fitzgerald, Reproducing Successful Bitcoin Strategy?

Financial Times cited sources stating that Routnick's special purpose acquisition company (SPAC), Cantor Equity Partners, raised $200 million in January. These funds will be used to establish a new company called 21 Capital.

Cryptocurrency companies participating in this plan are donating large amounts of Bitcoin to 21 Capital. Stablecoin giant Tether will donate BTC worth $1.5 billion. Meanwhile, Bitfinex exchange will provide $600 million, and Japanese multinational investment company SoftBank will contribute $900 million.

This brings the total Bitcoin donation from partners to $3 billion. Additionally, this move highlights SoftBank's increasing interest in the cryptocurrency sector.

"This is Masayoshi Son's biggest Bitcoin bet," Matthew Sigel of Van Eck mentioned on X.

Cryptocurrency investments will be converted to 21 Capital's stock at $10 per share. Bitcoin is valued at $85,000 per coin. In addition to partner donations, the SPAC plans to acquire additional Bitcoin through $350 million in convertible bonds and a $200 million private placement.

"The deal may be announced within weeks, but people warned it might not materialize, and numbers could change," FT wrote.

This plan aims to replicate the success of MicroStrategy, the largest corporate BTC holder. The company has been purchasing BTC since 2020 and currently holds 538,200 coins, valued at $5.014 billion, with approximately 39.8% unrealized gains.

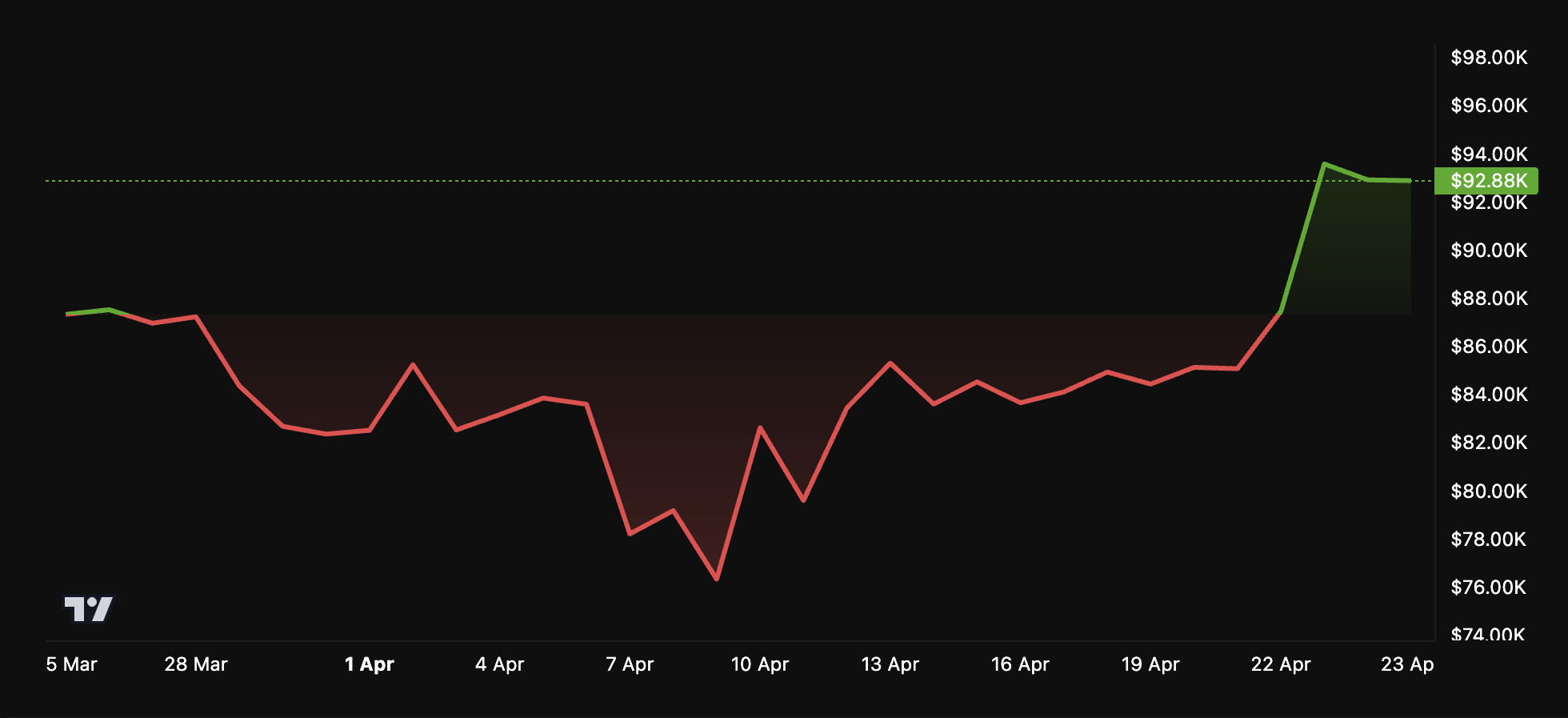

Meanwhile, Bitcoin at the center of this plan has shown significant recovery. As BeInCrypto previously reported, the largest cryptocurrency broke through $90,000 for the first time in 7 weeks. It rose 5.3% over the past day, trading at $92,862.

"People are starting to think Bitcoin rises as an inflation hedge as a store of value, but the market gods have a pathological sense of humor, and it turns out it was just Cantor/SoftBank/Tether MSTR 2.0," an analyst posted on X.

As the consortium moves forward, its success will depend on Bitcoin's long-term performance and the broader regulatory outlook for cryptocurrencies.