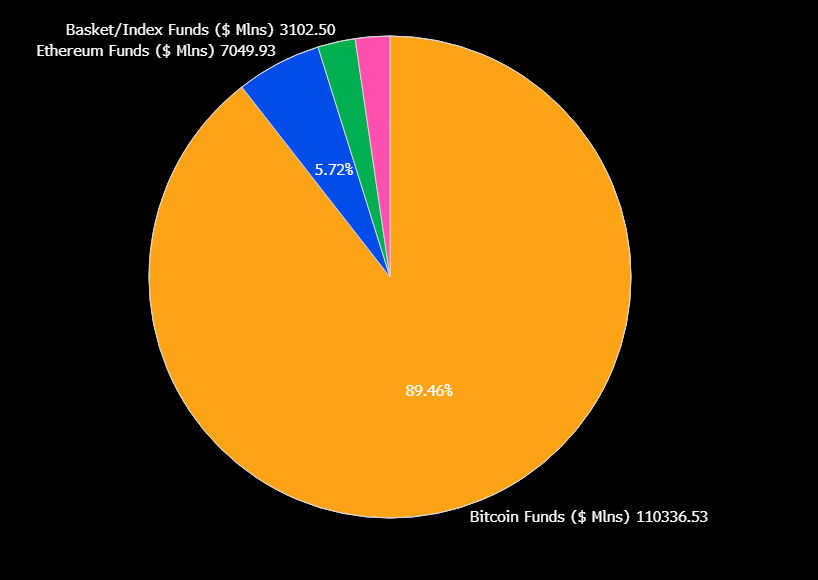

As the SEC signals potential approval of new altcoin ETFs, 72 active proposals are awaiting approval. While asset managers are showing increased interest in launching more altcoin-based products in the institutional market, Bitcoin ETFs currently account for 90% of global cryptocurrency fund assets.

New listings could attract fund inflows and liquidity to tokens, similar to the Ethereum ETF option approval. However, given the current market interest, it will be extremely difficult for any cryptocurrency to replicate Bitcoin's success in the ETF market.

Bitcoin Dominates ETF Market

Bitcoin ETFs significantly transformed the global digital asset market last month and are currently performing very well. In the United States, total net assets reached $94.5 billion, despite continuous outflows in recent months.

Their impressive initial success opened a new market for cryptocurrency-related assets, and issuers are flooding the SEC with new applications.

This flood is so strong that there are currently 72 active proposals awaiting SEC consideration:

"Currently, 72 cryptocurrency-related ETFs are waiting for listing or options listing with the SEC. From XRP, Litecoin, Solana to Penguin, Doge, 2x MELANIA. This year is going to be really exciting." – ETF Analyst Eric Balchunas

The US regulatory environment has become much more favorable to cryptocurrencies, and the SEC is signaling willingness to approve new products. Many ETF issuers are trying to seize the opportunity to create products as successful as Bitcoin.

However, Bitcoin has a significant head start, and it's difficult to imagine a newcomer disrupting its 90% market share.

Considering this, BlackRock's Bitcoin ETF has been declared the "greatest ETF launch in history". New altcoin products will need substantial added value to encroach on Bitcoin's position.

Recent products like Ethereum ETF options have attracted new liquidity. However, Bitcoin's dominance in the institutional market remains unchanged.

Of these 72 proposals, only 23 are about altcoins excluding Solana, XRP, and Litecoin, with many proposals relating to new derivatives of existing ETFs.

Some analysts argue that even together, these products cannot replace more than 5-10% of Bitcoin's ETF market dominance. Any significant event disrupting Bitcoin would also impact other cryptocurrencies.

Nevertheless, this doesn't mean altcoin ETFs are meaningless attempts. These products continue to generate new fund inflows and interest in underlying assets, especially as issuers secure token reserves.

We must be realistic. While XRP and Solana ETF approvals could bring a new upward cycle to the altcoin market, Bitcoin is widely recognized as a 'store of value' and is likely to continue dominating the ETF market.