The 'Kimchi Premium' for cryptocurrency prices in Korea has slightly expanded compared to overseas prices.

According to CryptoPrice at 8:16 AM on the 21st, the Kimchi Premium (Upbit<> Binance) is recording 1.33%.

This is a slight increase from the previous Friday (1.27%), showing a re-inflow of domestic buying pressure. Major altcoins such as Ethereum, XRP, and Doge are also showing a consistent premium of around 1.4%.

Kimchi Premium Status by Coin

Bitcoin (BTC) $87,295.00 / 125,740,000 won / 1.33%

Ethereum (ETH) $1,576.39 / 2,273,000 won / 1.44%

Solana (SOL) $135.92 / 196,000 won / 1.44%

XRP $2.076 / 2,993 won / 1.43%

Doge $0.1586 / 228.5 won / 1.33%

The Kimchi Premium is a phenomenon where cryptocurrency prices are higher on Korean exchanges compared to overseas, caused by a sudden increase in domestic demand or lack of overseas liquidity. A reduction or negative conversion of the Kimchi Premium indicates a weakening of domestic buying pressure or weakness in domestic prices compared to global rates.

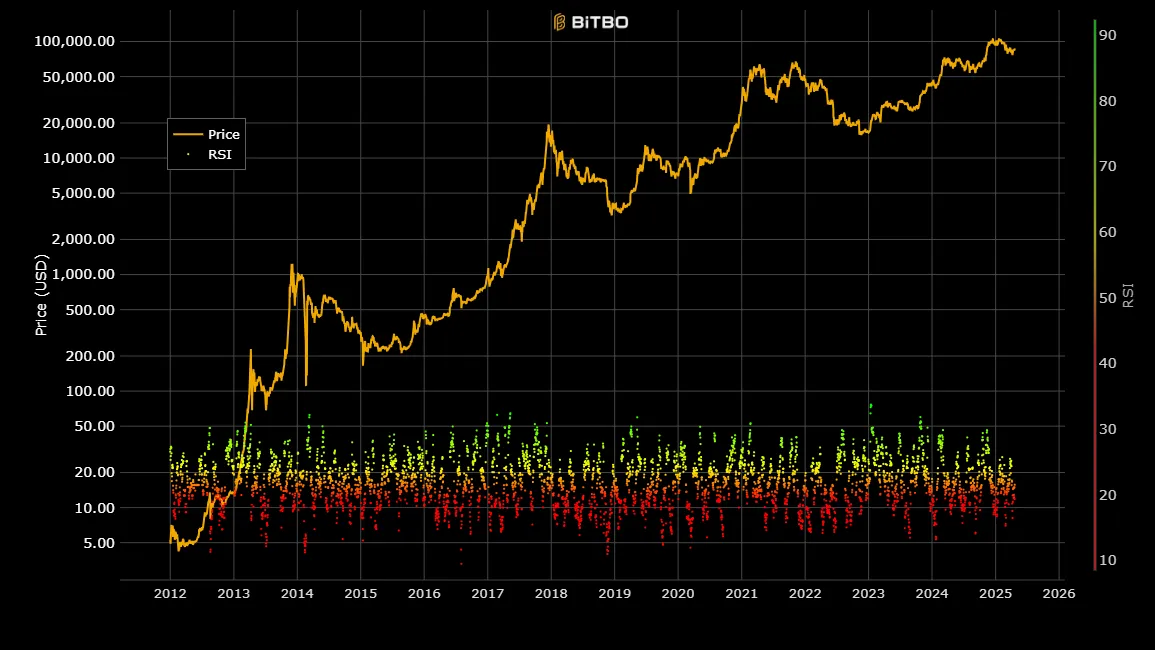

Bitcoin Technical Analysis

The Bollinger Band upper limit is at $88,466.84, and the lower limit is at $77,864.33. Breaking through the upper band indicates an overheated (overbought) state with a possible adjustment (decline), while breaking below the lower band indicates an oversold state with a potential rebound.

Currently, Bitcoin is trading at $87,316, close to the upper band. It has risen by 2.63% and shows a trend recovery, but has not yet broken through the upper limit, with the short-term direction potentially determined by whether it breaks through the upper band.

The widening band width suggests a possibility of increased volatility in the future. It can also be interpreted as entering a phase where the directional momentum is increasing.

The 20-day moving average, which determines the strength and direction of the trend through the average price over a certain period, is currently located at $83,165.59.

The 20-day moving average is at $83,165.59, and since the current price is well above this, the basic upward trend remains valid.

If the trend line serves as a support line, it could provide an opportunity for buying on dips. However, if it breaks, a potential slowdown in the short-term buying pressure should be considered.

The RSI (Relative Strength Index), which measures the strength of price increases and decreases, has slightly increased from 48.81 to 50.15. Located in the neutral area (near the 50 line), it reflects a gradual recovery of buying sentiment without overbought or oversold signals.

Currently, it is considered a transition section attempting to break through the upper limit in a state that is not overheated. In the short term, breaking through $88,460 is crucial, and if the upward momentum weakens, there is also a possibility of a short-term adjustment to the $83,000 range.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>