Bit's price has recently recorded a monthly high, surpassing $87,000 and showing a notable rise of the crypto king. This rally is attributed to favorable macroeconomic conditions and increased confidence among major investors.

Despite this growth, the returns of Longing-term holders have fallen to a two-year low. This indicates a more cautious outlook among some market participants.

Bit Whales, Still Strong

Whale and shark addresses holding 10 to 10,000 BTC are actively accumulating Bit at lower price levels. Over the past month, these addresses have purchased approximately 53,652 BTC, equivalent to about $4.7 billion. This buying frenzy indicates that large investors view Bit's recent decline as an opportunity and believe in the asset's Longing-term potential.

This accumulation by large investors emphasizes confidence in Bit's growth. While some market participants were uncertain about Bit's recent price fluctuations, these key holders appear to be positioning themselves for future gains.

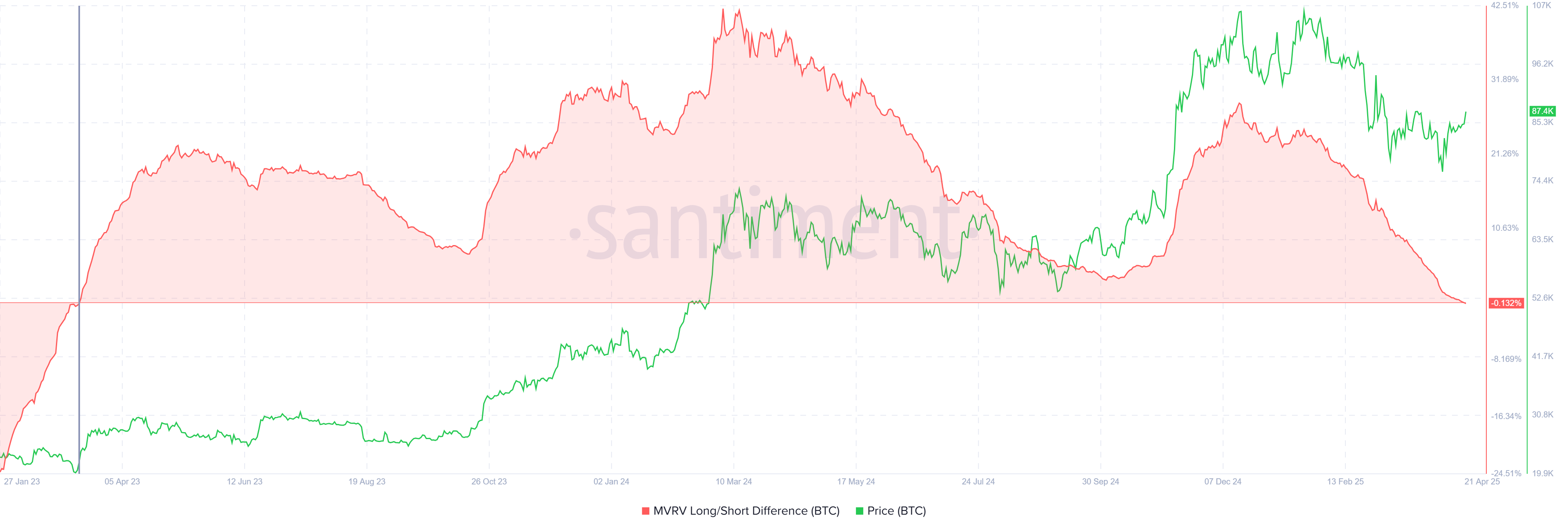

The MVRV Short/Longing difference indicator, which tracks the realized profit difference between Short-term holders (STH) and Longing-term holders (LTH), is currently at a two-year low. This indicates STH domination in the market, reflecting whale accumulation. However, Short-term holder profit dominance could signal that the market is ripe for selling, potentially exerting downward pressure on Bit's price.

As the MVRV indicator turns below the zero line, there is a risk that Bit's price could be negatively impacted if STH decide to cash out. While whales continue to accumulate, increased STH influence could increase volatility if market sentiment changes.

Bit MVRV Short/Longing Difference. Source: Cryptocurrency online data platform Santiment

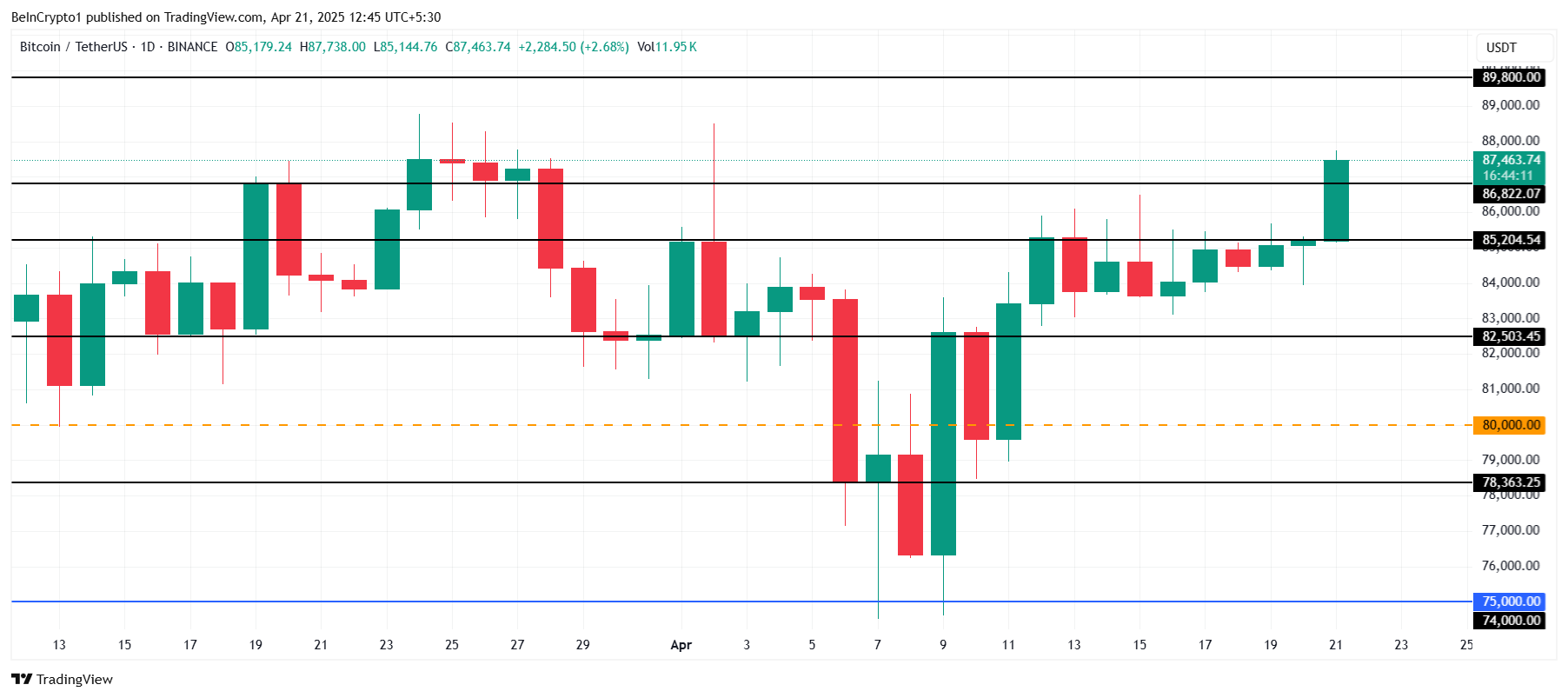

BTC Price, $90,000 Target

Bit is currently trading at $87,463, above the critical support level of $86,822. When Bit failed to secure this support level, the price significantly dropped. However, if Bit can maintain support at $86,822, it could move to the next resistance level at $89,800.

Breaking through $90,000 is a crucial milestone for Bit. If Bit can recover $90,000 as a support level, it is likely to continue its upward trend. This psychological level is important for strengthening investor confidence, which will drive further price increases.

If a downtrend pressures Bit, it may struggle to maintain support at $86,822. Falling below this level could lead to further decline to the next support level at $85,204. If this support fails, Bit could drop to $82,503, potentially erasing recent significant gains.