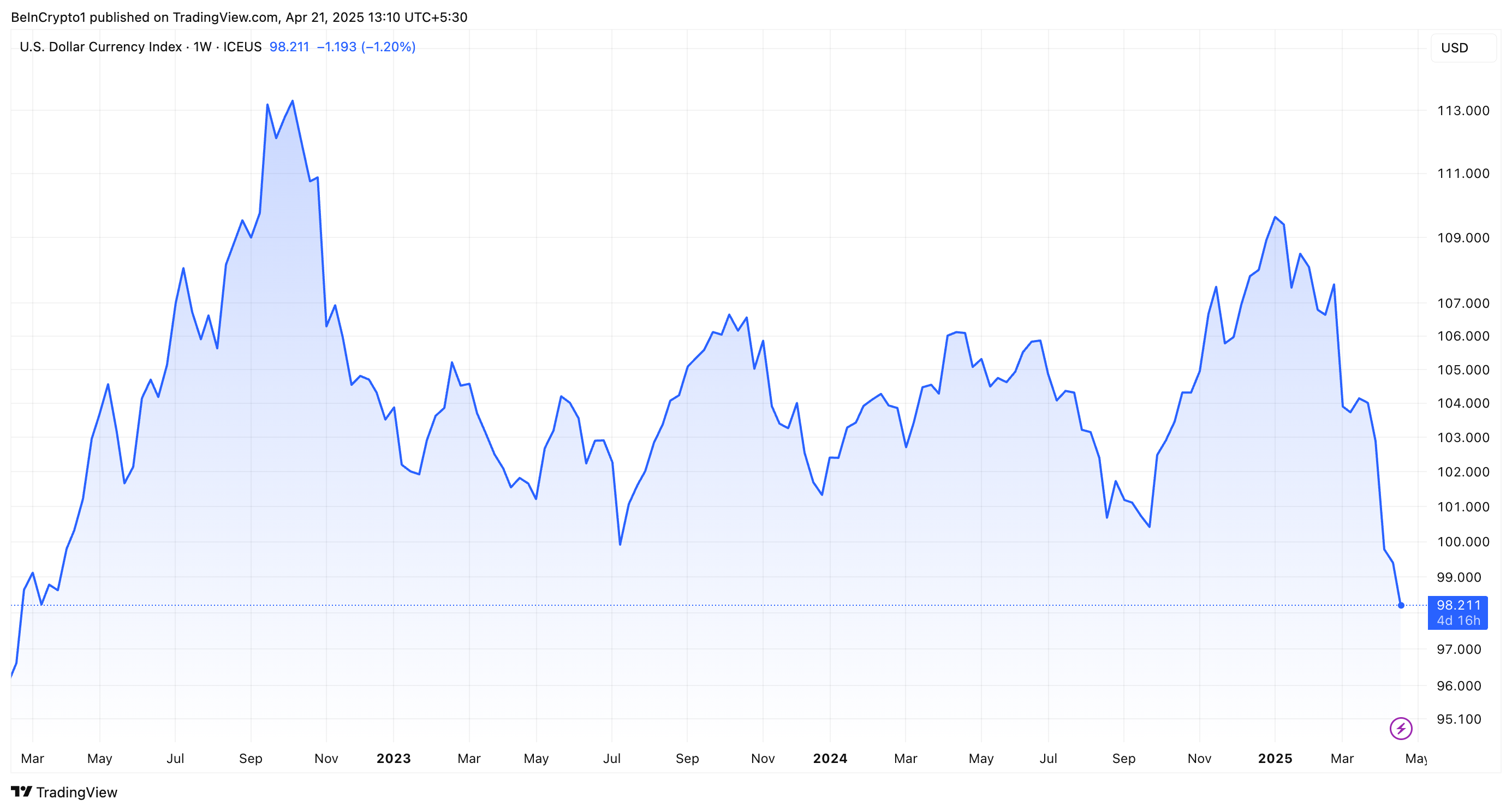

The US Dollar Index (DXY) has fallen to its lowest level in three years amid reports that President Donald Trump is considering dismissing Federal Reserve Chairman Jerome Powell.

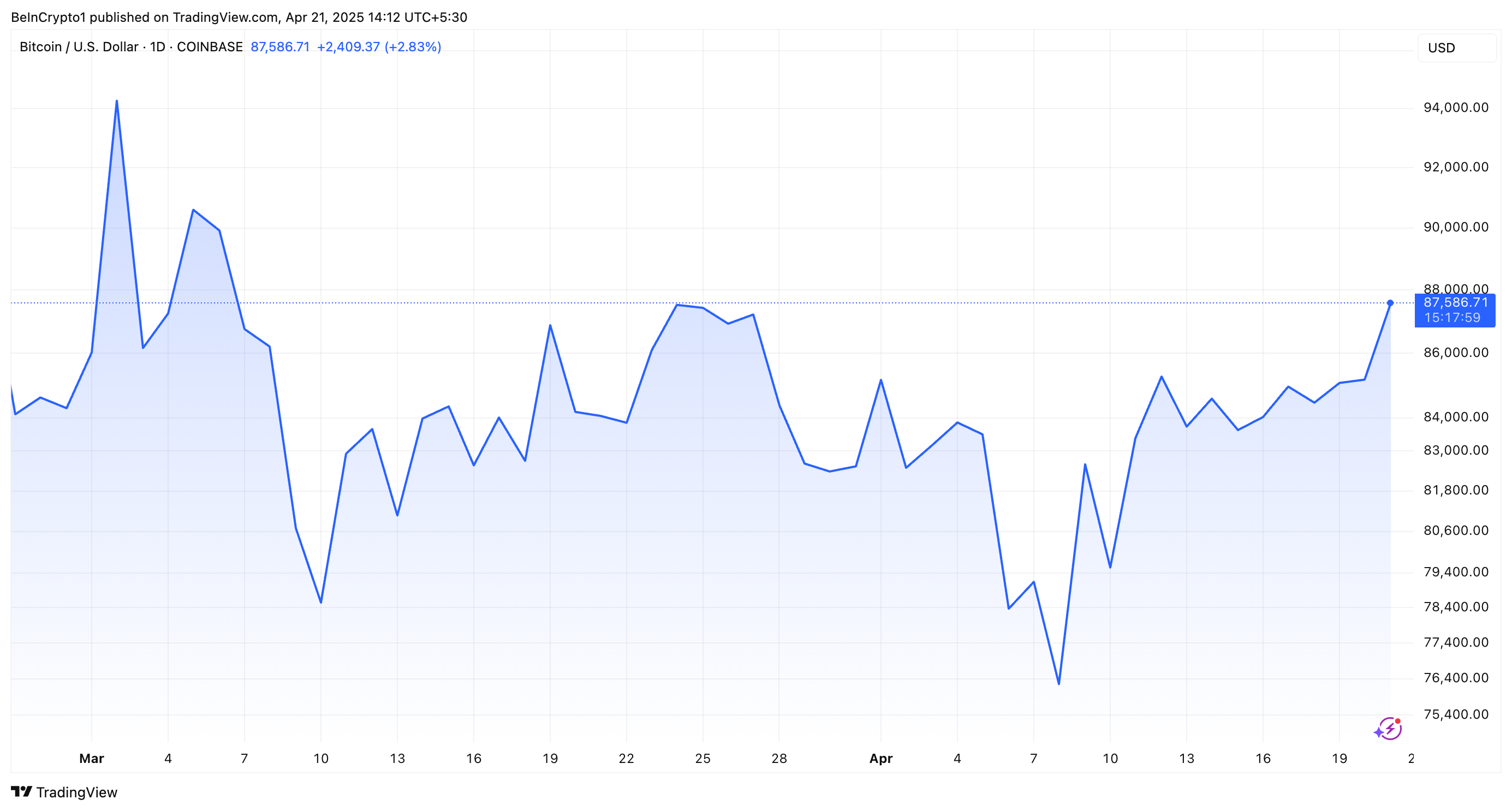

Meanwhile, this situation has positively impacted the BTC price, lifting it to its highest level since Trump's Day of Liberation.

Trump Pressures Powell…Burden on Dollar

According to the latest data, DXY has sharply dropped below 99. At the time of reporting, it was located at 98.2, which represents the lowest level since March 2022.

Economist Peter Schiff emphasized the severity of the situation on X (formerly Twitter).

"Gold has risen over $50, reaching an all-time high of $3,380. The euro is over 1.15 dollars. The dollar has also fallen below 141 Japanese yen and 0.81 Swiss francs (lowest in 14 years, 3% above its all-time low). The dollar index has fallen below 98.5, reaching a three-year low. The situation is getting serious." – Peter Schiff, Economist

The dollar's sharp decline occurred on Friday, April 18th, during a recent statement by Kevin Hassett, Director of the National Economic Council. Hassett revealed that Trump and his team are actively exploring the possibility of dismissing Powell.

His statement was in response to a journalist's question about whether Powell's dismissal was an option.

"The President and his team will continue to study that issue," Hassett responded.

He also criticized the Federal Reserve for politically motivated actions under Powell's leadership. Specifically, Hassett criticized the Fed for raising rates after Trump's election and lowering rates before the election, claiming these moves favored the Democratic Party.

The increasing contempt for Powell is particularly a response to the Fed's stance on interest rates. BeInCrypto reported that the Fed is unlikely to cut rates in May, due to rising inflation and Trump's tariff suspension.

Recently, Trump has also criticized the Fed Chairman for slow action on rate cuts. In a social media post, Trump compared Powell's actions to the European Central Bank (ECB), which is set to implement its seventh rate cut.

Trump described Powell as always acting "too late and wrong" and argued that similar measures should have been taken long ago to address the economic situation.

"The sooner Powell is fired, the better!" the President wrote.

The potential dismissal of the Fed Chairman raises serious questions about the Federal Reserve's independence and its impact on global markets. Powell previously stated that his chairmanship has been extended until May 2026, and legal protections would prevent his dismissal and allow him to complete his term.

Weak Dollar Driving Bitcoin's Rise?

Nevertheless, if Powell is dismissed and Trump successfully persuades the Federal Reserve to cut rates, it could lead to a cryptocurrency market rally. Generally, when the Fed cuts rates, the US dollar weakens.

Therefore, investors prefer cryptocurrencies, especially Bitcoin, which is often mentioned as a hedge against inflation. The inverse relationship between DXY and BTC further strengthens the possibility of a rally when the dollar is weak.

Indeed, the recent decline in the dollar index coincided with a notable rise in Bitcoin's price. The top cryptocurrency exceeded $87,000 for the first time since April 2nd.

"Dollar weakness is driving the crypto rally," – Shawn McNulty, Derivatives Trading Leader at Falcon X, told Bloomberg.

At the time of writing, BTC was trading at $87,586. According to BeInCrypto data, this represents a 3.5% increase over the past day. As the market celebrates this rise, the focus remains on Trump's next moves and their broader economic consequences.