This week, several U.S. economic indicators are scheduled that could impact Bit and cryptocurrency.

U.S. macroeconomic data has had a broad impact on the cryptocurrency market's sentiment over the past few months. Therefore, traders and investors need to adjust their portfolios and align their trading strategies to leverage key economic events.

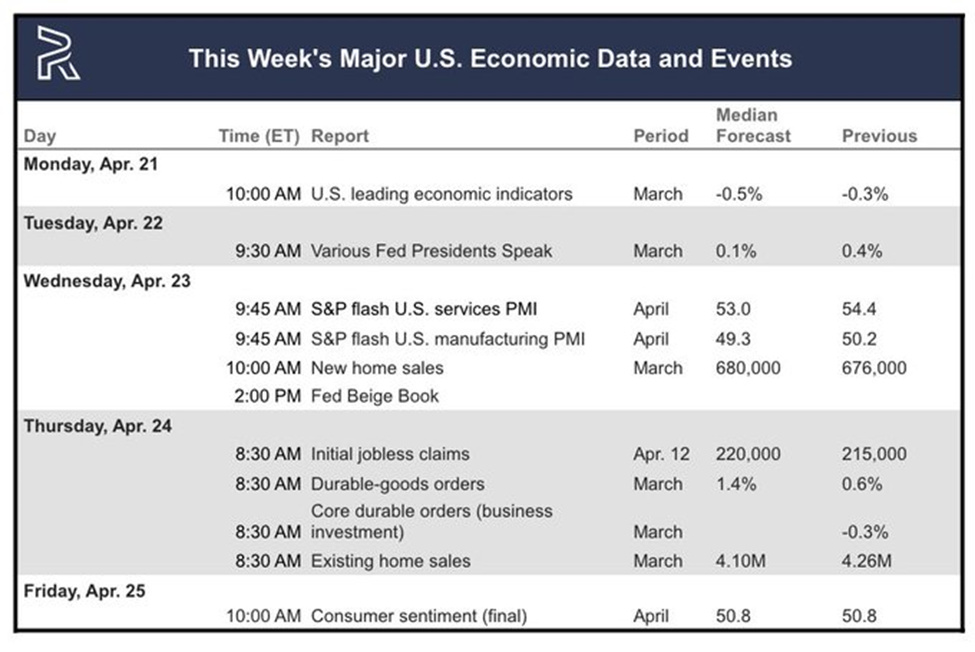

U.S. Economic Events This Week

Bit's price dynamics are influenced by several factors, including macroeconomic sentiment, monetary policy expectations, and the growing narrative of Bit as a hedge or risk asset. These factors are particularly relevant this week.

On the other hand, unemployment benefit claims have a significant impact on the Bitcoin sentiment. A slight decrease in claims can help mitigate signs of economic weakness. If claims continue to decrease significantly, raising hopes for monetary easing, Bitcoin could benefit from increased liquidity and falling yields.

Consumer Sentiment

Consumer sentiment, as measured by the University of Michigan's index, was 50.8 in March 2025. This is a slight decrease from the February figure, reflecting pessimism about tariffs and inflation concerns despite a robust economic situation.

The preliminary data for March suggests a figure of 50.8, which remains negative according to TradingEconomics' estimates.

"US consumer sentiment is lower than during the Great Depression. Consumer sentiment is at 50.8, the second-lowest level in history. This is lower than all US recessions in the past 50 years... This is a crisis." – A global market investor mentioned.

Consumer sentiment is a measure of retail investor confidence, which is crucial for the retail-driven Bitcoin market. Low sentiment can weaken enthusiasm for speculative assets, potentially driving Bitcoin down, especially when risk-averse psychology dominates.

Conversely, if sentiment stabilizes or tariff concerns ease, Bitcoin could ride a wave of risk appetite. However, given the current trend, this seems unlikely.

The possible effect is a downward trend, with declining confidence aligning with broader economic caution.

According to BeInCrypto data, Bitcoin (BTC) is currently trading at $87,424. This represents a slight increase of 2.66% over the past 24 hours.