XRP is currently directionless, hovering with limited momentum as traders await clear signals. Over the past 24 hours, XRP's trading volume has decreased by 20.37%, currently reaching $2.4 billion, reflecting a short-term decline in interest.

Technical indicators such as RSI and Ichimoku Cloud show a neutral trend with no strong upward or downward movement. Price movement is trapped between major support and resistance levels, with the next breakout direction still uncertain.

Neutral RSI Requires XRP Trader Caution

XRP's Relative Strength Index (RSI) is currently positioned at 46.82, indicating a neutral momentum in the market. This neutral zone has persisted since April 7th, with no significant shifts into overbought or oversold territories.

Notably, the RSI was 57.30 three days ago, suggesting that XRP has experienced a decrease in buying pressure.

This decline indicates waning interest or a psychological shift among traders, showing the asset is approaching the midpoint of the RSI scale.

The RSI is a momentum measurement indicator that assesses the speed and magnitude of recent price changes, typically using a scale from 0 to 100.

Values above 70 indicate an overbought asset potentially needing correction, while values below 30 suggest an oversold condition with potential for a rebound. Currently at 46.82, XRP implies market uncertainty.

This level, combined with the recent decline from 57.30, may indicate increasing caution or weakening upward momentum. This could suggest a short-term correction or slight downward pressure unless buyers confidently re-enter.

Ichimoku Cloud Reveals XRP Price Movement Uncertainty

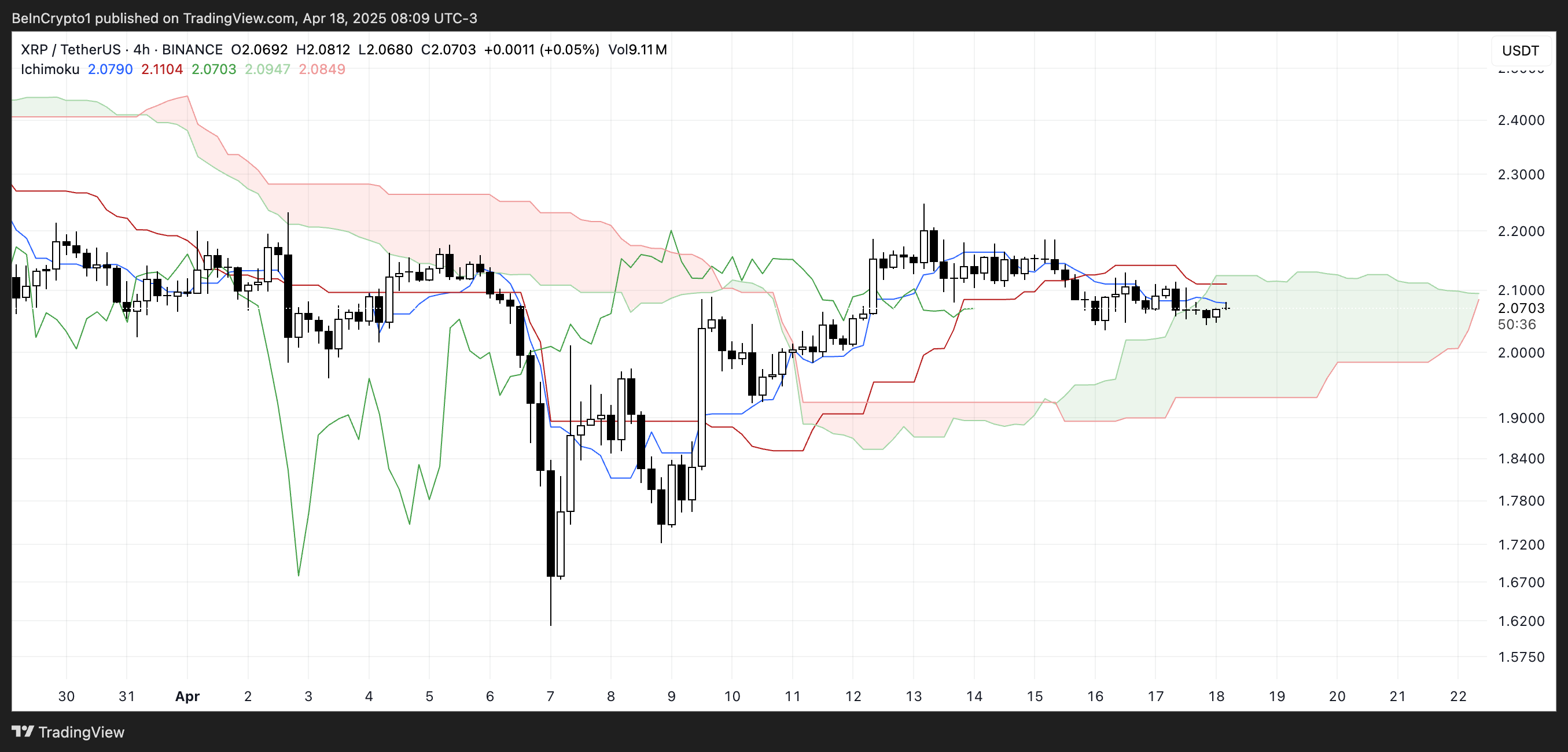

XRP is currently trading within the Ichimoku Cloud, reflecting uncertainty or a consolidation state.

The Conversion Line (blue) and Base Line (red) are flat and closely aligned, suggesting weak momentum and a lack of short-term trend direction.

Leading Span A and B (cloud boundaries) are also relatively flat, indicating a balanced market without strong pressure from either buyers or sellers.

The Ichimoku Cloud helps visualize support, resistance, and trend direction at a glance. Prices above the cloud are considered in an uptrend, while those below suggest a downtrend.

With XRP currently inside the cloud, the trend is neutral, often with reduced volatility. The flatness of the cloud's leading edge suggests a consolidation phase, and the lack of a clear breakout above or below reinforces market uncertainty.

Currently, XRP is likely to remain range-bound until a strong trend emerges.

$2.03 Support and $2.09 Resistance: Keys to XRP's Next Move

XRP price is currently trading within a narrow consolidation range, with key support at $2.03 and resistance at $2.09.

Price movement is relatively quiet, but moving averages are beginning to show signs of weakness, with a potential death cross forming as short-term moving averages cross below long-term moving averages.

If this bearish crossover is confirmed and XRP falls below the $2.03 support, the likelihood of a decline to $1.96 increases.

A strong continuation of the downtrend could trigger a steeper decline, potentially pushing prices down to $1.61 if selling pressure accelerates.

However, an upward scenario remains possible. If buyers push XRP above the $2.09 resistance, opportunities to retest levels at $2.17 and $2.35 could open up.

This would indicate a reinvigoration of bullish strength and momentum reversal. If the rally extends beyond these levels, XRP could move towards $2.50, achieving a significant recovery.