Large-scale Bitcoin withdrawals worth millions of dollars from major exchanges have drawn significant attention from the crypto community.

However, if Bitcoin fails to break through the $86,000 barrier, investor confidence may be shaken, with price correction remaining a realistic possibility.

Bitcoin Whales Withdraw Hundreds of Millions in BTC

According to data from the X account OnchainDataNerd on April 17, several large Bitcoin whales executed massive withdrawals from major exchanges. Galaxy Digital withdrew 554 BTC, worth approximately $76.74 million, from OKX and Binance.

Abracas Capital withdrew 1,854 BTC, worth approximately $157.26 million, from Binance and Kraken.

Two other whales identified by addresses 1MNqX and 1BERu withdrew 545.5 BTC ($45.50 million) and 535.2 BTC ($45.44 million), respectively, from Coinbase. Over $280 million in Bitcoin was removed from exchanges in a single day.

Such withdrawals by Bitcoin whales like Galaxy Digital and Abracas Capital often indicate a strategy to move BTC to cold storage. This is generally considered a positive signal that reduces selling pressure and reflects expectations of future price increases.

Surge in First-Time Bitcoin Buyers

A report from glassnode on X highlights a surge in first-time Bitcoin buyers. The influx of these new investors could drive short-term price increases. However, long-term holders (LTH) have stopped their accumulation, indicating caution amid market volatility.

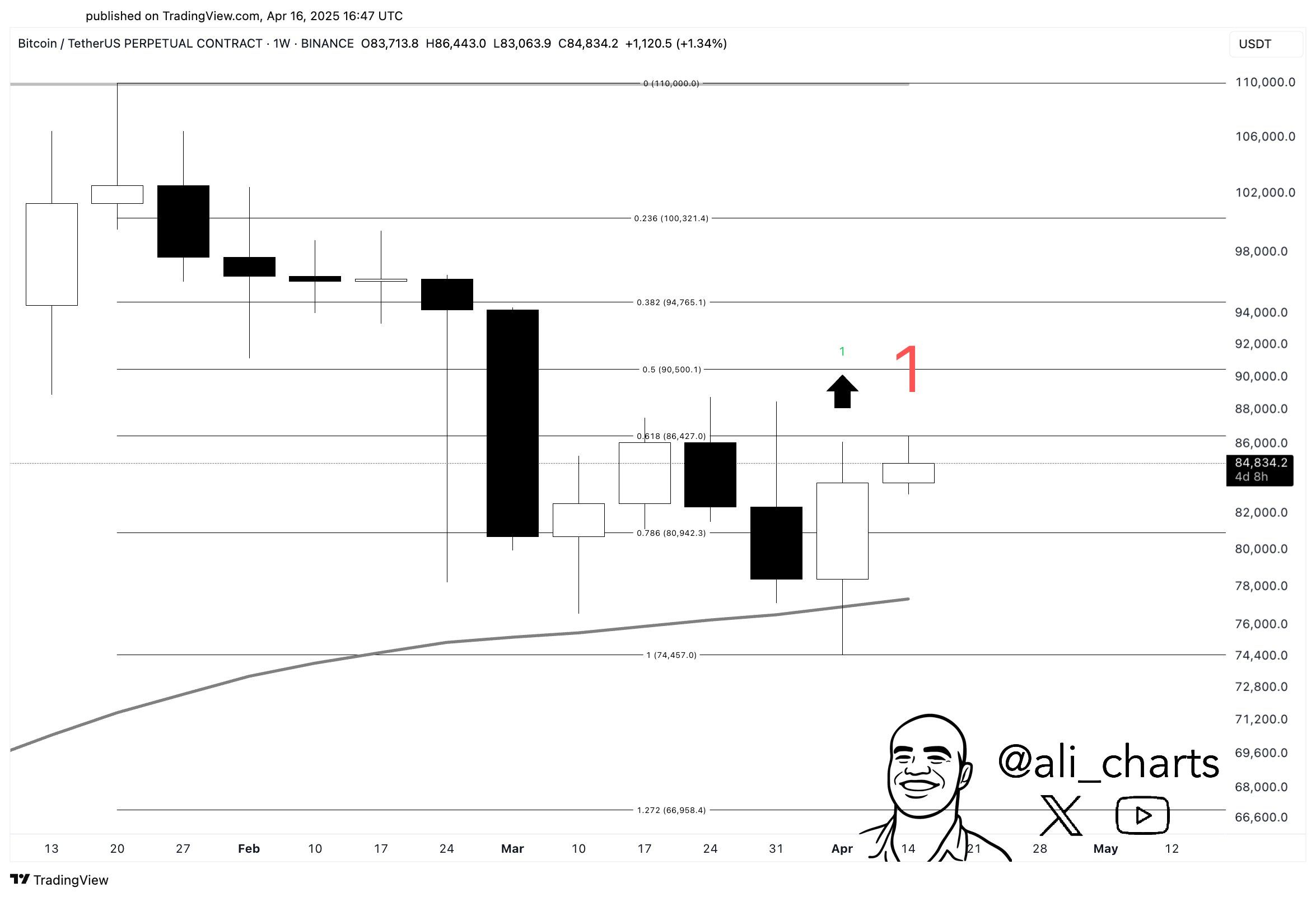

In a post on X, analyst Ali used the TD Sequential technical indicator to predict Bitcoin's price trend. TD Sequential showed a buy signal on Bitcoin's weekly chart.

Additional price increases are expected if Bitcoin consistently closes above $86,000. Currently, Bitcoin is hovering above $80,000, indicating growth potential. However, a positive trend can only be confirmed by breaking through the critical $86,000 resistance level.

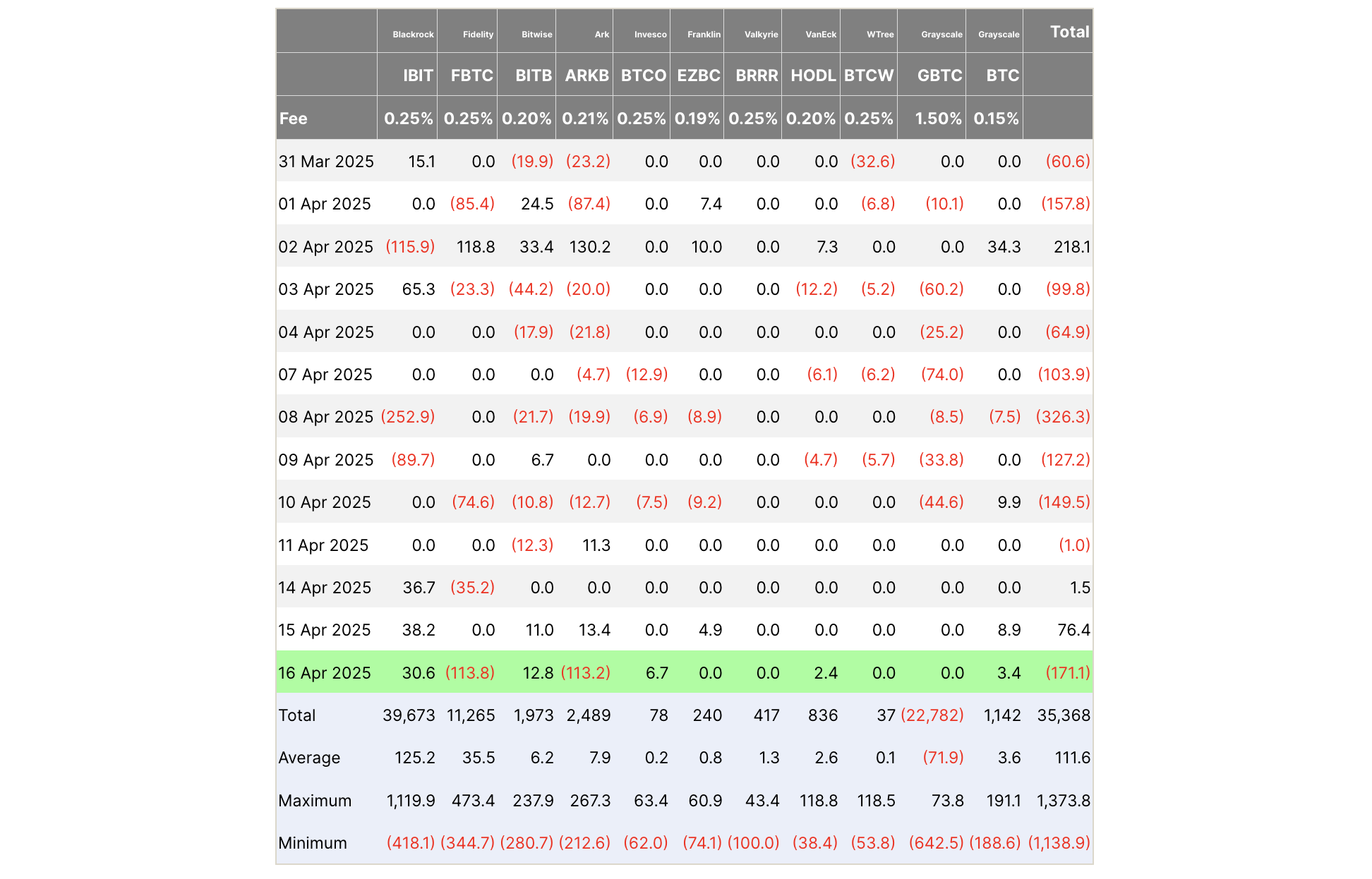

Despite recent whale accumulation, not all signals are positive. Bitcoin ETF inflows have significantly decreased. This decline suggests weakening investor confidence and could exert downward price pressure without new catalysts.

Additionally, according to LookOnChain, over $1.26 billion in Bitcoin has been unstaked from Babylon. If this capital re-enters exchanges, it could strengthen selling pressure, making it difficult for Bitcoin to break through major resistance levels.