Ethereum's (ETH) dominance has steadily decreased over the past two years. This suggests that investor capital is no longer prioritizing ETH. Instead, funds appear to be moving to Bitcoin and other altcoins like Solana or XRP.

However, analysts see a great opportunity in this situation. Many now believe there is a rare chance to accumulate ETH.

Ethereum's Lowest Market Share in 5 Years…Opportunity?

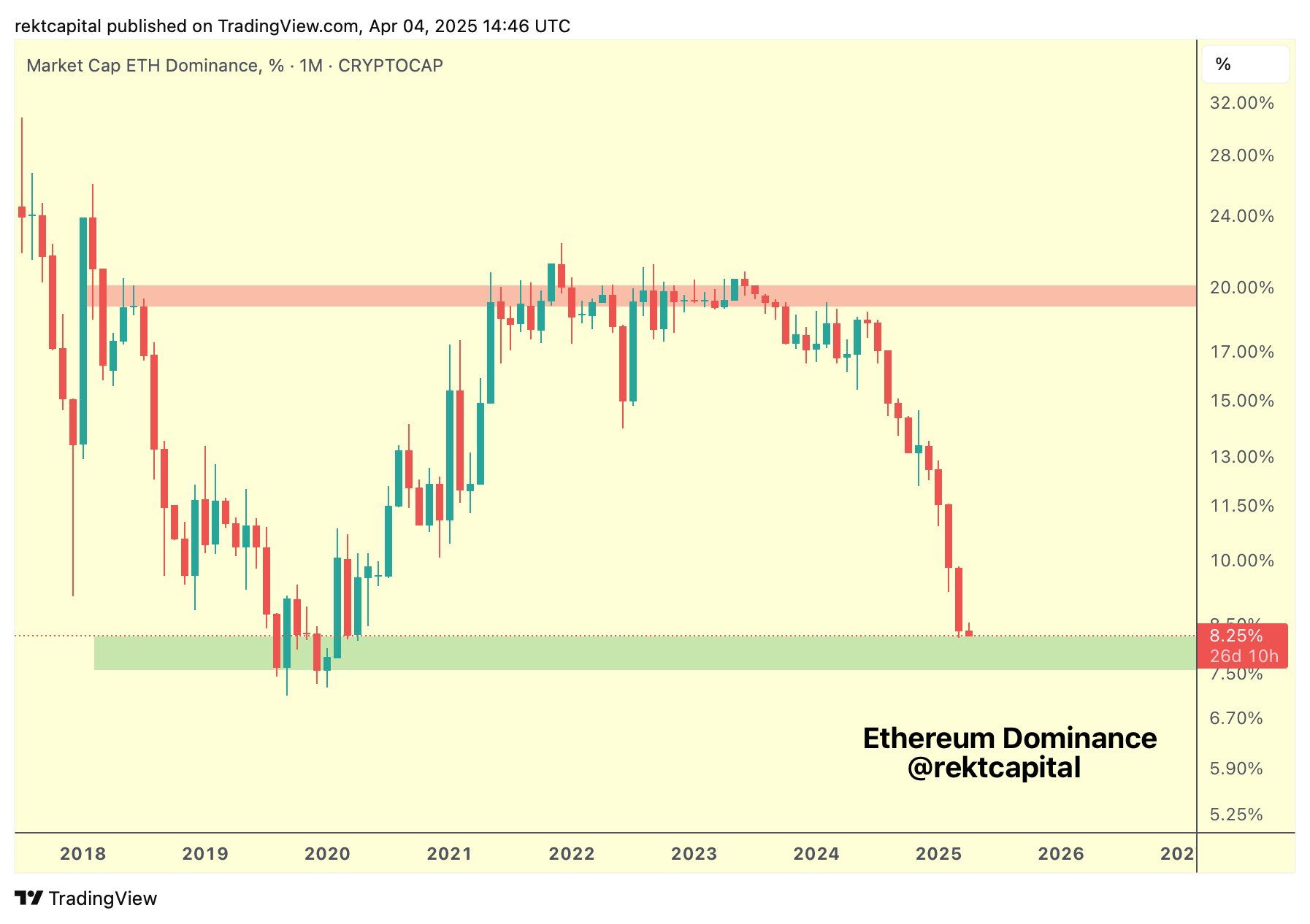

According to analyst Rekt Capital, Ethereum's dominance (ETH.D) dropped from 20% in June 2023 to 8% in 2025. At the time of writing, it was even lower at around 7.3%.

ETH.D represents Ethereum's market capitalization as a percentage of the total cryptocurrency market cap. The decrease in ETH.D indicates that investors are showing less interest in ETH, both compared to the past and to other assets in the market.

Rekt Capital shared a chart showing ETH.D touching a green support zone. Historically, Ethereum tends to reverse in this area and gain market strength.

Rekt Capital questioned whether Ethereum could repeat this historical pattern, noting it as a strong buy signal.

"Since June 2023, Ethereum's dominance has fallen from 20% to 8%. Historically, Ethereum's dominance has reversed in this green area to regain market dominance. Can Ethereum repeat history?" – Rekt Capital said.

Another analyst, CryptoAnup, also saw this decline as an unmissable opportunity. He pointed out that when ETH.D hits an all-time low, it's a good time to accumulate ETH before a new growth cycle begins.

"ETH dominance seems to have found a bottom—it will rebound soon!" – CryptoAnup predicted.

However, a recent BeInCrypto analysis shows that ETH whale addresses are still actively selling. This week, addresses holding 100,000 to 1 million ETH sold approximately 1.19 million ETH, worth over $1.8 billion. These sales are exacerbating the decline in ETH's price and dominance.

ETH Supply Profit Ratio at 4-Year Low

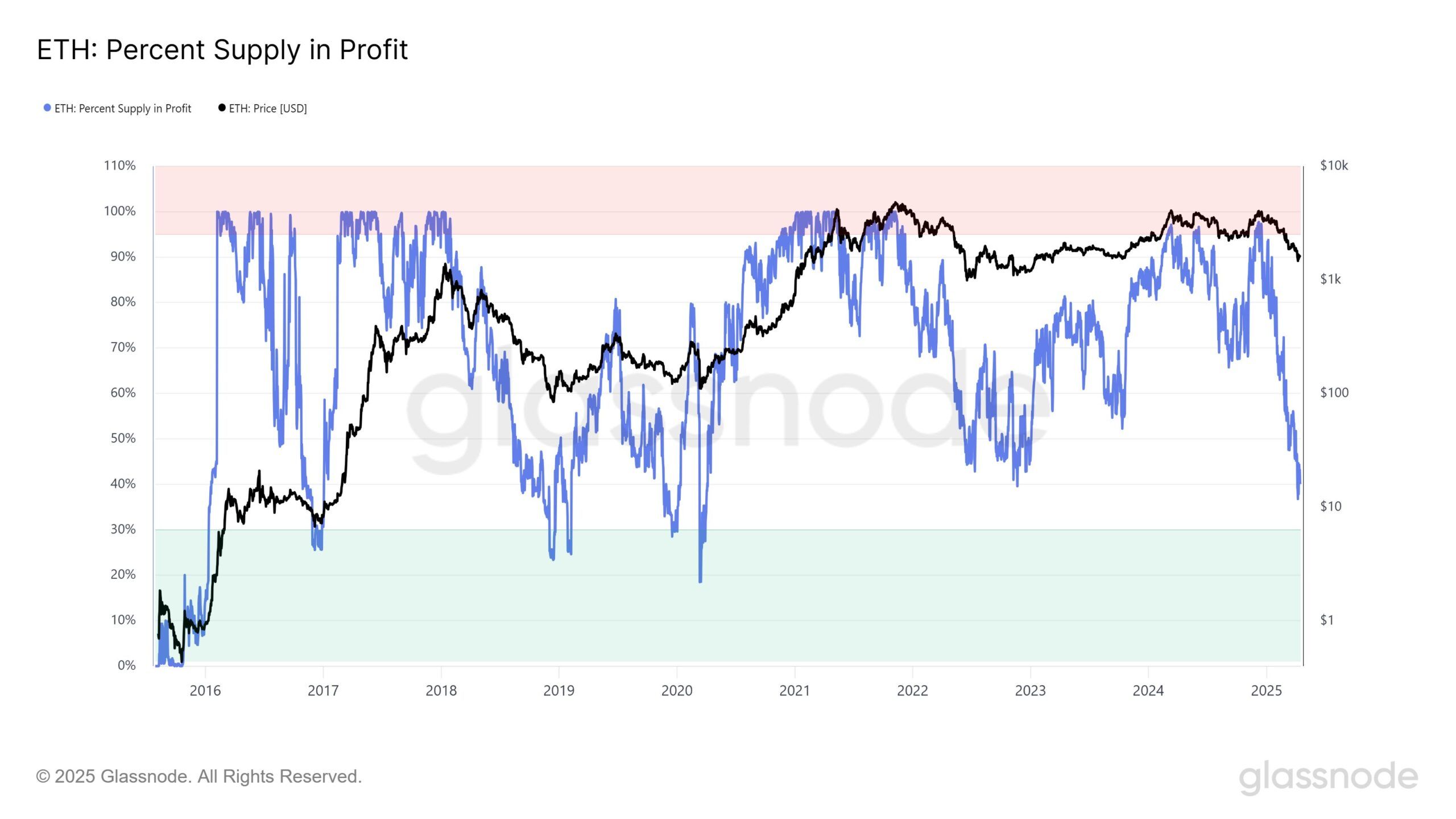

Besides the dominance decline, data from glassnode shows that the ETH supply profit ratio has also dropped to a 4-year low.

Currently, only 40% of ETH supply is in profit, a significant decrease from 97.5% in early December 2024. Analyst Venturefounder stated that if this indicator drops below 30%, it would represent a rare buying opportunity that has only occurred a few times in the last decade.

"The ETH supply profit ratio (40%) is now lower than the last bear market cycle bottom (42%), when ETH was trading at $800. On-chain data shows this is already a batch signal," – Venturefounder said.

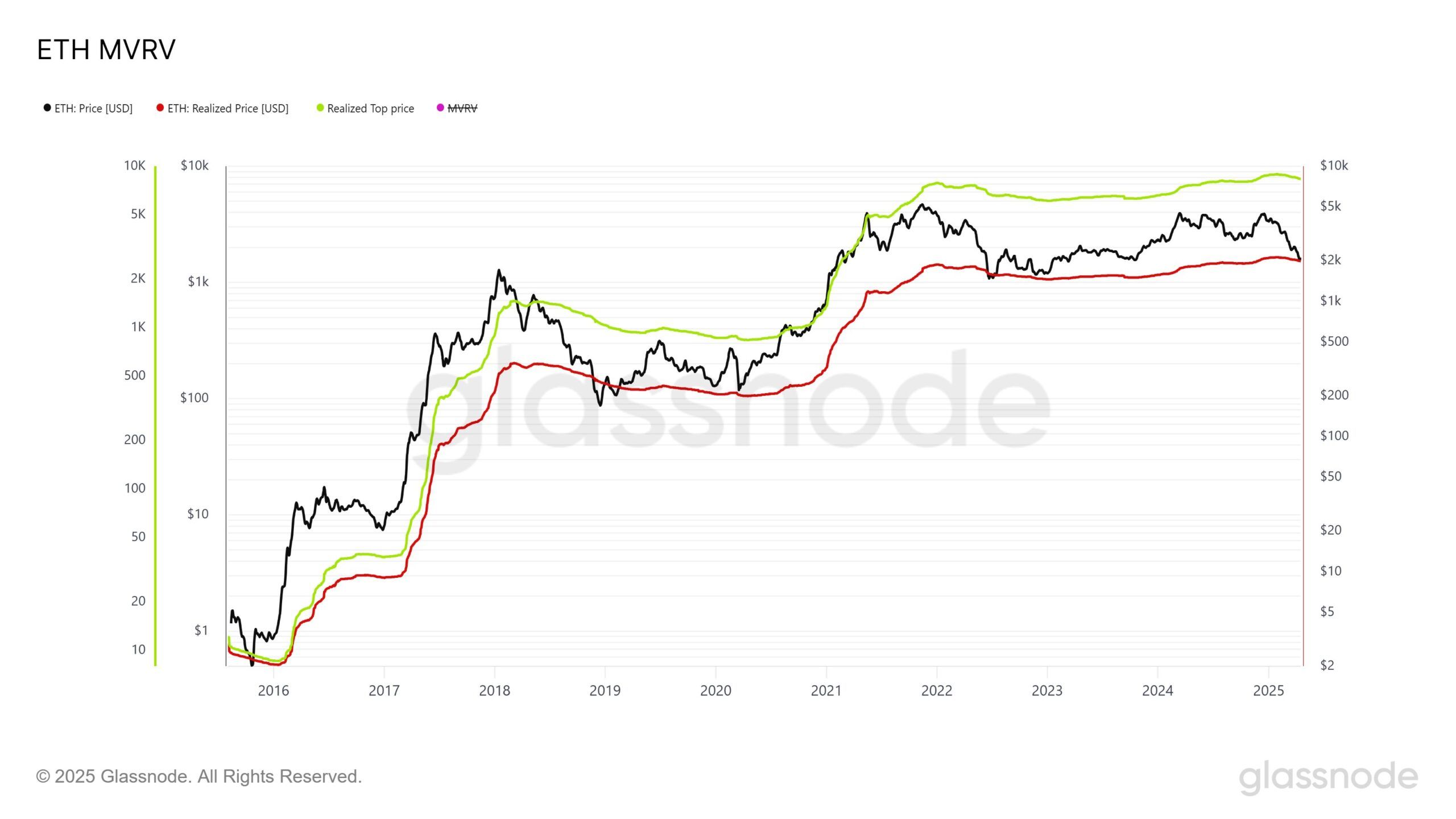

Venturefounder also emphasized another important indicator. Ethereum's current market value has dropped to align with its on-chain realized value. Realized value reflects the average price at which all ETH tokens last moved. When market price drops to this level, it often indicates a rare buying opportunity. Historically, such moments often precede strong price increases.

"Looking at this long-term Ethereum chart, do you want to buy Ethereum or sell it? Be honest," – Venturefounder mentioned.

Despite ETH falling 60% from its 2024 high, a recent BeInCrypto report confirms that Ethereum remains the top DApp platform. DApp fee revenue exceeded $1 billion in the first quarter of 2025.

Additionally, the upcoming Petra and Husaca upgrades are scheduled for mainnet release in May 2025 and late 2025, respectively. These upgrades could significantly improve network performance and boost investor sentiment.