The trading patterns of top cryptocurrency futures traders are used as an important indicator to gauge the future movements of the cryptocurrency market. As they possess high trading expertise and market sensitivity, examining which assets they focus their long positions on helps understand the overall investment sentiment and direction. However, some may use futures contracts to hedge spot positions, requiring additional analysis when interpreting data. Coinglass defines top traders as the top 20% in margin balance. [Editor's Note]

Major Asset Long Position Status

According to Coinglass, as of 10:38 on the 16th, the long position proportion of top futures traders for Bitcoin was 66.01% in the dollar margin market and 61.42% in the coin margin market, decreasing by 0.08%p and 0.12%p respectively compared to the previous day.

The overall reduction in Bitcoin futures long position proportion among top traders reflects a potential short-term adjustment or wait-and-see stance.

Ethereum's long proportion was 66.65% in the dollar market, increasing by 0.12%p from the previous day, but decreased by 0.25%p to 64.67% in the coin market.

Long Position Account Proportion

The proportion of accounts holding Bitcoin long positions among top futures traders was 56.38% (↑6.30%p) in the dollar margin market and 69.45% (↓0.77%p) in the coin margin market. This indicates that some traders have strongly entered new long positions, with the possibility of a short-term rebound based on supply and demand.

Ethereum's long position account proportions were 78.02% (↑1.26%p) and 83.70% (↓1.53%p) in each market respectively.

The overall long proportions in Bitcoin and Ethereum futures markets were 49.95% and 49.23% respectively.

For other altcoins, XRP saw its long position proportion decrease by 2.44%p in the dollar margin market, weakening buying sentiment, while increasing by 1.21%p in the coin margin market. The conflicting position flows reveal uncertainty in direction.

SOL showed strengthened buying sentiment across both position and account metrics. Notably, the dollar margin account proportion increased by 5.56%p, clearly indicating institutional investor interest.

DOGE maintained high long proportions across all indicators, reflecting strong expectations. Particularly, the coin margin account proportion exceeded 88%, approaching an overheated zone requiring caution.

Strongest Trend Positions

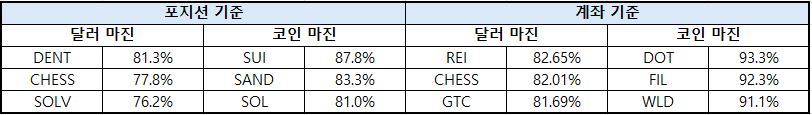

In the cryptocurrency futures dollar margin market, the top traders' strongest trend assets were ▲Dent(81.3%) ▲CHESS(77.8%) ▲SOLV(76.2%). In the coin margin market, ▲Sui(87.8%) ▲SAND(83.3%) ▲SOL(81.0%) showed prominent strength.

The assets with the highest long-holding account proportions in the dollar margin market were ▲REI(82.7%) ▲CHESS(82.0%) ▲GTC(81.7%). In the coin margin market, ▲DOT(93.3%) ▲FIL(92.3%) ▲WLD(91.1%) took the top spots.

The dollar margin market (U market) is primarily preferred by institutional investors seeking stable returns, used to reduce volatility and for short-term trading and hedging. The coin margin market (C market) is often used by cryptocurrency bulls or long-term holders to increase assets through leverage. In a bullish market, the unsettled contracts in the C market increase, indicating market optimism, while in a bearish market, increased trading volume in the U market may suggest institutional fund inflows.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>