The 'Kimchi Premium' is expanding, where cryptocurrency prices are higher in Korea compared to overseas.

As of 8:21 AM on the 16th, according to CryptoPrice, the Kimchi Premium (Upbit<><>Binance) is recording 2.33%.

A slight increase from 2.05% the previous day suggests a somewhat improved domestic investment sentiment. Major coins are showing similar premium levels (2.3~2.4%).

Kimchi Premium Status by Coin

Bitcoin (BTC) $83,664 122.3 million won 2.33%

Ethereum (ETH) $1,591.38 2.328 million won 2.41%

Solana (SOL) $126.5 184,900 won 2.32%

XRP $2.088 3,056 won 2.43%

Doge $0.1539 225 won 2.34%

The Kimchi Premium is a phenomenon where cryptocurrency prices are higher on Korean exchanges, caused by sudden domestic demand or lack of overseas liquidity. A reduction or negative conversion of the Kimchi Premium indicates weakening domestic buying pressure or domestic price weakness compared to global rates.

Bitcoin Technical Analysis

The Bollinger Band upper limit is $88,297, and the lower limit is $77,588. Breaking the upper band indicates an overheated (overbought) state with potential adjustment (decline), while falling below the lower band suggests an oversold state with potential rebound.

Bitcoin is trading at $83,703, a 1.07% decline from the previous day. Its position close to the band's center shows an unclear trend direction, suggesting potential movement in both upward and downward directions in the short term.

The relatively wide band width indicates high market volatility, and significant price movements cannot be ruled out.

The 20-day moving average, which determines trend strength and direction through average prices over a certain period, is currently located at $82,942.

The current price is above the 20-day moving average, confirming a short-term upward trend.

However, the gap between the current price and moving average is not large, so a clear support zone has not been formed. If the price falls below the moving average, the possibility of a short-term decline remains open.

The rising moving average and price above it are technically interpreted as a positive signal. If additional increases occur, the moving average could serve as a support line.

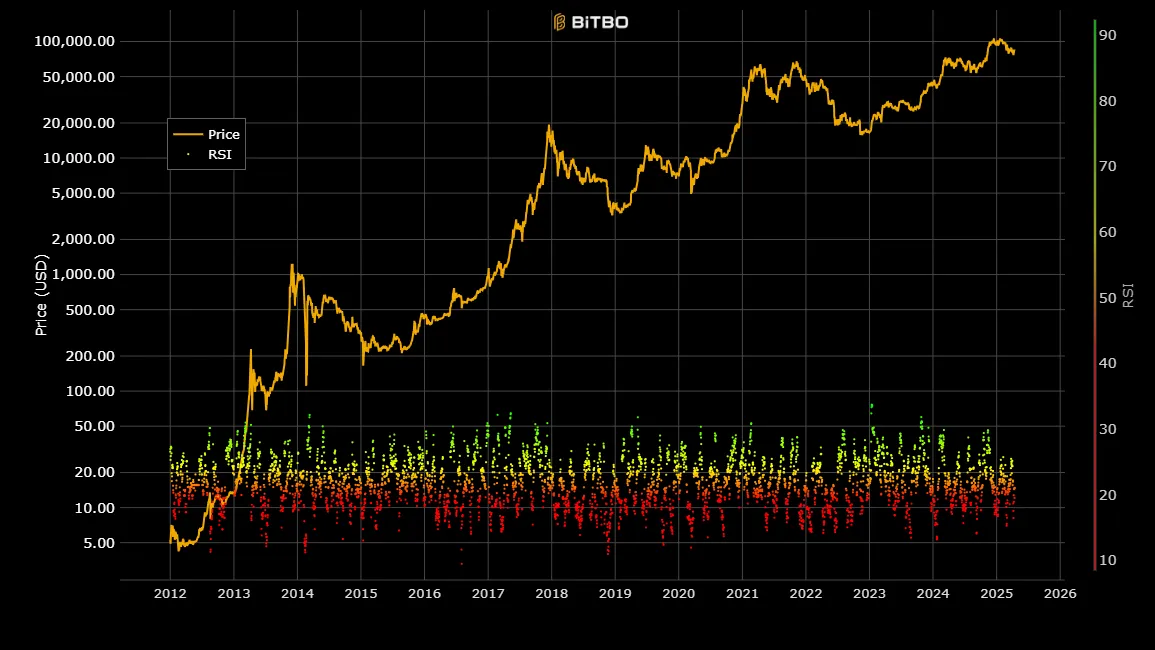

The RSI (Relative Strength Index), which measures price rise and fall intensity, is at 48.52 in the neutral zone but has risen from 43.14 the previous day. This suggests a potential transition from a downward trend to an upward momentum.

With the RSI located in the neutral zone between 30-70, there are currently no extreme buy or sell pressures, but recovery near the 50-line indicates gradually reviving buying sentiment.

The recent RSI upward trend shows strengthening Bitcoin price momentum, and if the RSI rises above 50, the possibility of further increases may increase.

RSI above 70 indicates an overbought state with increased adjustment (decline) possibility, while RSI below 30 indicates an oversold state with increased rebound potential.

[This article does not provide financial advice, and investment results are the sole responsibility of the investor.]

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>