Solana dropped to a 12-month low of $95.23 on April 7th and has since risen by 40%, creating a new bullish sentiment in the derivatives market.

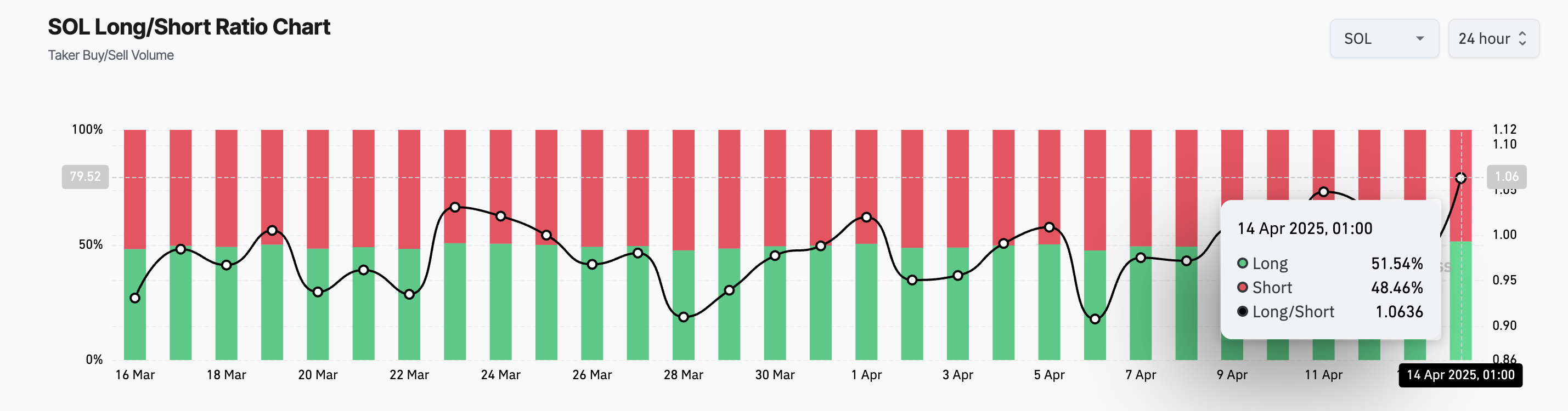

Currently, this price recovery has pushed SOL's Longing/Short ratio to a 30-day high, indicating a significant increase in demand for Longing positions among futures traders.

SOL, Longing/Short Ratio Surges… A New Rally?

According to Coinglass, SOL's Longing/Short ratio is currently at a 30-day high of 1.06, reflecting increased demand for Longing positions today.

The Longing/Short ratio measures the proportion of Longing positions (betting on price increases) and Short positions (betting on price decreases) in the market.

A ratio below 1 indicates more traders are betting on asset price declines. Conversely, a ratio above 1, like SOL's, suggests bullish sentiment, with most expecting further price increases.

The increasing demand for Longing indicates growing confidence among SOL traders. This is noteworthy as SOL appears to be entering a consolidation phase after a sharp rebound from its 12-month low, which is often a typical cooling period before the next rally.

Therefore, if the demand for Longing positions continues and buying pressure intensifies, SOL could break out of this narrow range and initiate the next rally cycle.

Technically, the coin's Moving Average Convergence Divergence (MACD) setup confirms this bullish outlook. At the time of reporting, SOL's MACD line (blue) is positioned above the signal line (orange).

This trend indicates increasing bullish momentum in the SOL spot market. The crossover confirms that buying pressure is increasing and the recent price movement could continue in the short term.

Solana Attempts Stability Above $130… Target $147

SOL is currently trading at $131.66, attempting to stabilize above a new support line at $130.17. If demand for Longing continues and bullish momentum remains strong, SOL could break out of its sideways movement and rise to $147.59.

Conversely, if bullish pressure weakens and profit-taking resumes, SOL could fall below $130.17 and drop to $95.54.