According to the latest CoinShares research, cryptocurrency outflows last week reached $795 million. This marks a negative trend for the third consecutive week, continuing to be significantly impacted by financial uncertainty on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs. Last week saw outflows of $713 million, a 314% increase from the previous week's $172.69 million.

Cryptocurrency Outflows Reach $795 Million Last Week

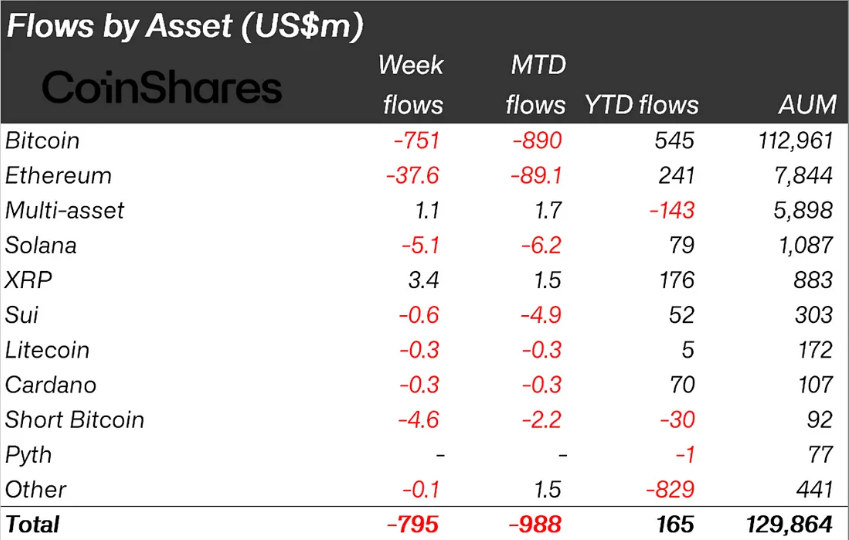

CoinShares researcher James Butterfield noted that Bitcoin led the outflows with $751 million, while some altcoins like XRP, Ondo Finance (ONDO), ALGO, and AVAX showed positive trends.

This suggests investors are adjusting their investment strategies to altcoins as economic chaos hits the BTC market.

"...recent tariff activities continue to influence sentiment towards the asset class," Butterfield wrote.

This trend is not new. Altcoins have previously outperformed Bitcoin in flow indicators. Two weeks ago, altcoins broke a five-week negative trend and drove crypto inflows to $226 million.

Meanwhile, the impact of Trump's tariffs on digital asset investment products remained consistent. In the week ending April 7, cryptocurrency outflows reached $240 million amid trade confusion.

Investor sentiment changed dramatically after Donald Trump's tariff suspension announcement. The tariff suspension excluding China reignited fears of the US-China trade war. This surprised traditional and digital asset markets and worsened sentiment alongside China's retaliatory measures.

Nevertheless, Trump's temporary tariff withdrawal excluding China increased AUM by 8% to $13 billion, rising from its lowest point since November 2024.

"...the price rebound in the latter part of the week pulled total AUM to $13 billion from the April 8 low (the lowest since early November 2024), representing an 8% increase following the temporary withdrawal of the president's economically disastrous tariffs," Butterfield added.

Bitcoin Decline Confirmed by ETF Flows

As mentioned, Bitcoin took the major hit in last week's decline. Outflows surged with a 314% week-on-week increase in Bitcoin ETF outflows. Continuous outflows highlight waning institutional interest, particularly among US-based ETF providers.

Short Bitcoin products also experienced $4.6 million in outflows. This suggests traders might be completely observing rather than leveraging bets on downward movements.

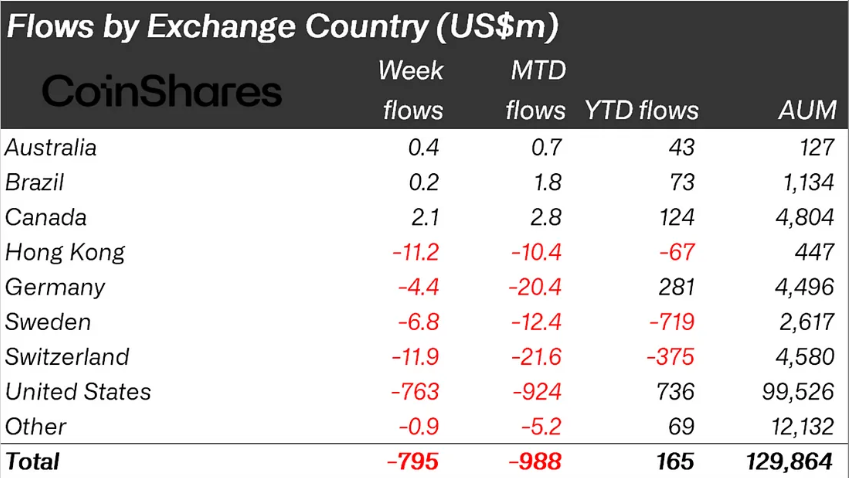

CoinShares emphasized that last week's outflows spanned multiple regions and product providers, indicating the decline was not limited to specific markets. This aligns with risk-averse behavior across stocks and commodities in response to volatile US trade stances.

Trump's unpredictable tariff movements reintroduced uncertainty to an unstable macro environment. The cryptocurrency market, especially institutional products, is responding with broad capital withdrawal.