Decentralized Finance (DeFi) is forming an ecosystem worth 130 trillion won.

According to defillama as of 1:57 PM on the 14th, the total value locked (TVL) in the DeFi ecosystem increased by 0.07% compared to the previous day, reaching $9.118 billion (130 trillion 202 billion won).

This is a 22% reduction compared to the initial 11.722 billion dollars this year.

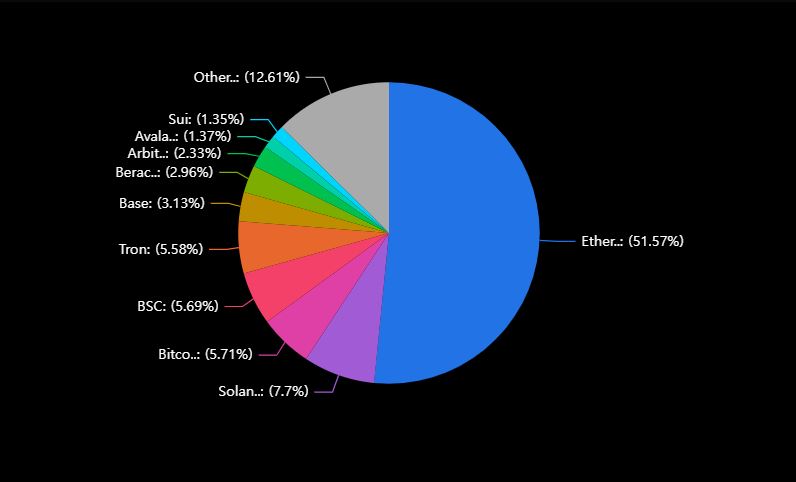

Chain Ranking and Fluctuation Rate Based on TVL

In terms of DeFi market share by chain, ETH maintains the top spot at 51.64%. Solana (7.71%), Bitcoin (5.72%), BSC (5.7%), and TRON (5.59%) follow. Over the past week, Avalanche, Solana, and Sui showed the largest fluctuations at 17%(↑), 14%(↑), and 10%(↑) respectively.

ETH $4.698 billion, weekly 1.65%↑ monthly 6.43%↓

Solana $701.4 million, weekly 13.8%↑ monthly 0.9%↑

Bitcoin $5.2 billion, weekly 3.75%↑ monthly 5.17%↓

BSC $518.2 million, weekly 4.16%↑ monthly 0.69%↓

TRON $508.1 million, weekly 6.4%↑ monthly 12.69%↑

DeFi Sector TVL

The largest DeFi sector by TVL is lending. It is currently recording $39.783 billion, a 9.47% increase from the previous week.

Bridges increased by 9.16% to $36.446 billion, and liquidity staking rose by 8.9% to $33.793 billion, ranking second and third respectively.

Decentralized exchanges (DEX) followed with $17.545 billion, and restaking with $14.885 billion.

The sectors with the largest weekly fluctuations were lending (9.47%↑), bridges (9%↑), and liquidity staking (9%↑).

DeFi Protocol TVL

The largest protocol by TVL is Aave (lending). It is recording $17.826 billion, a 9.64% increase from the previous week.

Lido (liquidity staking) ranked second with a TVL of $15.189 billion, a 2.58% increase, and EigenLayer (restaking) ranked third with $7.562 billion, a 3.07% increase.

Sky followed with $6.041 billion, and Ethena (BT·RWA) with $5.020 billion.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>