As of April 14, 2025, 5:10 PM

Bitcoin recorded a slight increase to $84,620. The expectation of relaxed US tariff policies positively influenced risk asset sentiment, continuing the short-term momentum recovery. However, the increase remains limited due to rising exchange balances and constrained investment sentiment. The market maintains a balance between technical rebounds and selling pressure amid a wait-and-see stance.

📈 Price Now

Price $84,620 (0.22%↑) Bitcoin is trading at $84,622, up 0.22% from the previous day.

Volume $30.42 billion (4.53%↑) The trading volume in the past 24 hours increased by 5% to $26.79 billion, showing some revival of short-term momentum.

Daily Fluctuation 0.97% Bitcoin is up 0.97% today. Two days ago, it rose 2.26%, and yesterday it closed down 1.86%, showing repeated fluctuations.

Asset Comparison S&P500 ↑ · Gold ↓ The US S&P500 index, highly correlated with Bitcoin, rose 1.81% (95.31) to 5,363.36. Gold, a safe-haven asset, declined 0.09% (-2.9) to 3,241.70.

Mayer Multiple 0.9582 The Mayer Multiple dropped from 0.9773 to 0.9582, remaining below 1 and indicating the price is below the 200-day moving average ($87,383). Generally, below 0.8 is considered undervalued, and above 2.4 is considered overheated.

MACD 526.93 The Moving Average Convergence Divergence (MACD) was 526.94 on a daily basis and -2,593.47 on a weekly basis. There is some short-term upward pressure, but the medium to long-term downward trend continues.

🧭 Market Now

Active Addresses 609,614 Bitcoin active addresses decreased from 649,644 to 609,614, indicating a somewhat cautious investor attitude.

SSR 14.25 The Stablecoin Supply Ratio (SSR) decreased from 14.49 to 14.25. Generally, over 10 indicates insufficient standby funds, while below 6 suggests sufficient buying capacity.

OBV 16.37k The On-Balance Volume dropped from 16.62k to 16.37k, suggesting a slowdown in fund inflow and weakening buying pressure.

NUPL 47.5% The Net Unrealized Profit/Loss (NUPL) decreased from 48.56% to 47.50%, showing a reduction in the proportion of investors in profit.

MVRV 1.73 The Market Value to Realized Value (MVRV) dropped from 1.81 to 1.73, meaning the total market value is 73% higher than the average purchase price.

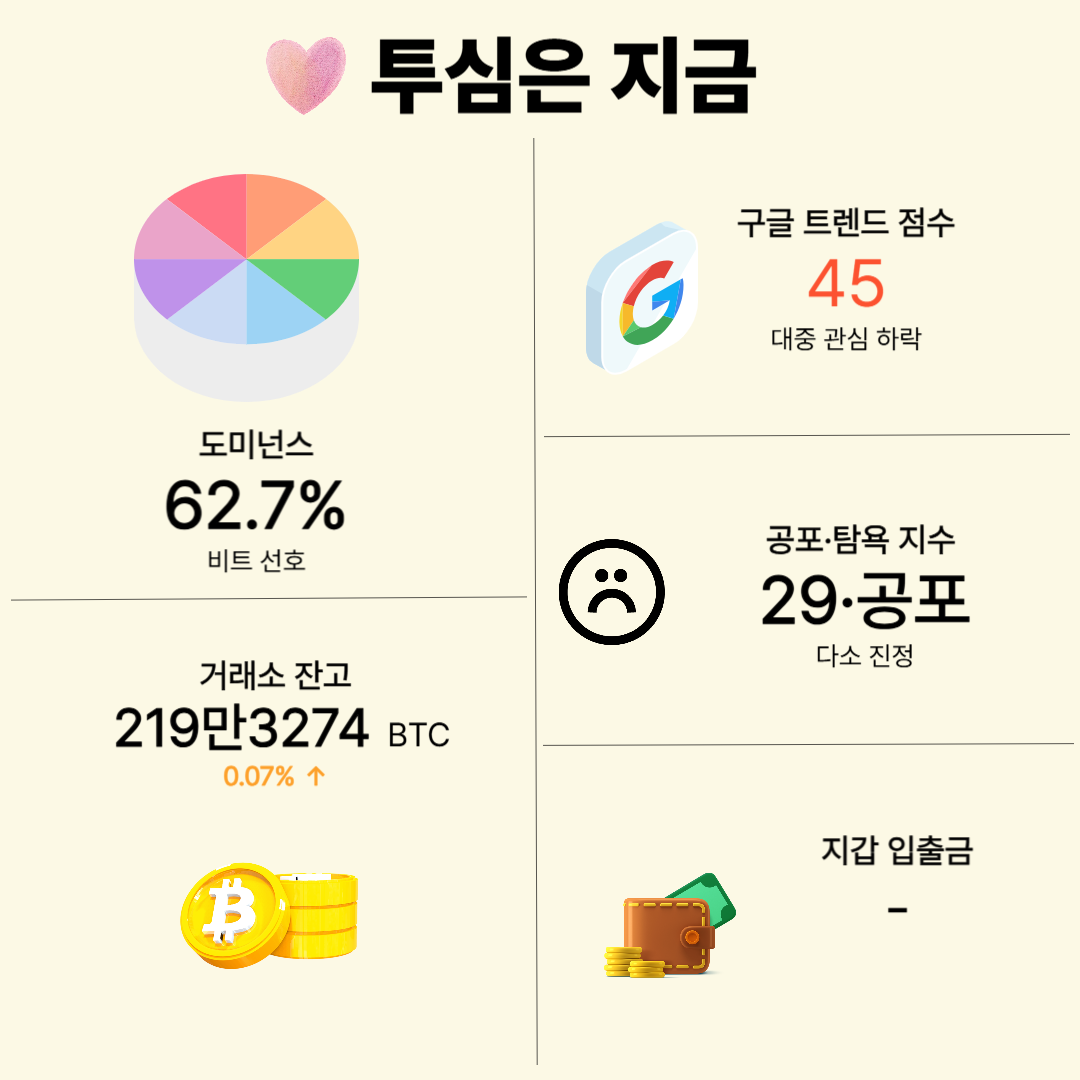

❤️ Investor Sentiment Now

Dominance 62.7% Bitcoin's market capitalization share increased by 1.84 percentage points to 62.7%.

Fear & Greed Index 29 (Fear) The CoinMarketCap Fear & Greed Index dropped from 32 to 29, indicating continued cautious investment sentiment.

Google Trend Score 45 The Bitcoin search volume increased from 43 to 45, showing a slight increase in public interest.

Exchange Balance 2,193,274 BTC Bitcoin deposited on exchanges increased by 0.07% to 2,193,274 BTC.

🎤 Today's Analysis

Analysis "BTC Recovers Short-Term Momentum... Influenced by Improving Macro Environment"

As the US shows signs of stepping back from extreme tariff policies and the macroeconomic environment improves, Bitcoin has recovered its short-term momentum. Bitget senior analyst Ryan Lee explained the current market situation, highlighting the potential for a risk-on rally and technical breakout.

[This article does not provide financial advice, and investment results are the sole responsibility of the investor.]

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>