The major coin Bitcoin has experienced a situation where many short-term investors have been leaving the market due to price issues in recent weeks.

However, amid price volatility, Longing holders of the coin are steadfastly holding on and trying to push BTC above $85,000. How quickly can they realize this?

Bitcoin Long-Term Holders Switching from Selling to Accumulation

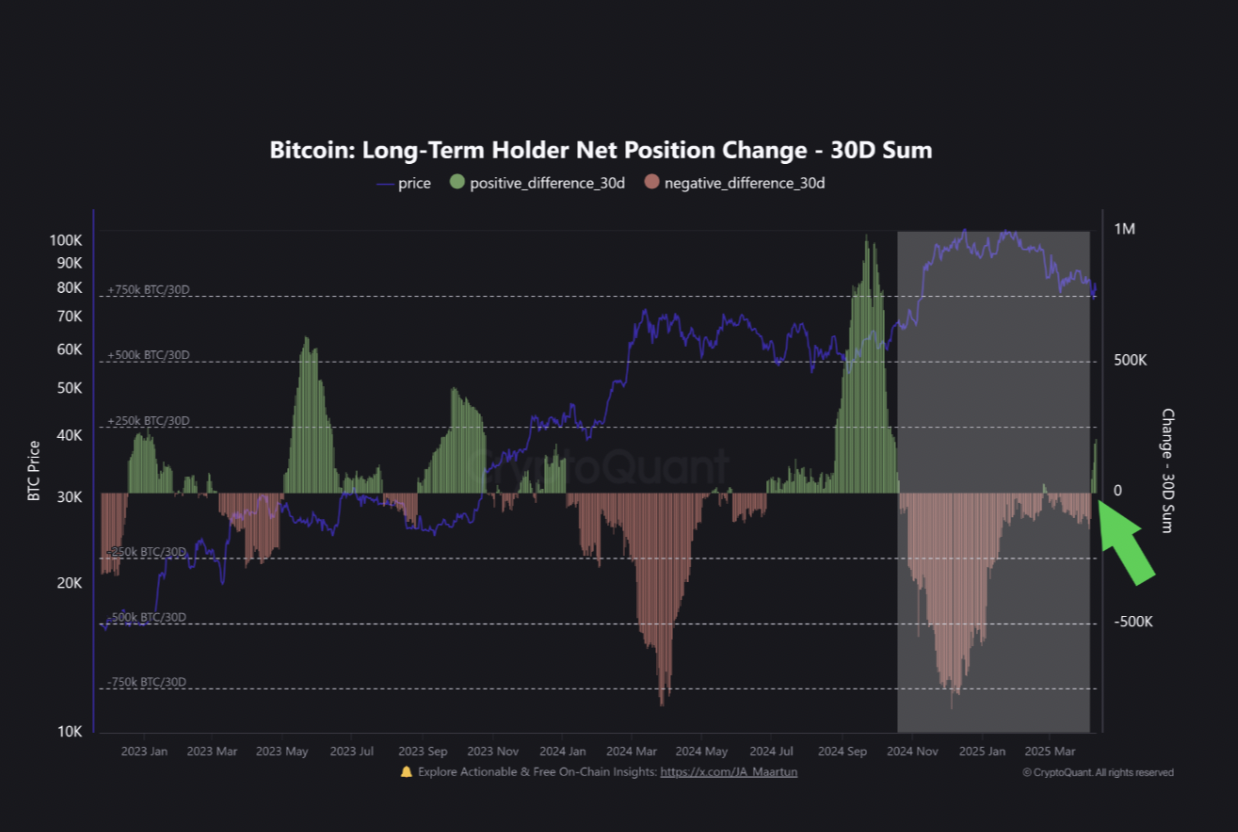

In a recent report, CryptoQuant analyst Burak Kesmeci evaluated the BTC long-term holder net position change (30-day sum). He noted that this indicator has turned positive since April 6, showing a clear upward momentum. As a result, Kesmeci wrote that BTC has risen by about 12%.

The BTC long-term holder net position change tracks the buying and selling behavior of long-term holders who have held assets for at least 155 days, measuring the change in the number of coins held by these investors during a specific period.

When this value is positive, it indicates that long-term holders are not selling and are optimistic about BTC's future price performance. Conversely, when it turns negative, it suggests these holders are responding to market pressure by selling or distributing coins, which is a bearish signal.

According to Kesmeci, the notable shift in BTC's long-term holder net position change (30-day sum) turning positive is significant. This indicator had remained below 0 since the last week of October, indicating that long-term holders were continuously selling BTC.

Selling reached its lowest point on December 5, with BTC price dropping 30% and marking the peak of a six-month distribution period by long-term holders.

However, this trend changed after April 6. The indicator is now positioned above 0 and showing an upward trend. Kesmeci added about its meaning:

"While it's too early to say definitively, the increase in positive momentum of this indicator could be a sign that long-term confidence is returning to the market."

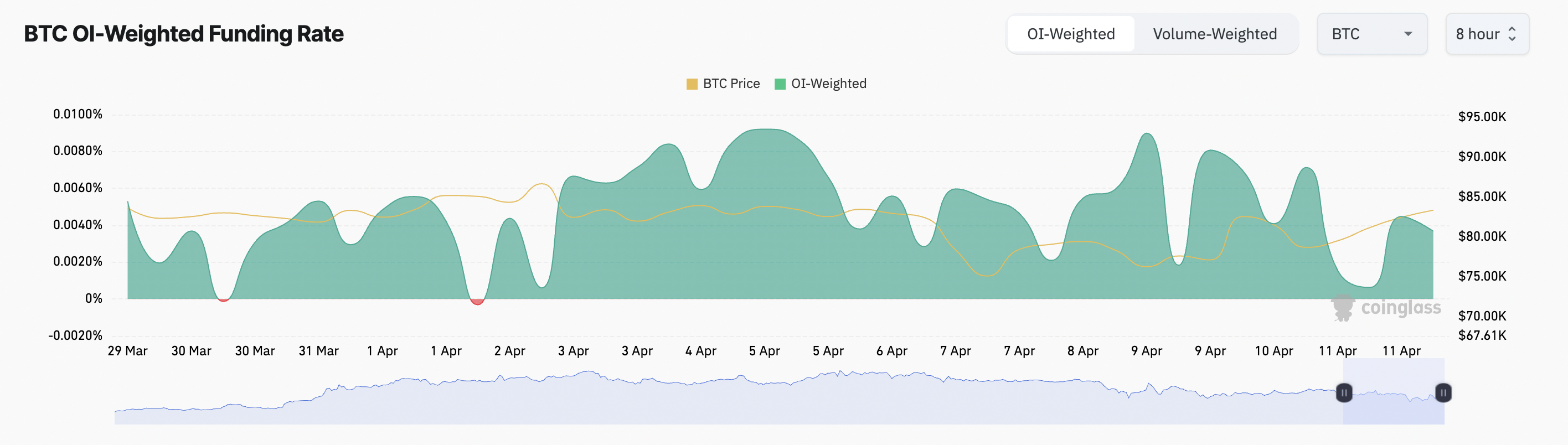

Moreover, BTC's funding rate remains positive despite price issues, confirming the above upward outlook. At the time of reporting, it is 0.0037%.

The funding rate is a periodic payment exchanged between Longing and short traders in the perpetual futures market. It is designed to keep futures prices close to the underlying asset's spot price.

When this is positive, Longing traders are paying short traders. This indicates more traders are expecting BTC's price to rise, signaling a bullish market sentiment.

Long-Term Holders Preparing to Rise to $87,000

Due to the increased accumulation by BTC long-term holders, the coin's price has crossed the major resistance level of $81,863. At the time of reporting, this major coin is trading at $83,665.

As the market responds to the continued buying pressure from long-term holders, the coin's price may be preparing for a significant rise in the near future.

If retail traders accordingly increase coin demand, BTC could break through $85,000 to $87,730.

However, if the accumulation trend ends and these long-term holders start selling for profit, BTC could resume its downward trend, falling below $81,863 and dropping to $74,389.