The cryptocurrency market experienced high volatility this week. Regulatory developments, macroeconomic tensions, and Binance's decisions shook the market.

Signs of trade war, rumors of covert quantitative easing, and the historic legal truce between XRP and SEC are reshaping the narrative. Here is a summary of what happened in cryptocurrency this week.

Binance Plans to Delist 14 Altcoins

Binance, the largest cryptocurrency exchange by trading volume, has decided to delist 14 tokens, including BADGER, BAL, and CREAM.

This decision caused double-digit losses for these tokens. This highlights the impact such announcements have on investor sentiment.

Binance initiated the delisting process through a token delisting vote mechanism. The community participated in determining the fate of specific tokens. According to reports, out of 24,141 participants, 103,942 votes were cast, with 93,680 considered valid.

The exchange identified these altcoins by evaluating factors such as development activity, trading volume, and liquidity.

"After the completion of the delisting vote and standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, VIDT on April 16, 2025," as stated in the announcement.

Trading for these tokens will be suspended on April 16, with withdrawal restrictions set on June 9. After this date, unsold tokens will be converted to stablecoins.

[The rest of the translation follows the same approach, maintaining the original structure and translating all text while preserving any HTML tags and links.]This application follows the decision by Judge Analisa Torres in 2023 that XRP is not a security when sold to retail investors. This decision meant a partial but important victory for Ripple.

What remains is a resolution for institutional sales, fines, and injunctions. According to legal experts, Ripple and the SEC's willingness to settle suggests that neither side wants to extend the case amid broader legal and political uncertainties.

This resolution is likely to impact how the SEC proceeds with enforcement actions against other cryptocurrency companies. For Ripple, regulatory clarity could open doors to a US relisting and deeper integration with traditional finance (TradFi).

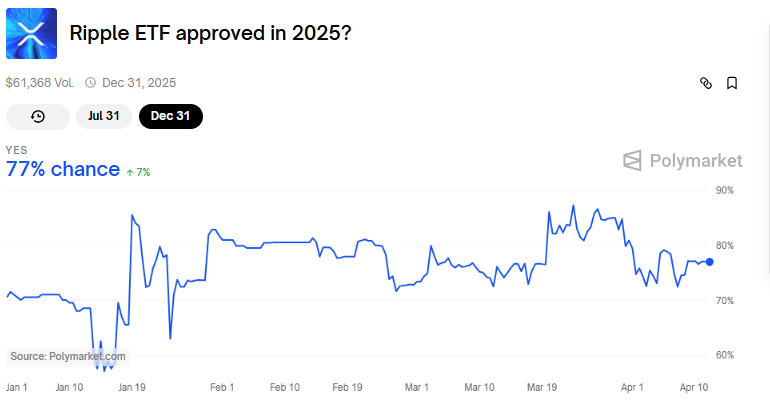

Specifically, this could increase the probability of XRP ETF approval in the US to 77%. As Polymarket's data shows.

Trump Halts Tariffs Excluding China

This week, the cryptocurrency market surged over 5% in market cap after Donald Trump announced he would suspend tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

"Based on the lack of respect China has shown to world markets, the US will immediately raise tariffs on China to 125%." – Trump shared on Truth Social here.

This move particularly reignited risk appetite sentiment in the cryptocurrency market. Cryptocurrencies are highly sensitive to macroeconomic policy changes.

Analysts interpreted this announcement as a double-edged message. On one hand, the global economy could escape widespread trade pressures.

On the other hand, China remains a geopolitical target, potentially causing the global trade system to become more fragmented and increasing dependence on decentralized assets. China has raised tariffs on the US to 125% in retaliation.