As Bitcoin, the leading cryptocurrency, experiences one of its weakest weeks since the beginning of the year, on-chain data suggests that miners have significantly contributed to increasing selling pressure.

According to on-chain data, Bitcoin network miners have increased their coin selling activity, which could exacerbate downward price pressure.

Bitcoin Weakness, Miner Holdings Decrease

Data from the crypto on-chain platform CryptoQuant shows that Bitcoin miner holdings have been steadily declining this week. Currently at 1.8 million BTC, this represents a 1% decrease from the previous week.

Bitcoin's miner holdings track the number of coins stored in miner wallets. This indicates the amount of coins miners have not yet sold.

When this indicator rises, it suggests miners are holding more mined coins, indicating confidence in future price increases. Conversely, when holdings decrease, miners are moving coins from their wallets, typically meaning sales and confirming a bearish sentiment towards Bitcoin.

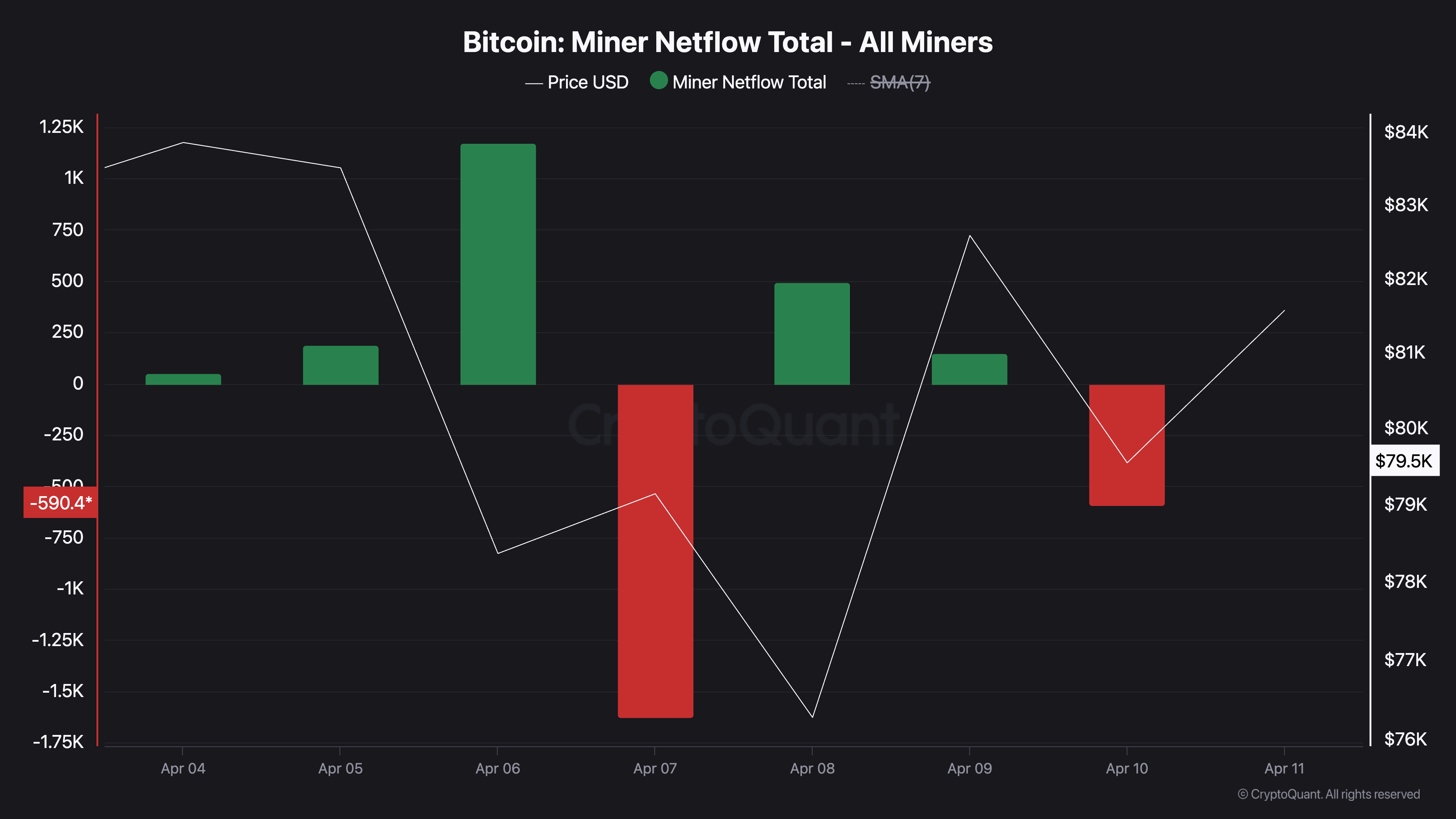

The negative miner net outflow further confirms this trend. As of April 10, it stands at -590.40. Bitcoin's miner net outflow tracks the difference between coins sent to and withdrawn from exchanges.

When this value is negative like now, more coins are moving from miner wallets to exchanges, usually a precursor to sales.

With this additional downward pressure from BTC holders, the coin's price could undergo a deeper short-term correction if buying interest fails to offset the current liquidation.

Bitcoin Decline, Price Could Drop to $74,000

On the daily chart, Bitcoin remains significantly below the Super Trend indicator, which forms a dynamic resistance at $90,911.

This indicator tracks the direction and strength of an asset's price trend. Displayed as a line on the price chart, it changes color to indicate the trend: green for an uptrend, red for a downtrend.

When an asset's price trades below the Super Trend indicator, selling pressure dominates the market. This bearish trend could worsen price declines by encouraging Bitcoin holders to sell. In this case, the coin's price could fall below the key support of $80,776 and trade at $74,389.

However, if market sentiment improves and coin holders reduce selling activity, Bitcoin could reverse its decline and rise to $86,172.