The core stablecoin sUSD in the Synthetix ecosystem has recently been deeply mired in a de-pegging crisis. As of April 9, 2025, its price dropped to around $0.8388, deviating by over 16% from the theoretical anchor value of $1, drawing high market attention. This crisis, which began on March 20, has lasted for over 20 days, with the de-pegging extent continuously expanding. Meanwhile, Synthetix's native token SNX has bucked the trend, rising by 7.5% in a single day, presenting a complex market sentiment. Synthetix founder Kain Warwick (@kaiynne) attributed the de-pegging to transition pains from mechanism adjustments and revealed that the protocol has sold 90% of its ETH position and increased SNX holdings to respond.

Event Overview: Gradual Deterioration of De-pegging

The de-pegging of sUSD did not happen overnight. On March 20, 2025, its price first showed a slight deviation, initially not raising widespread concern. However, as time passed, the fluctuation gradually evolved into a downward trend. By April 9, CoinMarketCap data showed sUSD quoted at $0.8388, dropping over 16% from its anchor value. This de-pegging, lasting over 20 days, exceeded expected time spans and deviated far beyond the market's typical tolerance for stablecoins, indicating the problem's deep complexity.

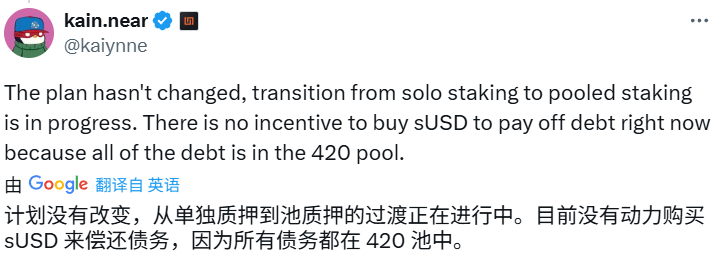

Kain Warwick explained on X platform that the de-pegging was an expected side effect of SIP-420 proposal implementation. The proposal aimed to optimize SNX staking mechanism and capital efficiency by introducing a centralized debt pool (the "420 Pool"), but the transition between old and new mechanisms temporarily disabled sUSD's anchoring repair capability. He candidly stated that at the current stage, "there is no incentive for users to buy sUSD to repay debt", with supply-demand imbalance becoming the direct driver of price decline. Additionally, the protocol's strategy of selling 90% of ETH position and increasing SNX holdings, while intended to strengthen internal support, might have weakened the system's liquidity and external stability foundation, adding more uncertainty to the market.

...Summary

From an industry perspective, the depegging of sUSD has a relatively limited impact. Its market value of $25 million is negligible in the stablecoin market, far smaller than USDT or USDC, resulting in minimal chain reaction in the DeFi ecosystem. However, for Synthetix internally, continuous depegging may undermine user trust. If liquidity pool funds continue to flow out, sUSD's utility will be restricted, further weakening its position in synthetic asset trading.

In the short term, intensified depegging may lead to more selling, potentially putting further pressure on prices. However, SNX's resilience has bought the protocol a window of opportunity. If the new mechanism can stabilize in the coming weeks, coupled with the debt relief plan, sUSD still has a chance to re-peg. In the long term, Synthetix needs to learn from this crisis, optimize stablecoin design, and avoid similar pain points from recurring. The success of mechanism adjustments will determine whether it can establish a foothold in the highly competitive DeFi market.