In the US market, Bitcoin buying sentiment appears to be somewhat subdued. The exchange net inflow conversion, premium decline, and decrease in OTC trading volume are collectively indicating a passive change in market conditions.

According to CryptoQuant's 'Coinbase Net Inflow' data on the 9th, 729 BTC was injected into Coinbase on this day.

Following a significant reduction in outflow volume of 8,680 BTC on the 7th and 292 BTC on the 8th, it has now switched to net inflow.

In the short term, the exchange inflow conversion can be interpreted as an increase in sell-side waiting volume, but the overall trend reversal needs to be observed further.

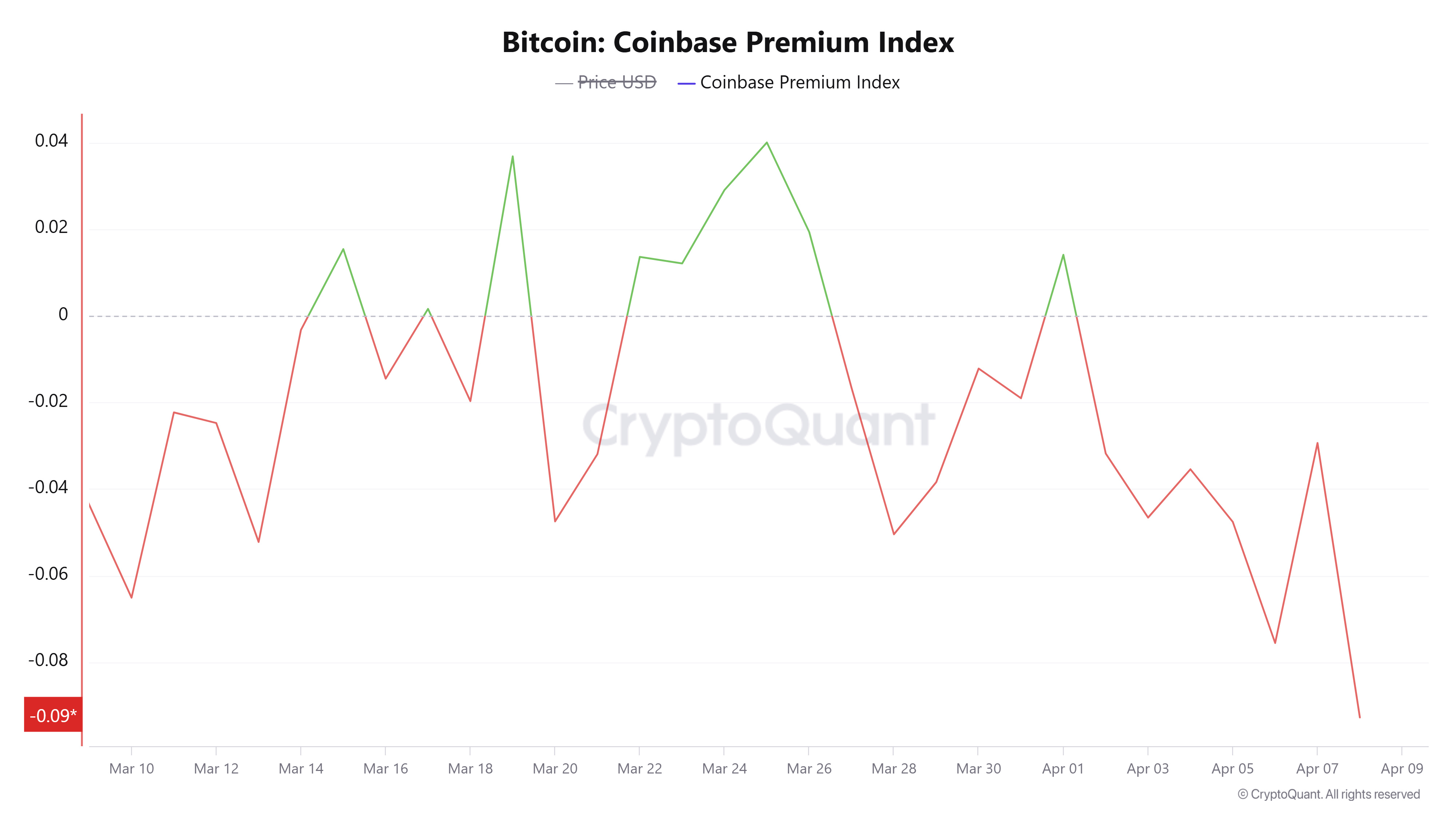

The 'Coinbase Premium Indicator', which gauges US buying pressure through the price difference between Coinbase and Binance, dropped from -0.029% to -0.093% the previous day.

This indicator shows strengthened US buying when positive and weakened US buying when negative. Currently, with the premium minus expanding, US buying sentiment appears somewhat weakened.

The OTC market 'Coinbase Prime' BTC/USD trading volume was recorded at approximately $1.306 billion over 24 hours. This represents a 38% decrease from the previous day's $2.102 billion.

Trading volume dropped from 26,578 BTC the previous day to 14,917 BTC, a reduction of around 40%. Large-scale transactions are contracting, and market participants continue to maintain a wait-and-see attitude.

As of 5:10 PM on the 9th, Bitcoin was trading at $77,845, a 2% decline from the previous day.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>