Bitcoin plummeted below $75,000 on Wednesday morning as Asian and Pacific stock markets opened, dropping 6% in a day. Global financial markets are under pressure as the United States impChinaoses 104% tariff.

The selling pressure occurred as concerns grew that trade tensions between the world's two largest economic powers could hinder global economic recovery.

Global Stock Markets Decline... Bitcoin Follows

In Asia saw Japan's Nikkei 225 index plunge nearly 4% at market opening, with markets in Korea, Australia, New and showing significant dec>

Australianin stocks opened with a 2% decline, offsetting previous session gains as hopes for US-China trade resolution diminished.

The S&P 500 index fell 1.6%, reversing previous 4.1% gains and nearly 19% lower than February's peak. The Jones Industrial Average dropped 0.8%, while the Nasdaq, focused on tech stocks, declined 2.1%.

The sharp cryptocurrency adjustment led to approximately $400 million in liquidation, driven by leverAged longing positions.

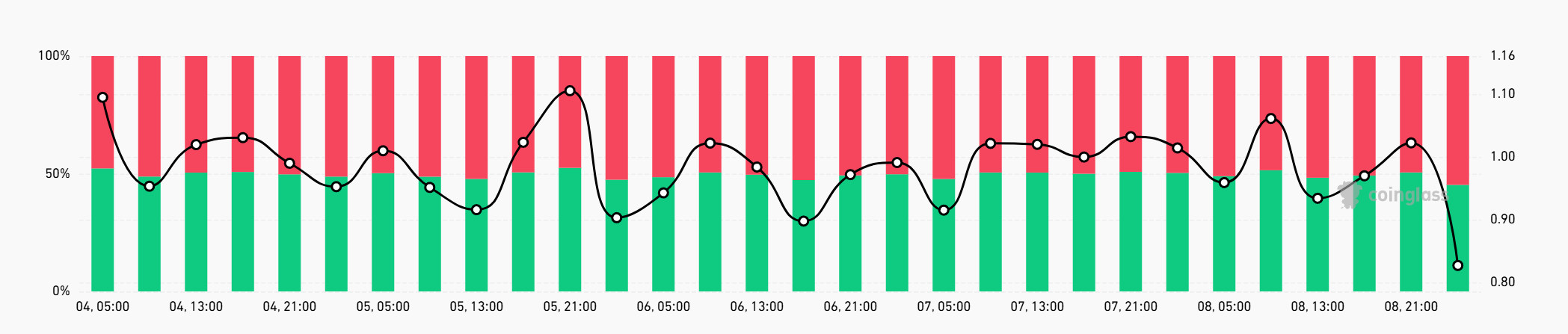

Notably, Bitcoin's Lonratio for the weeks, positionsing 55% of current open interest. a sentiment is predominantly bearish.

Investors are rapidly reducing risk across asset classes and preparing for additional volatility as trade disputes escalate.

Trump's additional 104% Chinese tariffs and lack of diplomatic progress have intensified uncertainty, with traders seeking for liquidity and shifting to defensive strategies.

Bitcoin is often considered an indicator of macro risk preference, and its decline emphasizes growing market anxiety.