Industry insiders have named April 7th as Crypto Black Monday, stemming from the sentiment of massive selling over the weekend.

Over the past two days, more than $1 billion in long and short positions were liquidated due to weekend volatility.

Coin Black Monday After Weekend Crash

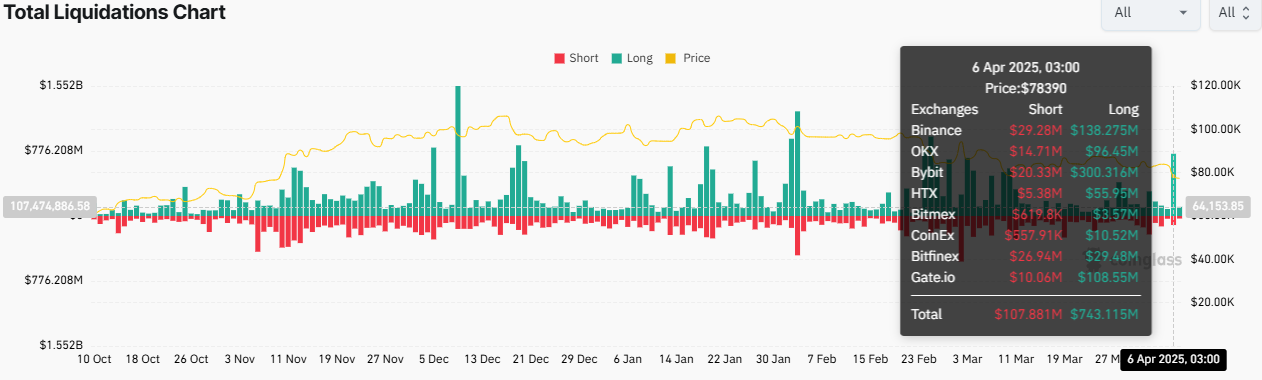

According to Coinglass data, on Saturday, April 5th, positions worth $116.59 million were liquidated, consisting of $33.02 million in short and $83.57 million in long positions.

The next day, cryptocurrency liquidations exceeded $850 million, increasing losses for traders and investors. Similar to the previous day, most of these liquidations were long positions, amounting to $743,115,000, while short positions were $107,881,000.

"In the past 24 hours, 320,444 traders were liquidated, with total liquidation amounts reaching $985.82 million." – Cryptocurrency derivatives data platform Coinglass mentioned.

These massive liquidations sparked widespread pessimism across the cryptocurrency market. According to CoinGecko data, the total cryptocurrency market capitalization dropped by over 10%, decreasing to $2.5 trillion.

Among the top 10 cryptocurrencies, XRP price fell by more than 15.4%, currently trading at $1.7. Similarly, Ethereum price dropped 14.3%, trading at $1,480 at the time of reporting.

Analysts on X (Twitter) are actively discussing the potential for a historical crash similar to "Black Monday".

"Tomorrow [April 7th] looks like it will be Black Monday 2.0." – Analyst Maine mentioned.

"Black Monday" refers to the stock market's sharp decline on October 19, 1987. That day, major global stock indices plummeted, with the US Dow Jones Industrial Average (DJIA) falling 22.6%, the largest single-day decline in history.

In this context, panic ensued as trading volume overwhelmed the market. During extreme volatility, a lack of mechanisms to halt trading meant continued free fall.

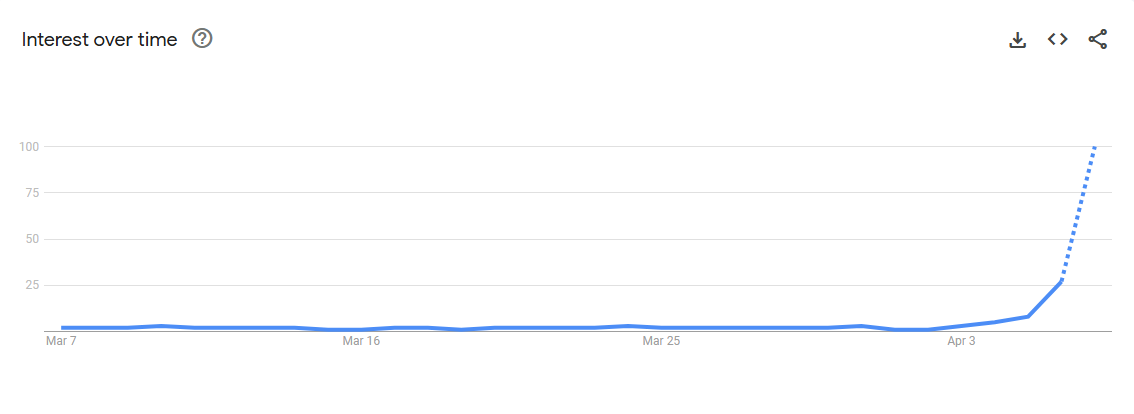

Following the massive liquidations, Google Trends data shows "Black Monday" searches reached peak levels globally.

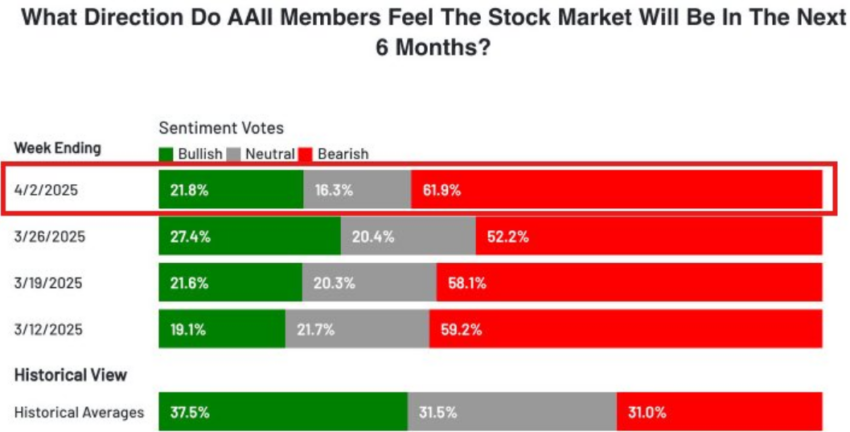

"Pessimistic sentiment is approaching historic highs." – Kobeissi Letter mentioned.

Panic Week... Background of Crypto Black Monday?

Renowned market commentary describes the gloomy atmosphere due to uncertainty about proposed tariffs, depicting "Black Monday" as a common perspective. Based on this, Kobeissi Letter analysts predict a "short-term surrender" this week.

"Down then up," analysts wrote, suggesting a volatile but potentially rebounding market.

This sentiment aligns with the AAII Sentiment Survey, which reported a surprising 61.9% pessimistic outlook, double the historical average of 31.0%.

"Black Monday 2.0," TheMaineWonk warned.

Analyst Duo Nine supports this assumption. He warns that Trump tariffs could dismantle global supply chains and reduce productivity, potentially causing a long-term bearish market for cryptocurrencies. However, he believes a recession could last 1-2 years.

"If the US doesn't change direction soon, this will be intentional and damage will increase over time. Unfortunately, for cryptocurrencies, this means the start of a long-term bearish market. If a global recession begins, it could last more than 1-2 years." – Duo Nine explained.

While fears of tariffs dominate, contrarian investors might view extreme pessimism as a buy signal. This perception is based on the assumption that market bottom might be near when such gloomy predictions become mainstream. These movements provide opportunities amidst extreme fear.

Not everyone agrees with the apocalyptic tone. Pearpop founder Ryan Wallner urged caution about exaggerated narratives on X. He also dismissed comparisons with the 1987 collapse.

"I think we might just be seeing a 2-3 week transition, and as tariffs become better understood, people will start buying again." – Wallner said.

Wallner suggested that wise traders might sell now and profit from low-price buying later. He emphasized that unlike past fraud-driven recessions, this decline is a temporary shift, with funds likely to flow to US companies and countries benefiting from tariffs.

According to BeInCrypto data, Bitcoin has fallen nearly 8% in the past 24 hours and is trading at $77,030 at the time of announcement.

As the market prepares for volatility, opinions range between an imminent disaster and an opportunistic rebound.